Increased appetite for less liquid How are the alternatives doing?

- Home

- Information Center by DahabMasr

- Increased appetite for less liquid How are the alternatives doing?

Increased appetite for less liquid How are the alternatives doing?

Jan 1, 2022

By

hajardev

0 comment(s)

Increased appetite for less liquid How are the alternatives doing?

Overview

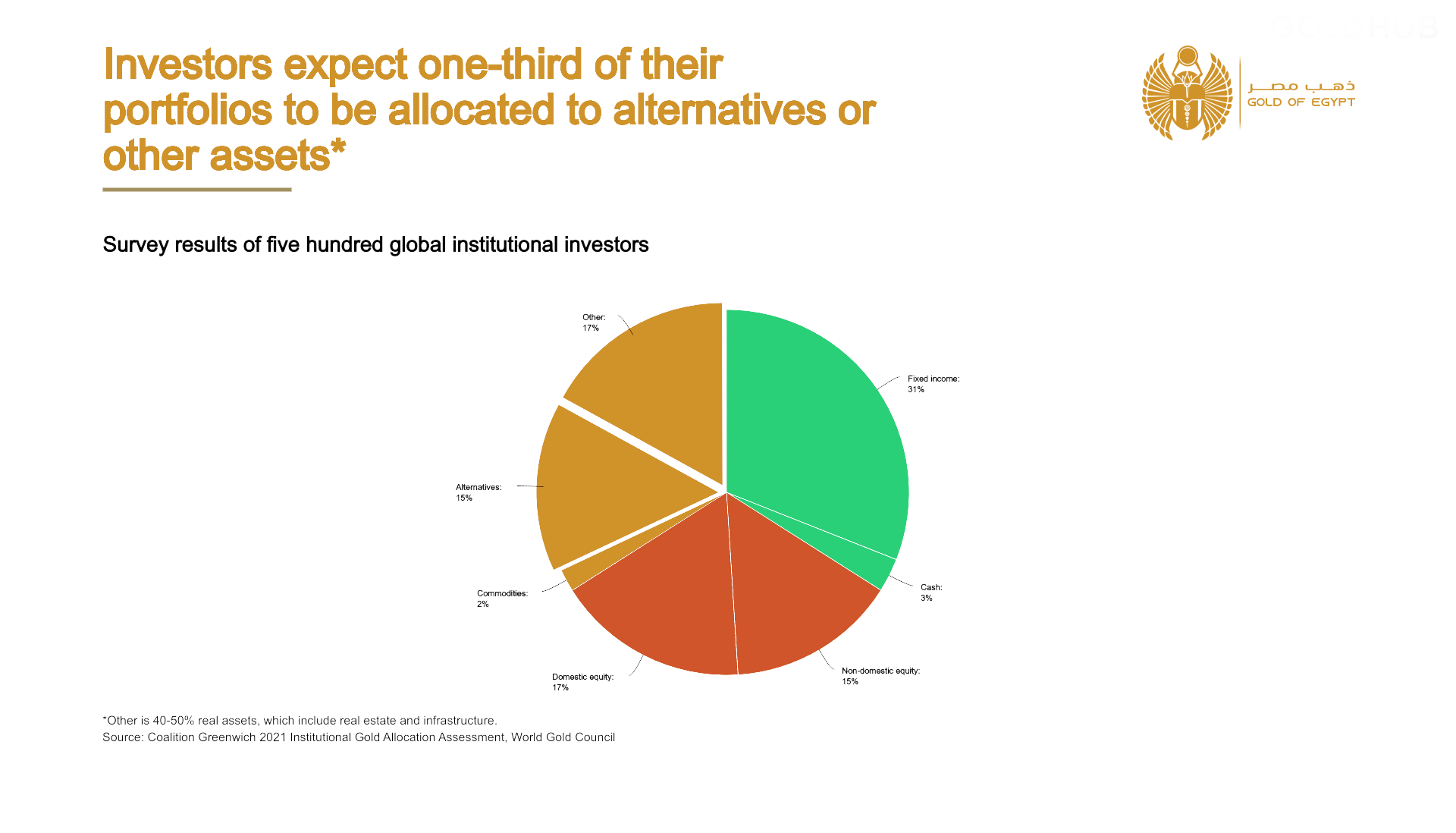

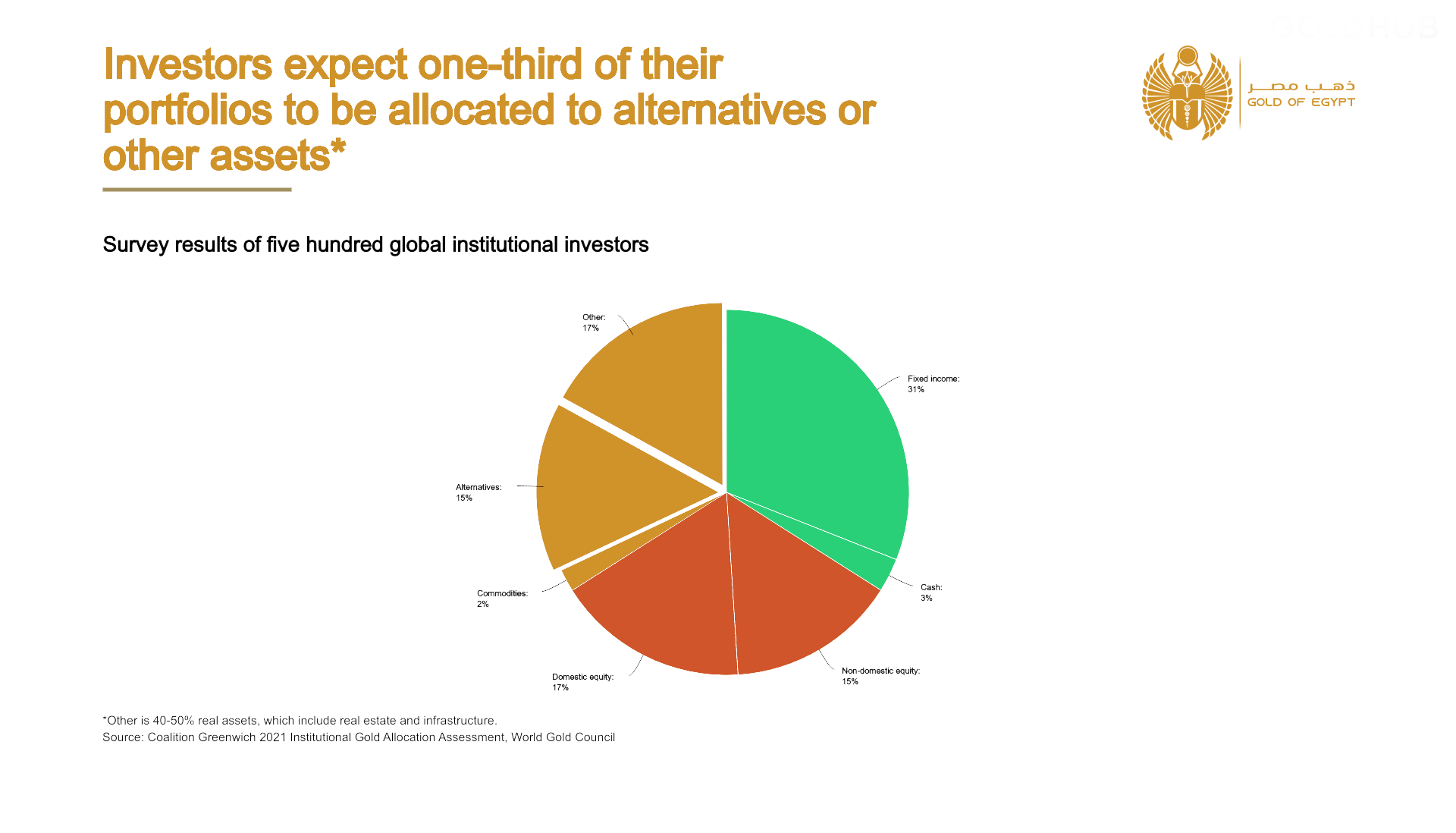

• Global portfolio composition continues to shift with larger allocations to alternatives

• Many of these alternative investments have previously helped portfolio performance but are less liquid than traditional investments

• The hunt for yield in a low-rate environment has also encouraged riskier fixed income investments

The shift to risker and less liquid assets strengthens the case for an allocation to gold, given its unique combination as a highly liquid diversifier, that can reduce portfolio volatility.

