Gold & Silver Price Analysis – Week 1 of December 2025

- Home

- Information Center by DahabMasr

- Gold & Silver Price Analysis – Week 1 of December 2025

Gold & Silver Price Analysis – Week 1 of December 2025

Dec 9, 2025

By

Dahab Masr Research Team

0 comment(s)

Gold and Silver Price Movements in Week 1 of December 2025

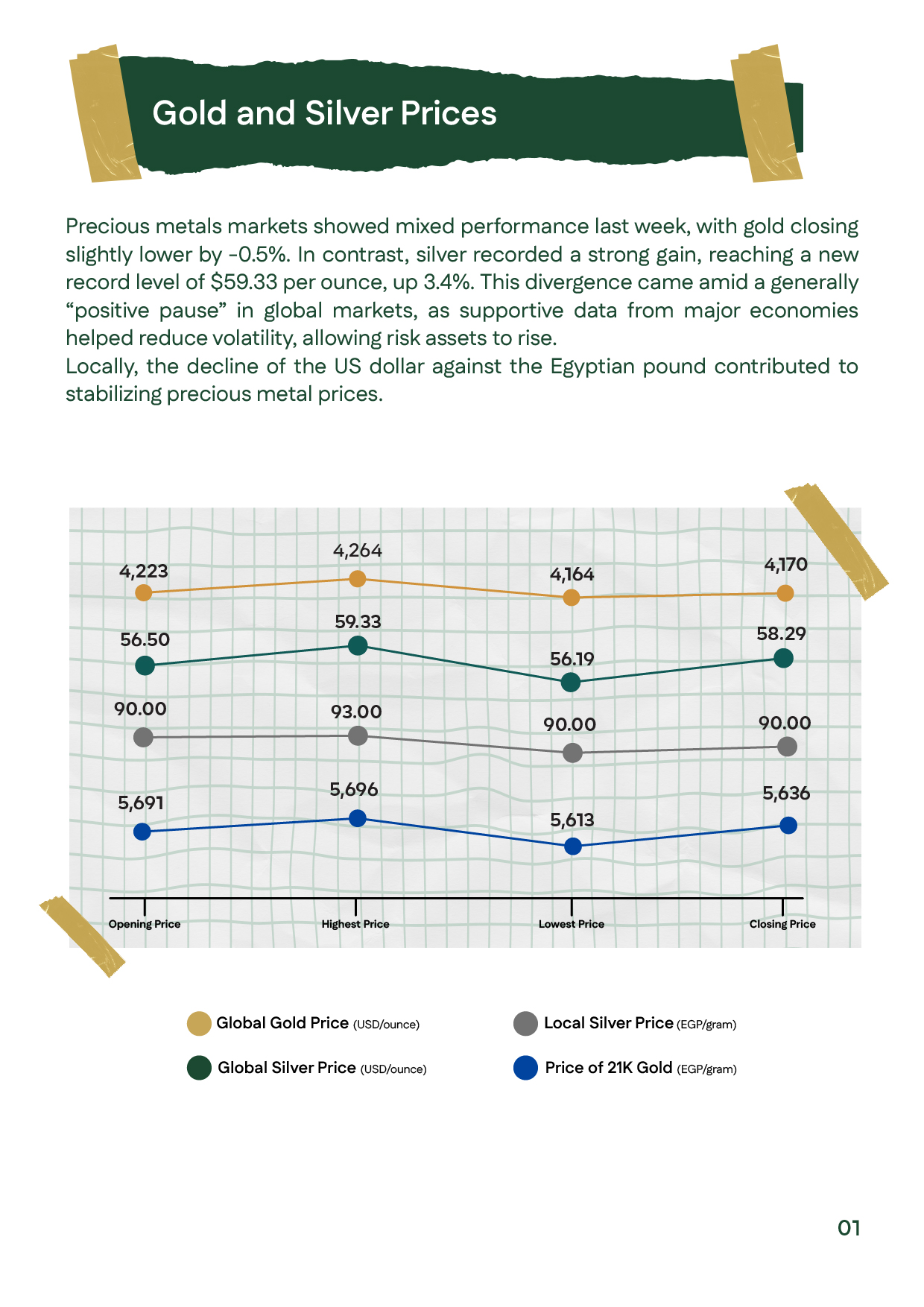

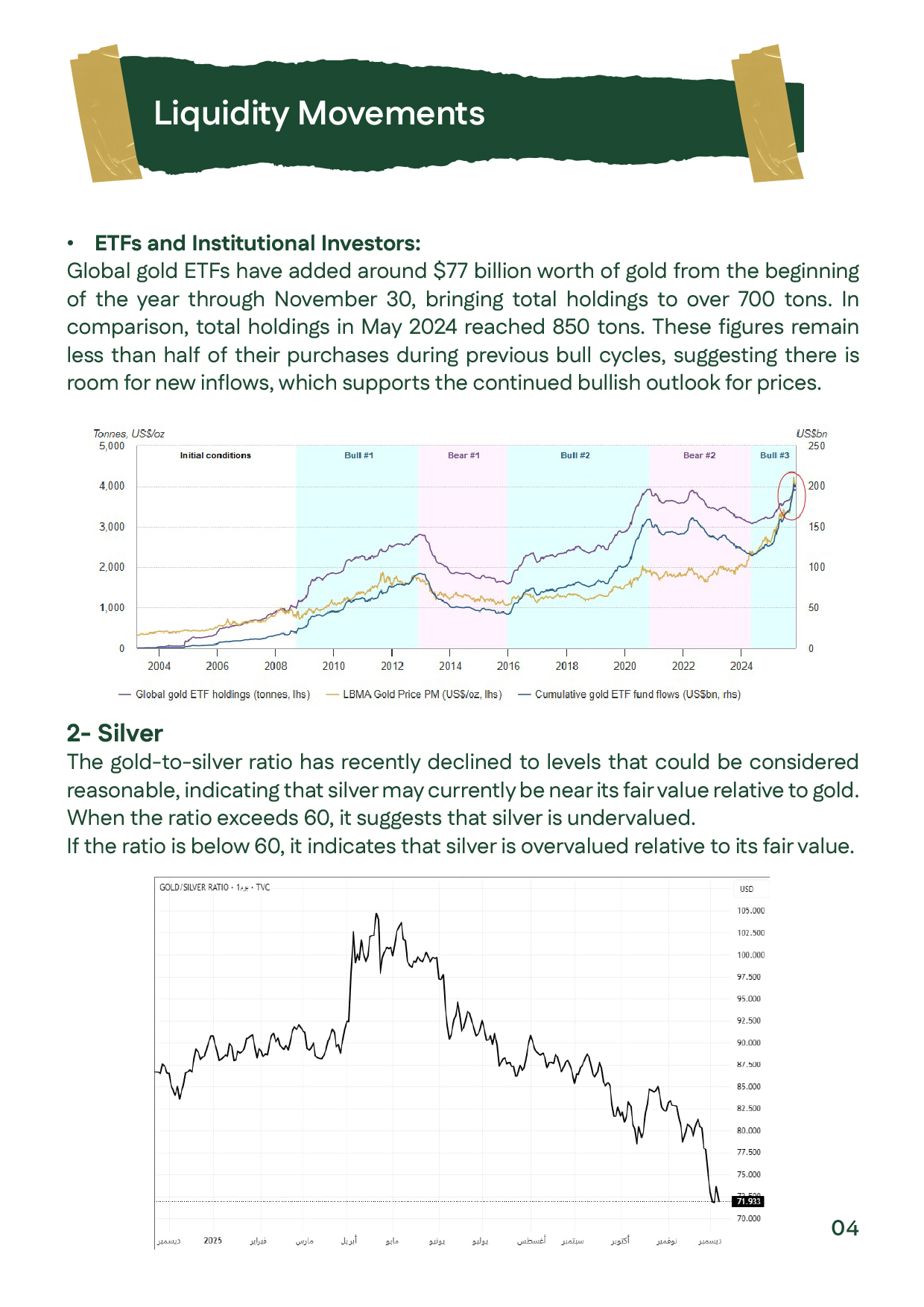

