Gold & Silver Price Analysis – Week 2 of December 2025

- Home

- Information Center by DahabMasr

- Gold & Silver Price Analysis – Week 2 of December 2025

Gold & Silver Price Analysis – Week 2 of December 2025

Dec 16, 2025

By

Dahab Masr Research Team

0 comment(s)

Gold and Silver Market Movements – Week 2 of December2025

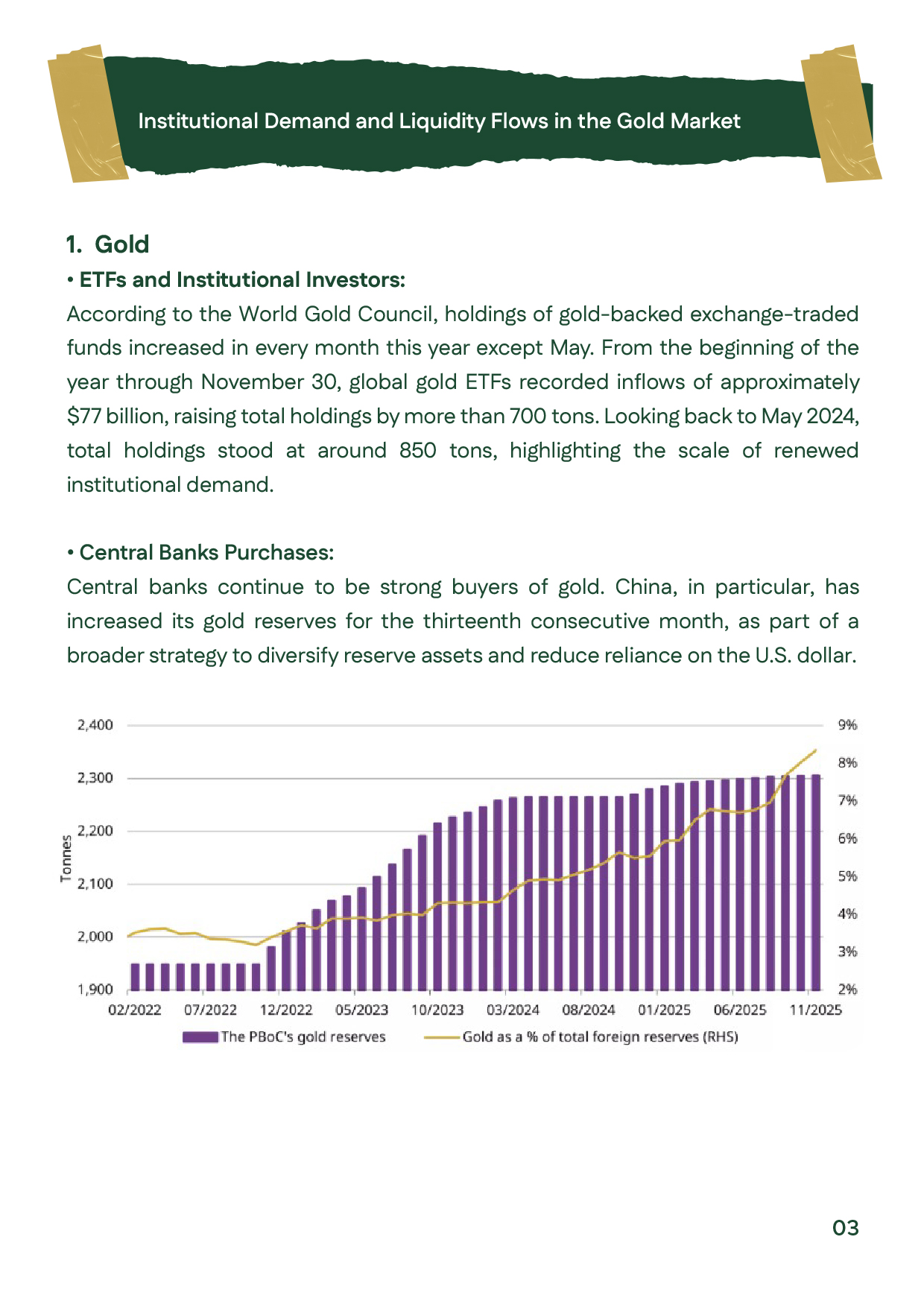

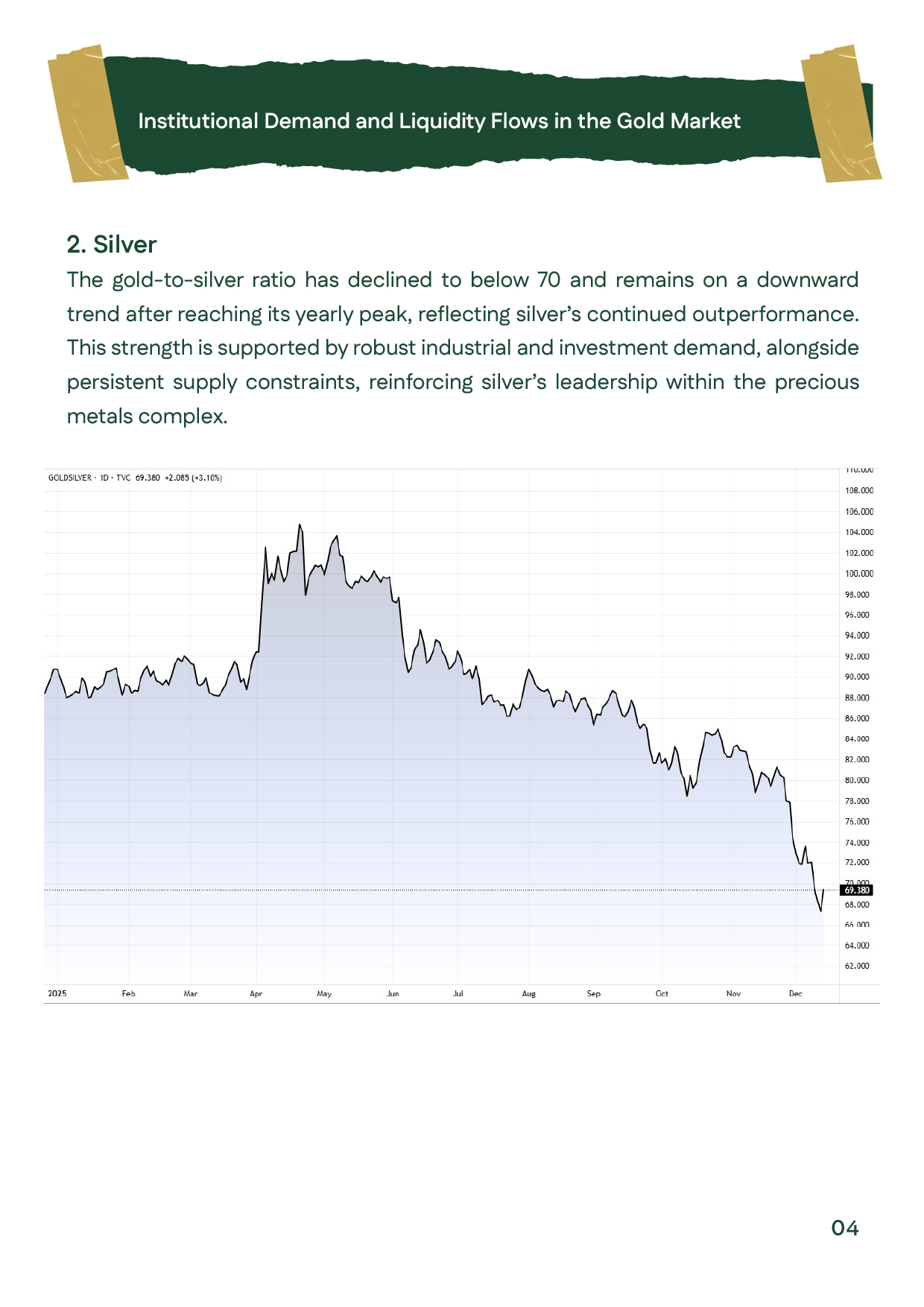

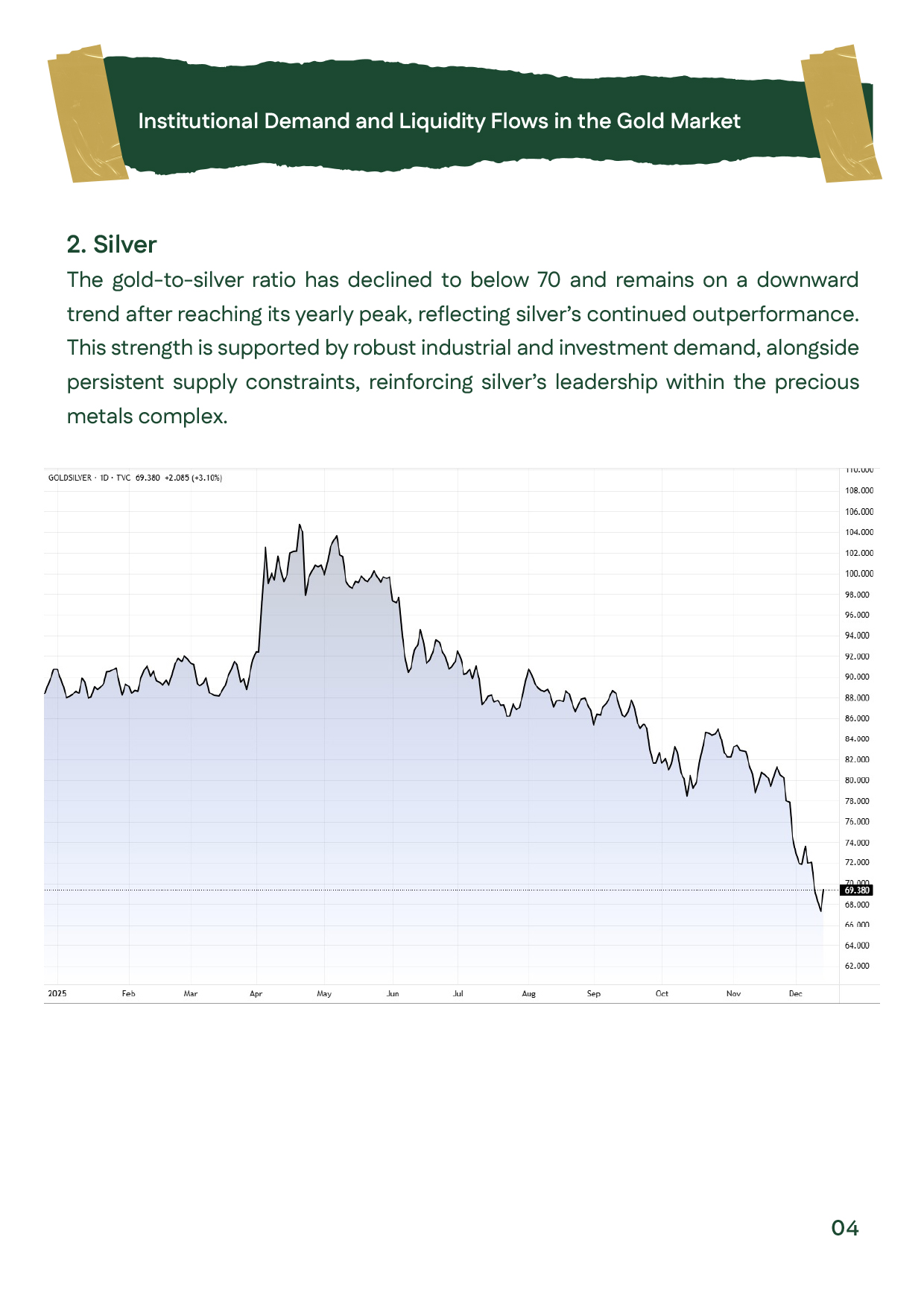

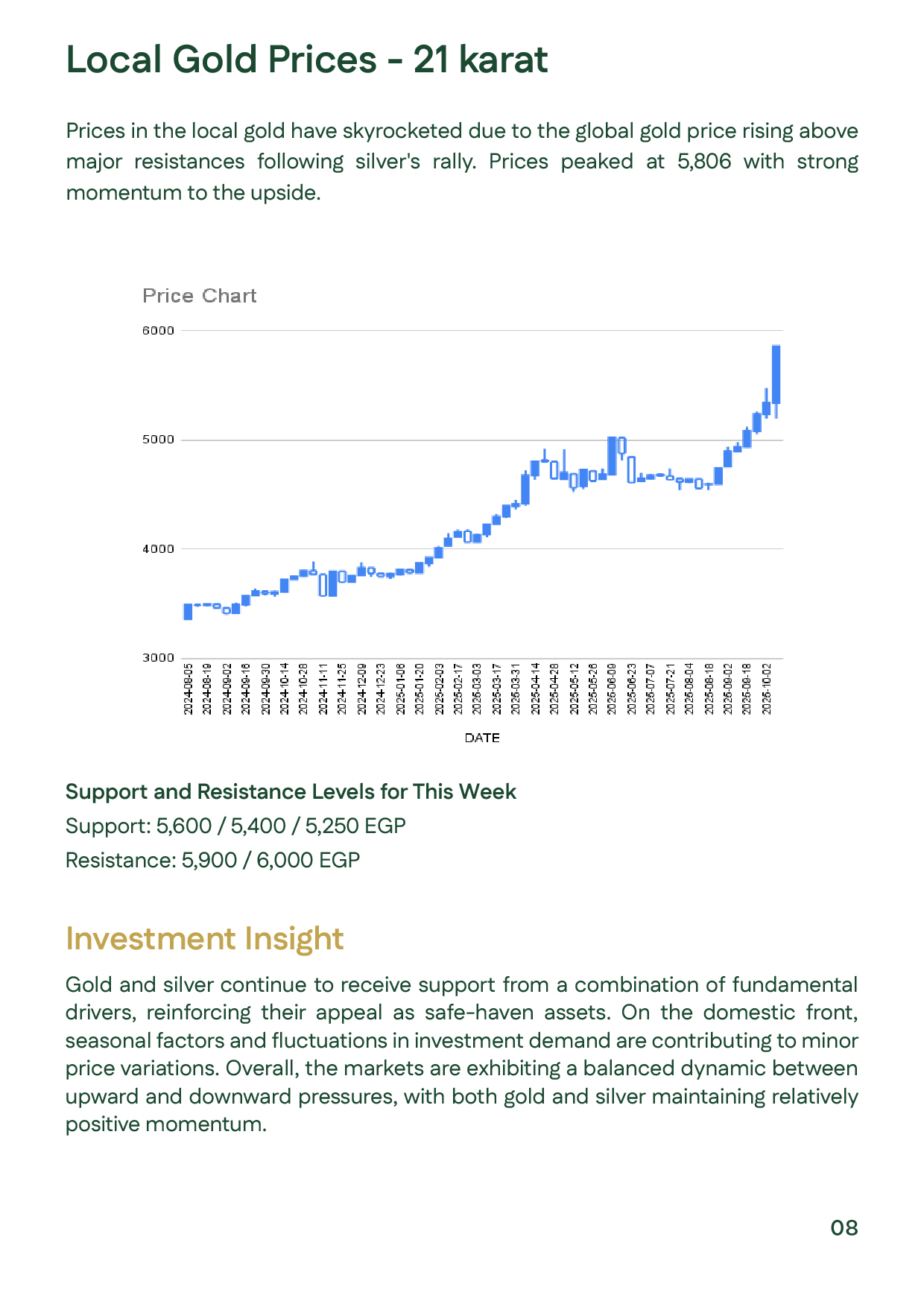

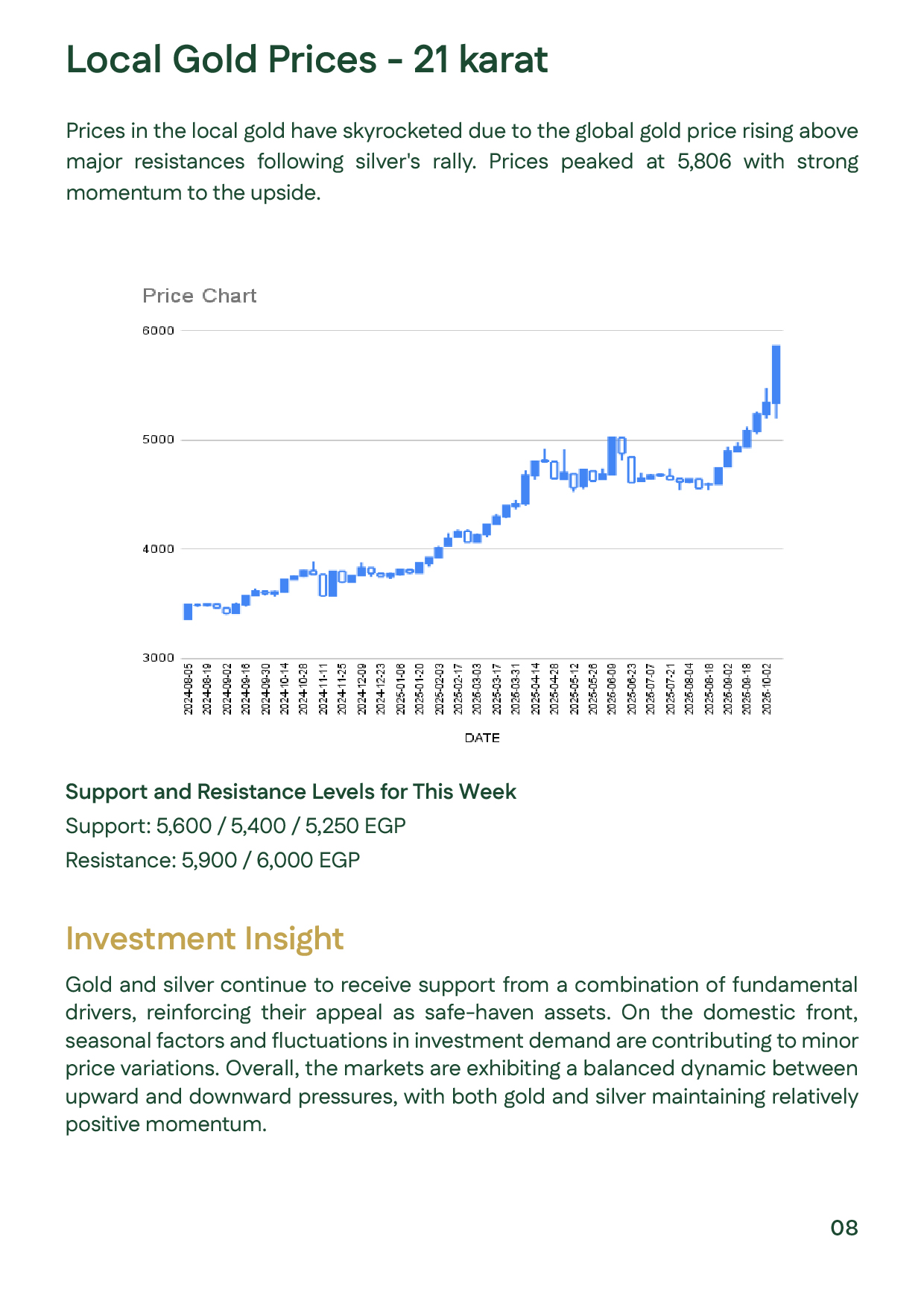

The second week of December 2025 showed strong performance in precious metals. Gold continued its upward trajectory, reaching $4,353 before closing near $4,299, supported by the Fed’s 25 bps rate cut and a dovish tone that boosted liquidity. Gold also benefited from a weaker dollar and historically low real yields.Silver extended its powerful rally, hitting new record highs at $64.65, driven by global supply shortages and rising industrial demand—particularly in solar and electronics sectors.Locally, Egypt’s 21K gold climbed above EGP 5,700 in line with global momentum and sustained investment demand. Technically, gold continues to move within a rising channel, with resistance at $4,353–4,381 and support levels around $4,200–4,240, indicating bullish potential unless key supports are broken.

عربي

عربي