After a strong 2020 performance where the price rallied 25% in US dollar terms in an environment where rates fell, gold has been much weaker during 2021, down 5% year-to-date with rising rates. While demand for gold has rebounded, particularly in the jewelry and bar and coin markets, the recent gold price sell-off has been largely driven by the sharp increase in interest rates in global fixed income markets relative to the record lows they reached last year

Gold & Risk

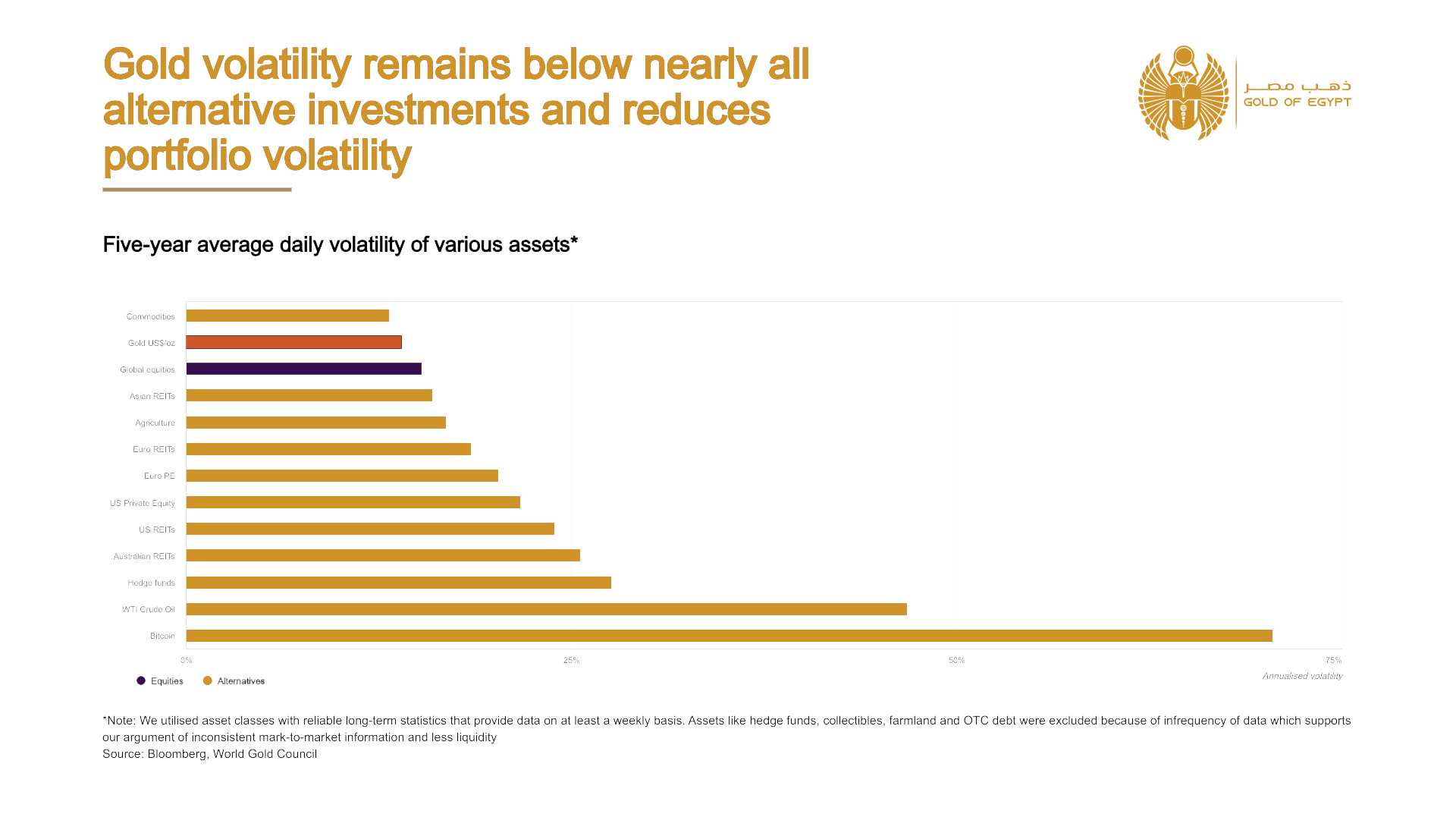

Yes, it has been an underperformance year for gold yet the following 2 charts are showing how is gold has one of the lowest moving averages among all alternatives graph 1, also it shows how it is a dependable asset over the long-term like graph 2 shows.

Graph 1

As Shown in the graph Gold has one of the least investment’s moving averages which making is directly one of the least investments that has risk over a period of time

