Silver & Gold Price Analysis for September 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis for September 2025

Silver & Gold Price Analysis for September 2025

Gold and Silver Prices Analysis – September 2025

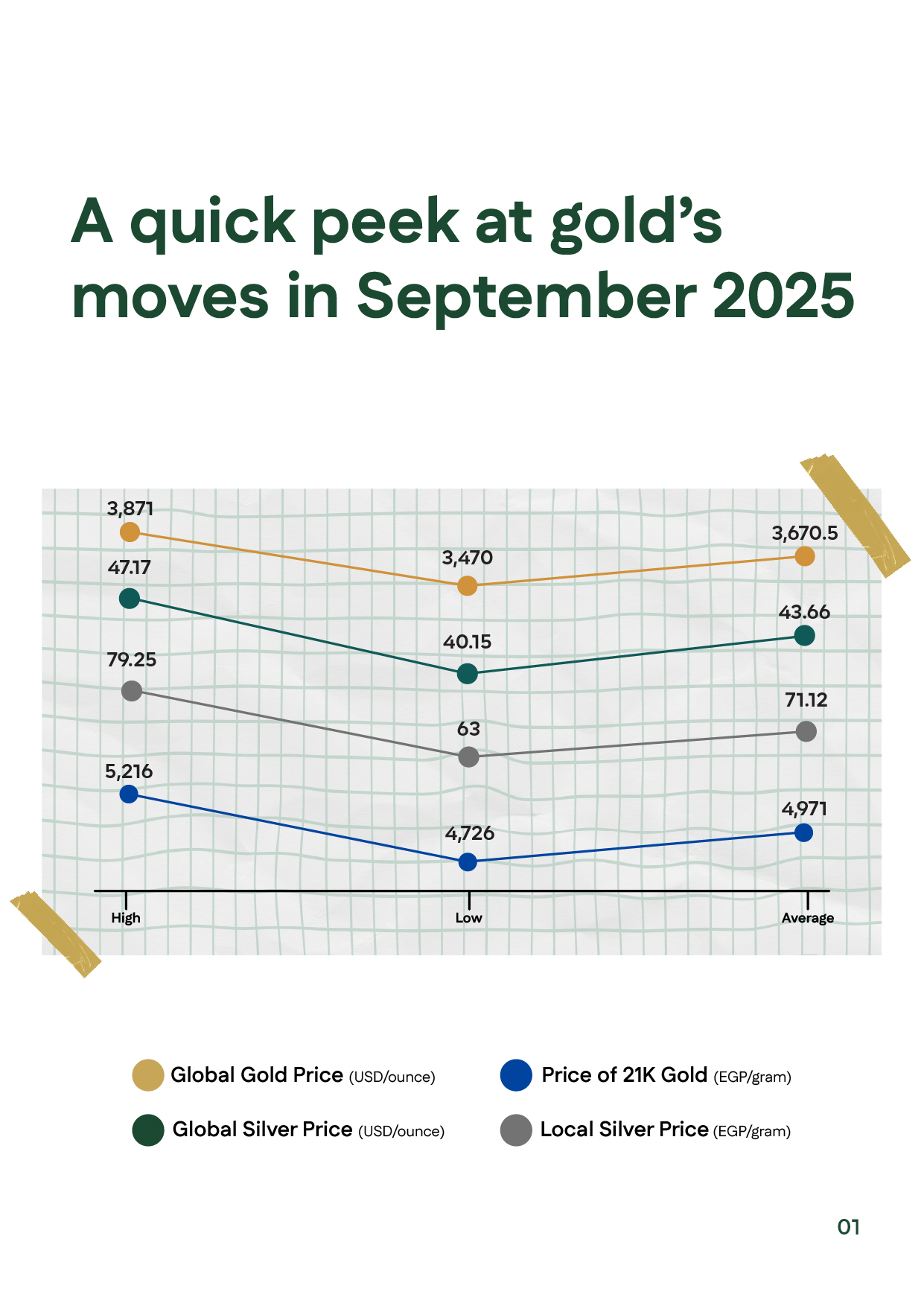

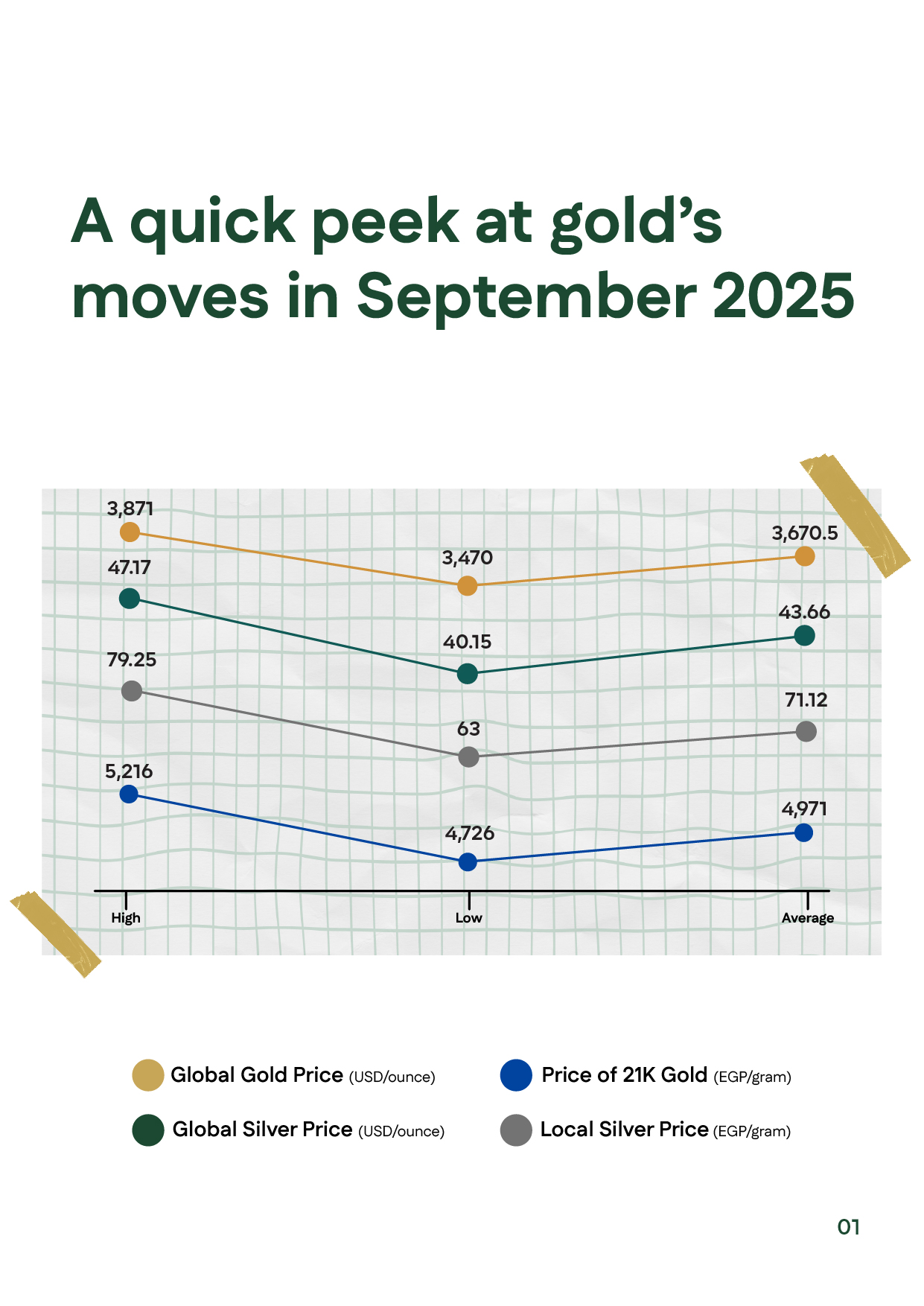

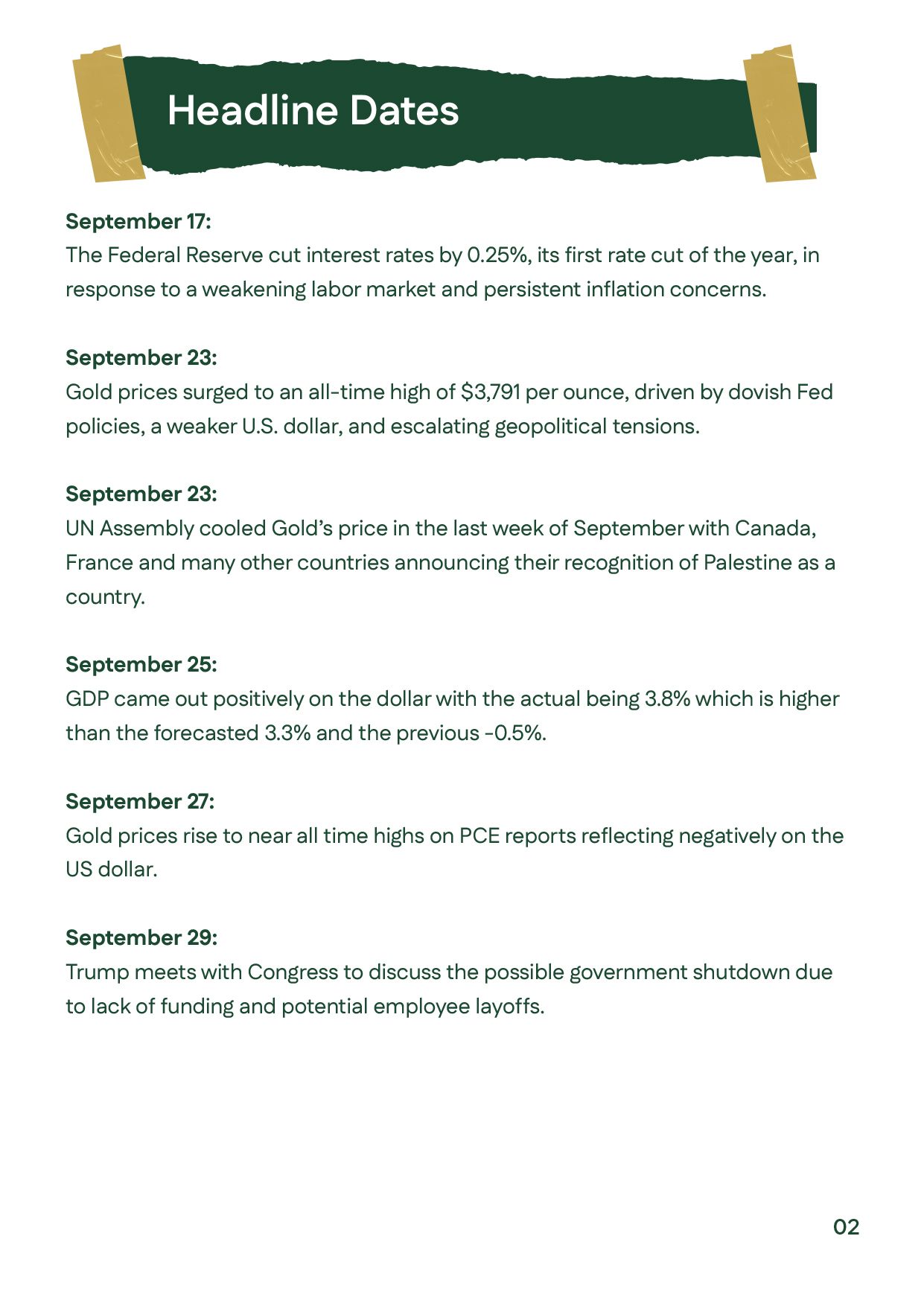

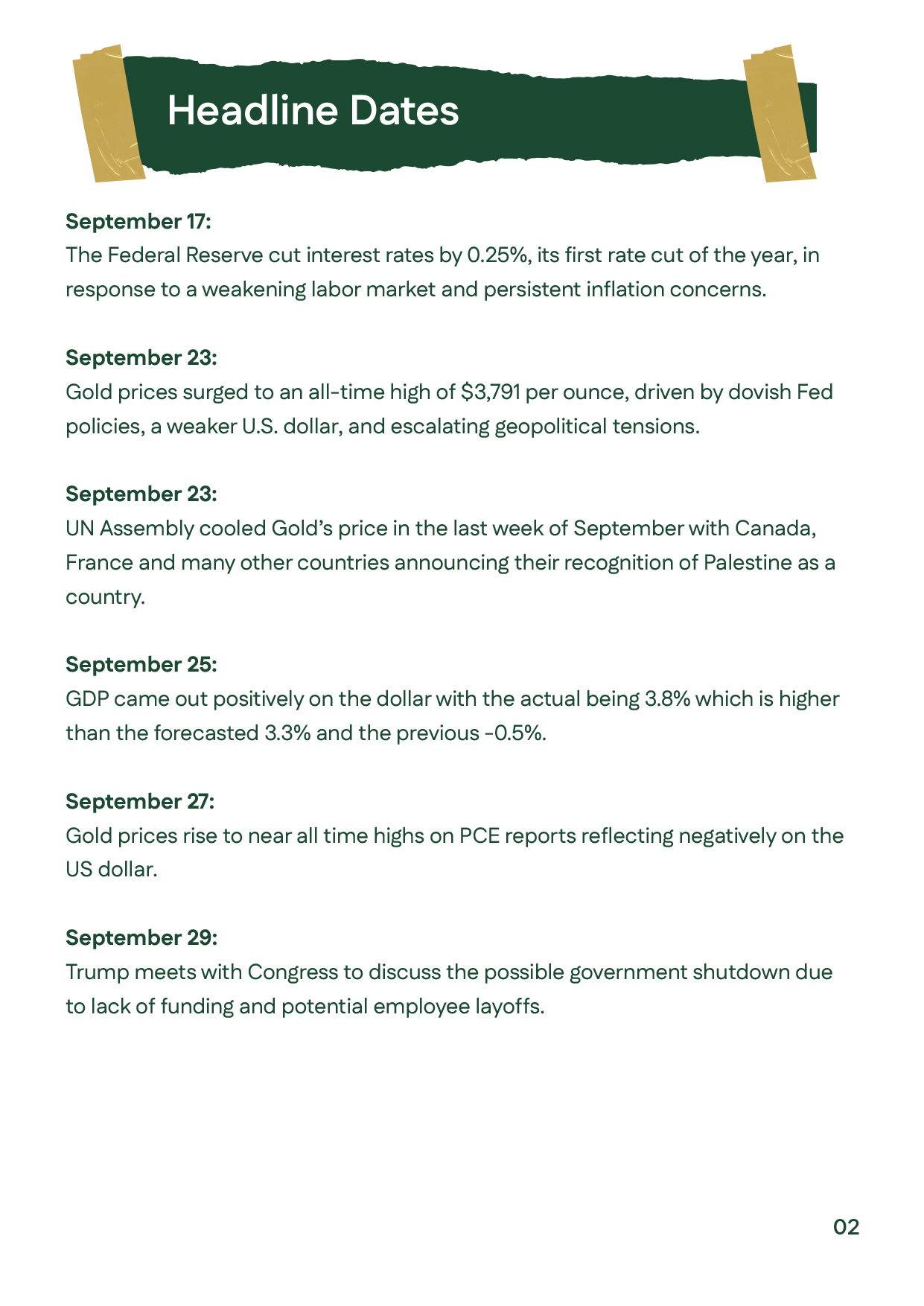

September 2025 saw strong gains in gold and silver. Gold climbed 11.33% to $3,871 on September 30, a new record high supported by the Fed’s first 0.25% rate cut of the year, weakening the dollar and boosting safe-haven demand. US tariffs and geopolitical tensions further fueled gold’s rally. Meanwhile, silver surged 16% to $47.17/oz, driven by strong industrial demand and ETF inflows. These developments reinforced bullish expectations for Q4 2025, with gold potentially surpassing $4,000 in early 2026.

عربي

عربي