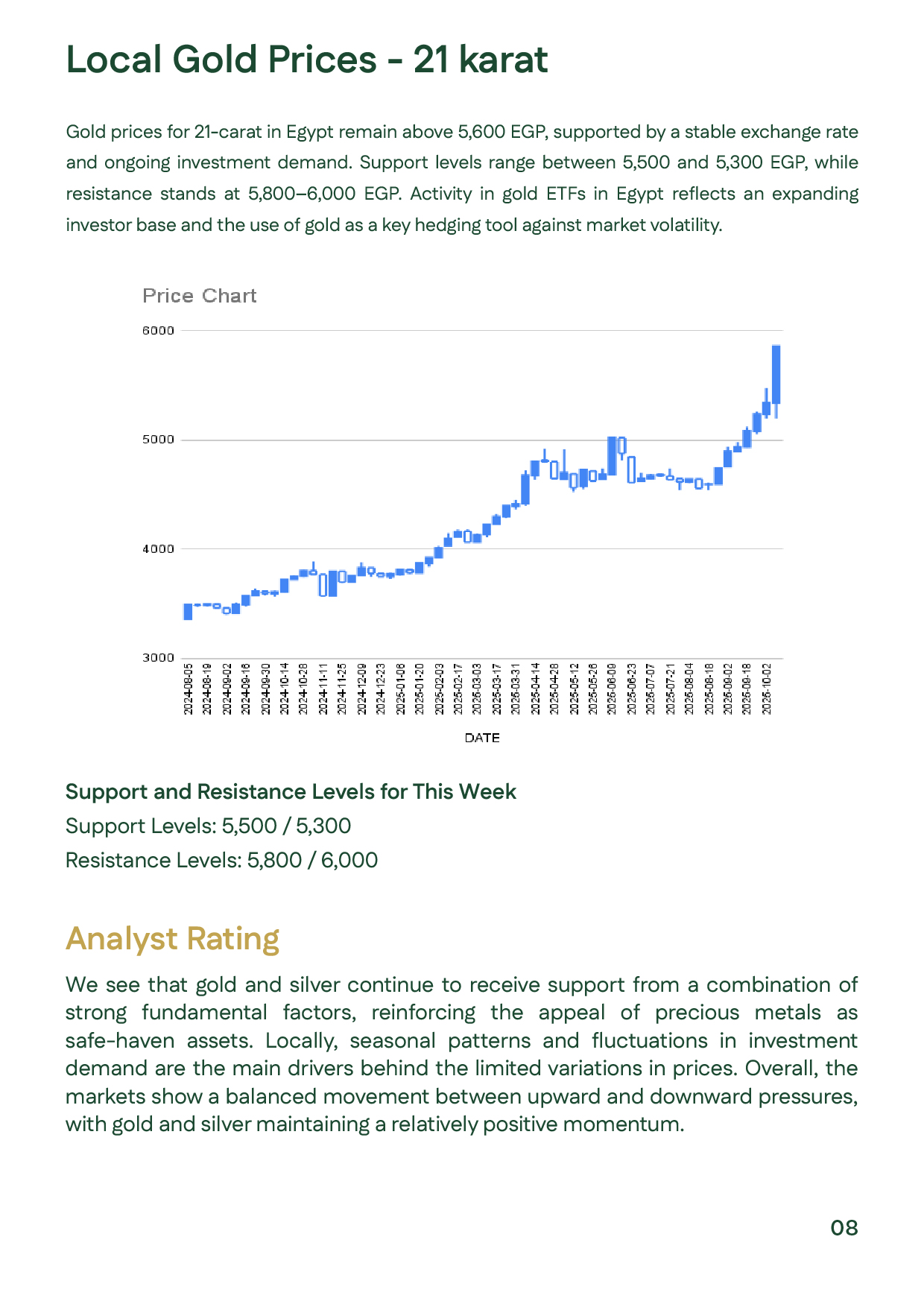

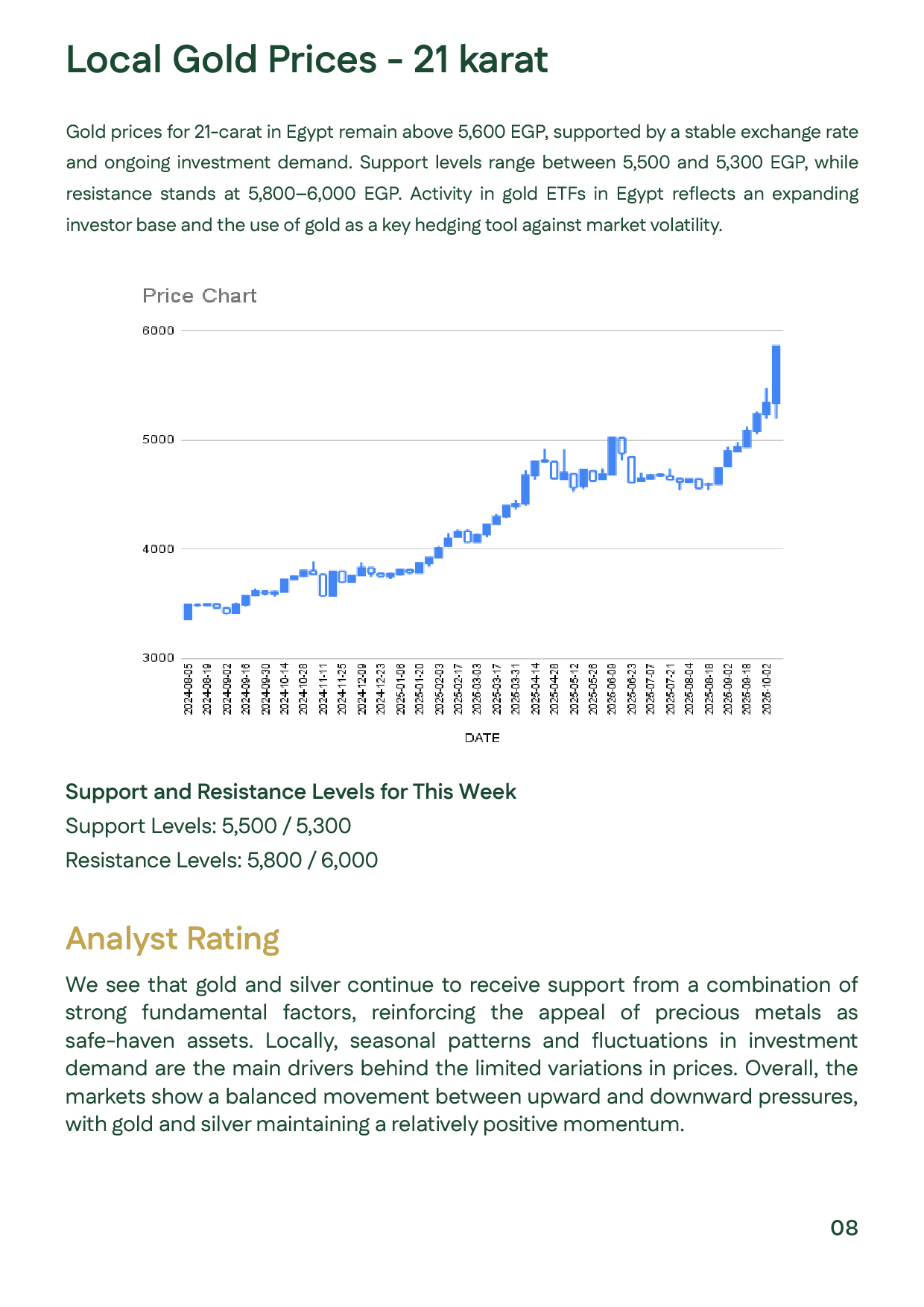

The first week of December 2025 saw mixed movements in precious metals. Gold slipped by 0.5%, closing at $4,170 amid profit-taking, a stronger U.S. dollar, and rising Treasury yields ahead of the Federal Reserve’s meeting. Meanwhile, silver surged to a record high of $59.33 (+3.4%) driven by tight physical supply and strong industrial and investment demand.