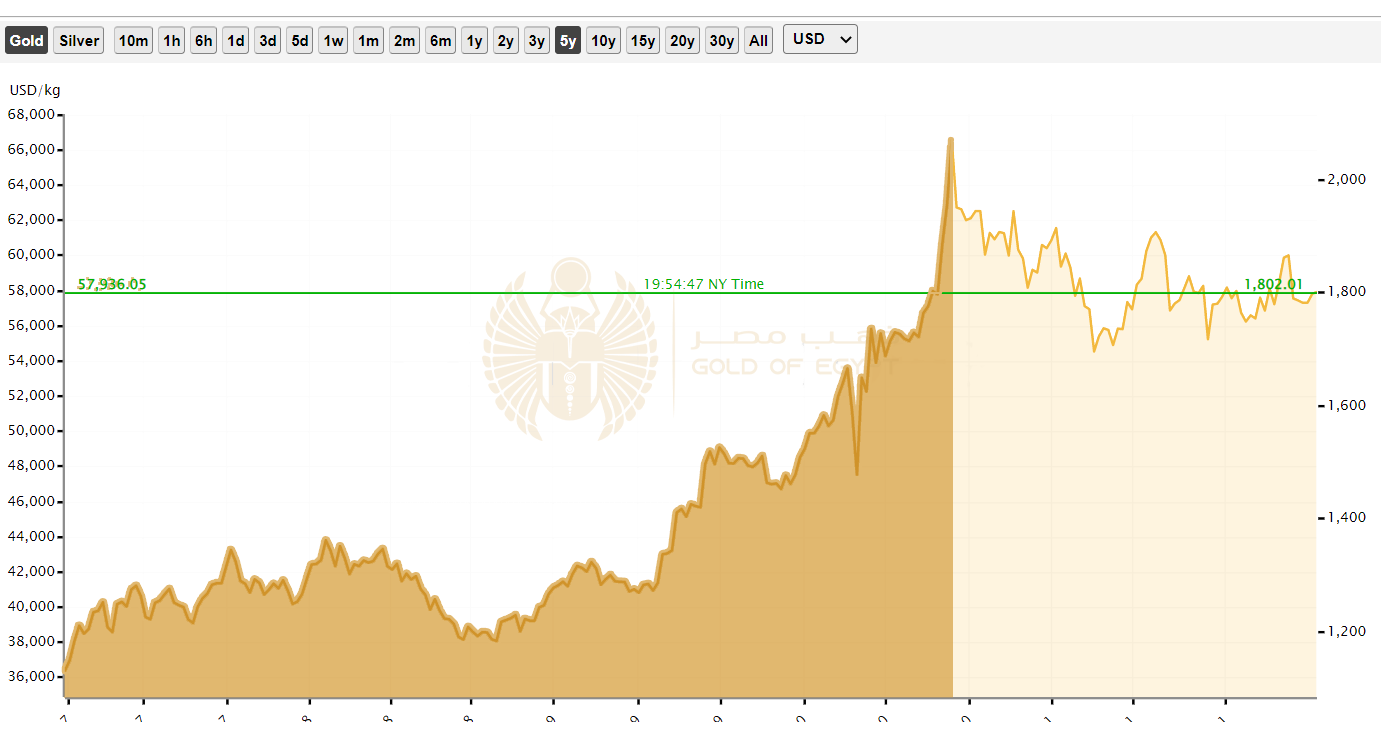

Graph 2

Mentioning the underperformance that happen this year. Gold still one of the most profitable investments over the last 5 years.

Holding physical gold for any sort of long-term period has proved its profitability over history.

Advantages and disadvantages of less liquid assets

Private markets are usually longer-term strategies that carry illiquidity premiums. Part of their appeal to investors is that they are not marked-to-market (MTM) as frequently as, say, a listed equity, which consequently can understate the true volatility and valuation of both the asset and the whole portfolio. This, in turn, can create a problem when markets enter risk-off environments.

Following the Global Financial Crisis (GFC), a major question investor often asked hedge fund and private equity managers was, “How long would it take you to exit all your positions?”. The reasons for this usually centered around concerns over counterparty risk, along with the restrictions to quickly exit illiquid positions when they needed to source capital. This remains a concern today: 42% of investors surveyed by Greenwich ranked liquidity concerns as one of their top three drivers of long-term allocation decisions.4

This liquidity question comes further to the forefront as investors explore more volatile assets like cryptocurrencies or non-fungible tokens (NFTs), or farmland and collectibles, which can take a significant amount of time to buy or sell with varying degrees of bid/ask spreads. Gold may help to answer the question.

Disclaimer:

Dahab Masr would like to remind you that the data contained in this video/article/report/website is not necessarily real-time nor accurate.

We only offer the sale or buyback for gold & other precious metal products and does not offer any investment advice or a solution to buy or sell. Opinions are the authors.

The decision to buy or sell gold or precious metals, and which precious metals to buy or sell, are the customer’s decision alone, and purchases and sales should be made subject to the customer's own research, prudence, and judgment

This video/article/report/website contains copyright material and references the use of which has not always been specifically authorized by the copyright owner (Dahab Masr).

EN

EN