Monthly Gold Analysis – June 2025

- Home

- Information Center by DahabMasr

- Monthly Gold Analysis – June 2025

Monthly Gold Analysis – June 2025

Gold Price Analysis – June 2025

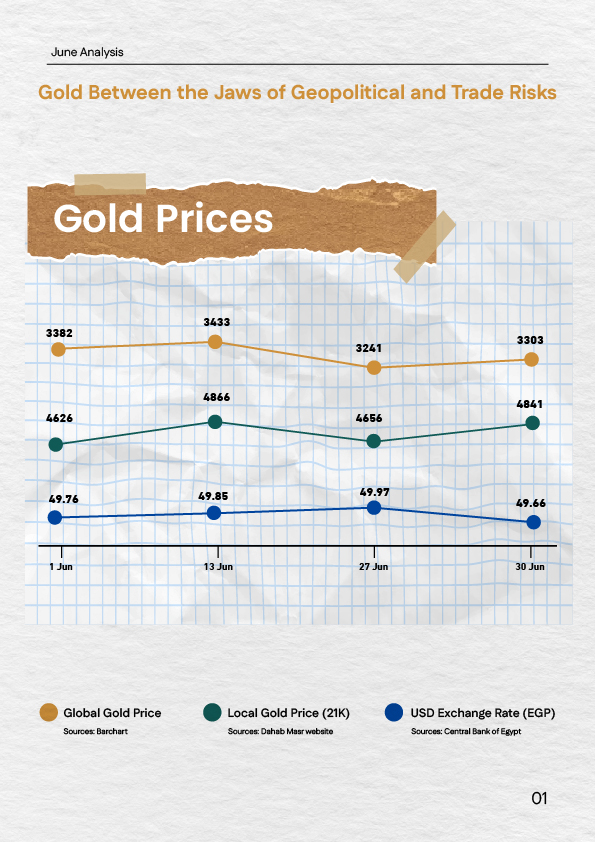

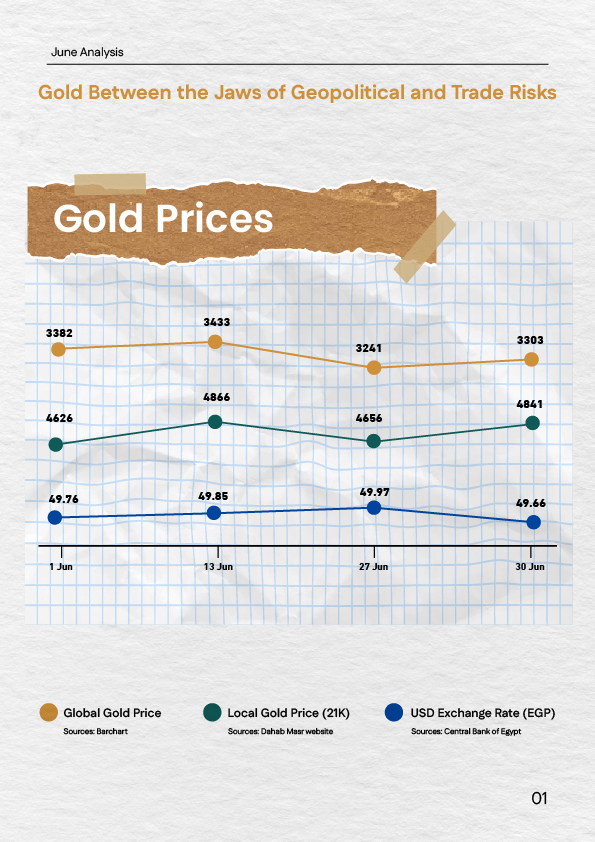

Gold prices in June 2025 remained resilient above the $3,300 per ounce level, despite sharp fluctuations driven by heightened geopolitical tensions—most notably the war between Iran and Israel, and intensified military actions between Russia and Ukraine. Central bank decisions also played a key role, including the Swiss National Bank’s rate cut and the U.S. Federal Reserve’s decision to hold rates steady.

The report also covers the impact of the U.S.–China trade agreement, rising inflation in the U.S., and market expectations for the Fed’s interest rate decision in July. June’s analysis serves as a valuable reference for anyone tracking gold trends, offering a clear view of the key economic and political forces shaping the market.

عربي

عربي