Locally, Egypt’s 21K gold remained above EGP 5,600, supported by a weaker dollar and continued investor activity, with both gold and silver maintaining positive momentum.

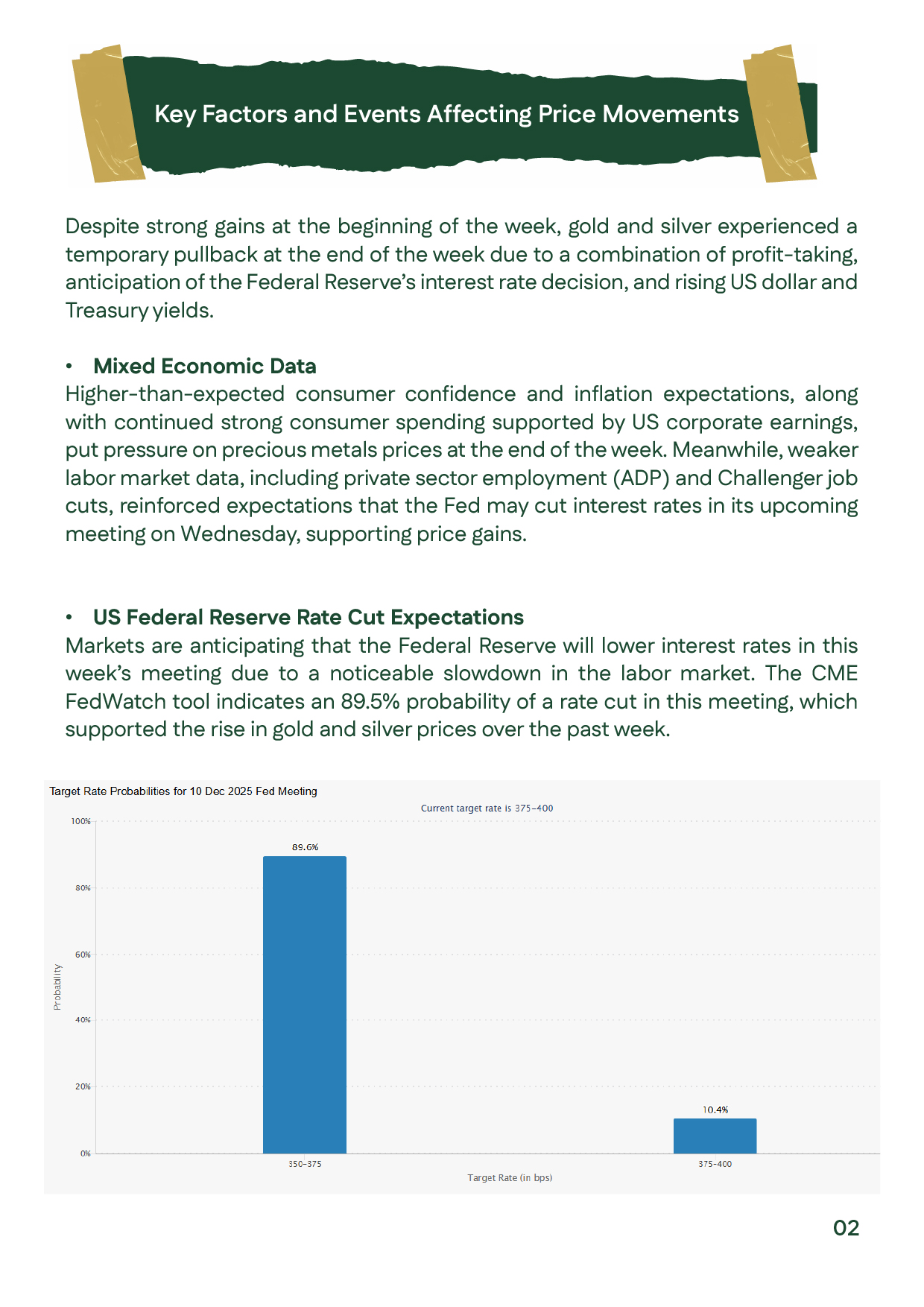

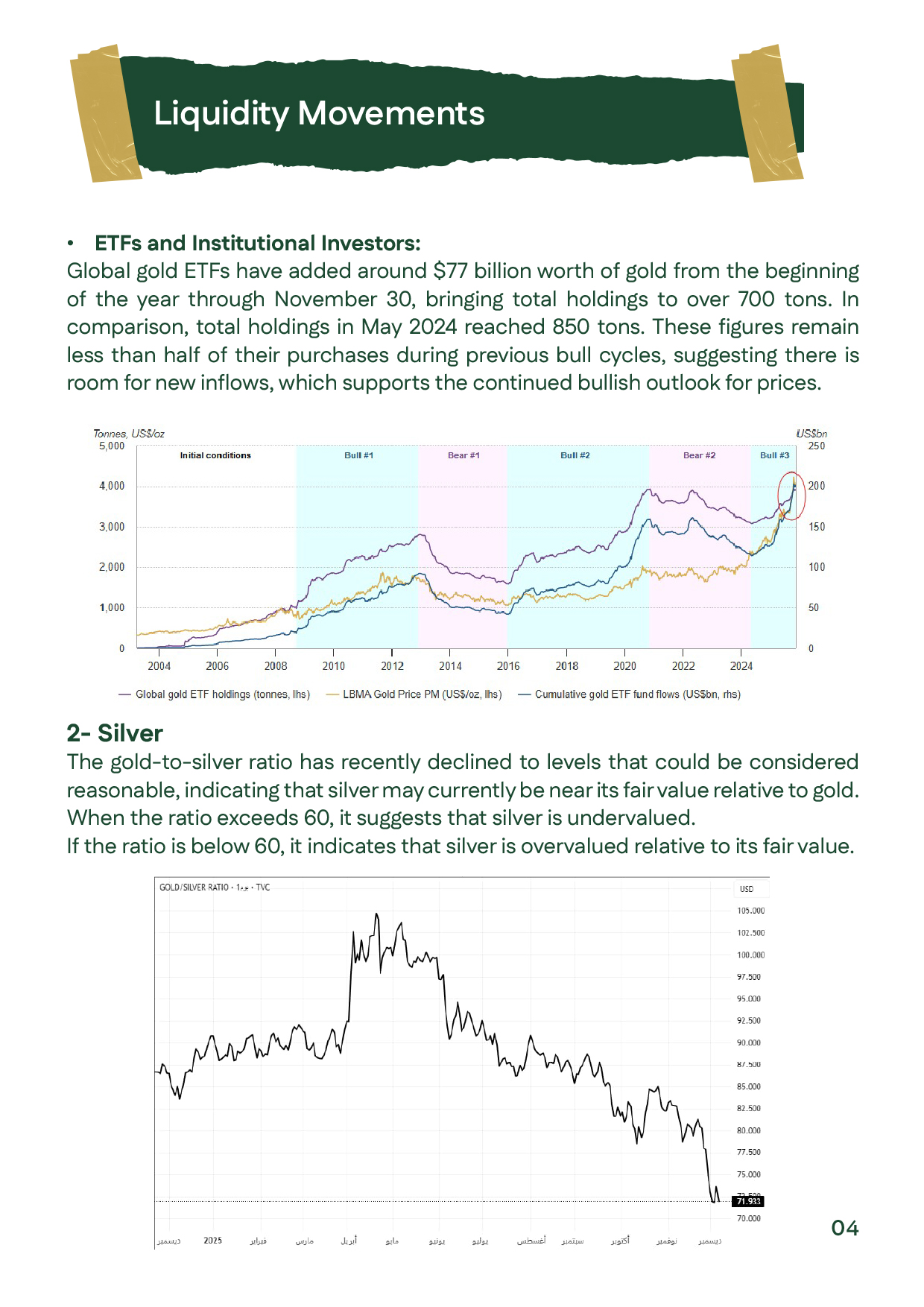

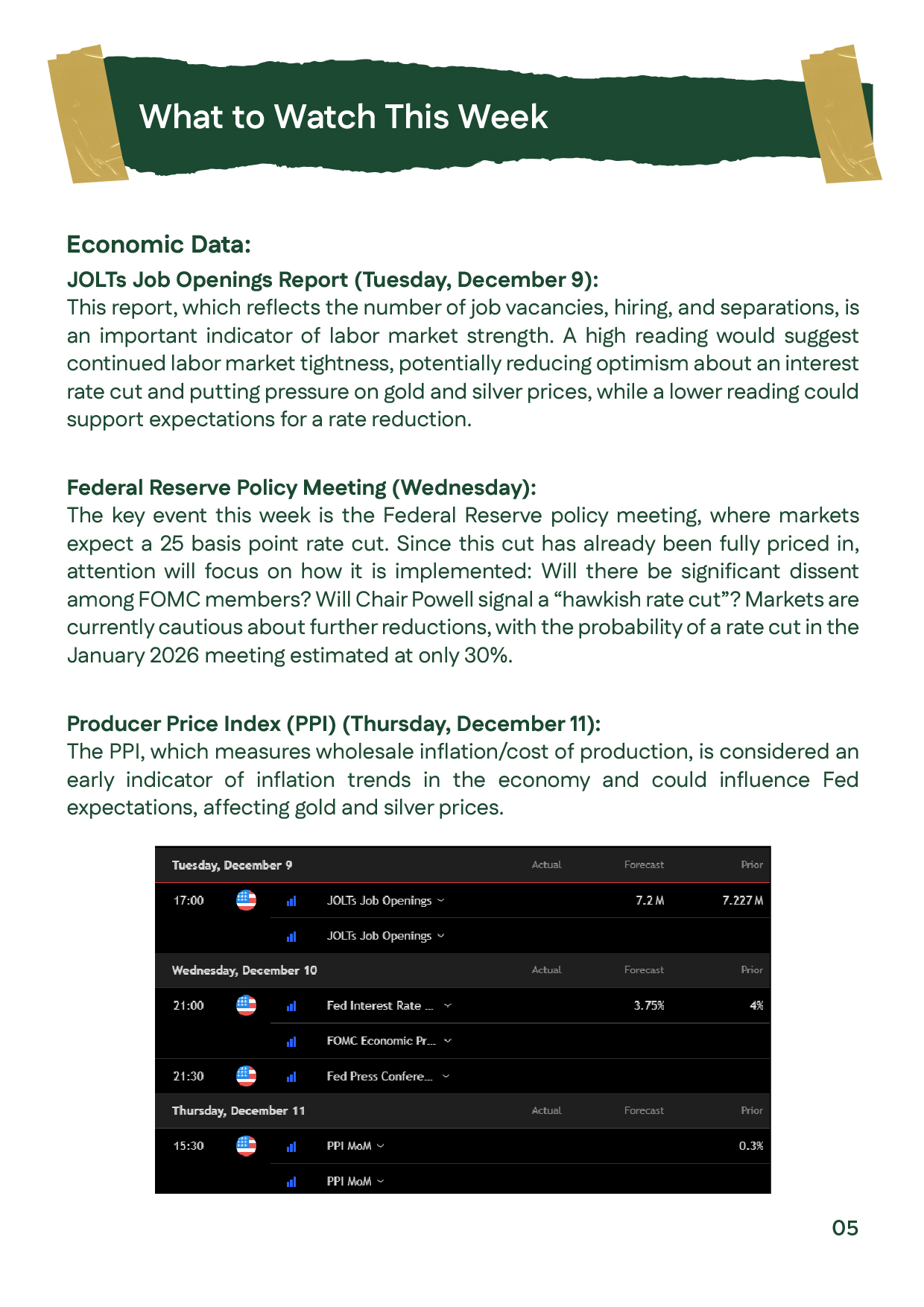

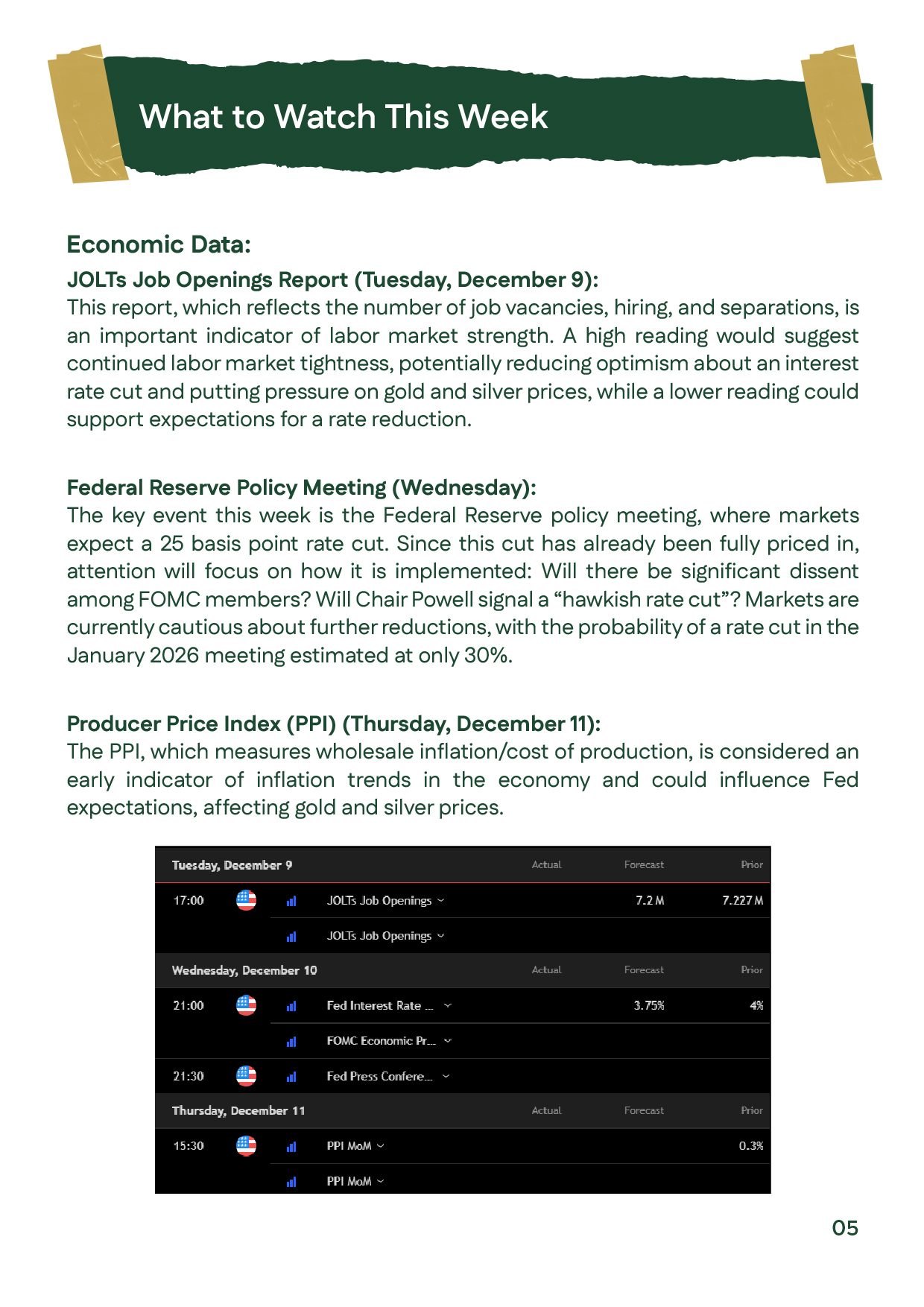

Market sentiment was shaped by soft labor data, rising expectations of a Fed rate cut—priced at 89.5% according to FedWatch—and inflows into ETFs. Technically, gold retains a bullish structure, with the 4,200–4,300 levels serving as key thresholds for determining the next directional move

عربي

عربي