Silver & Gold Price Analysis for January 2026

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis for January 2026

Silver & Gold Price Analysis for January 2026

Feb 8, 2026

By

Dahab Masr Research Team

0 comment(s)

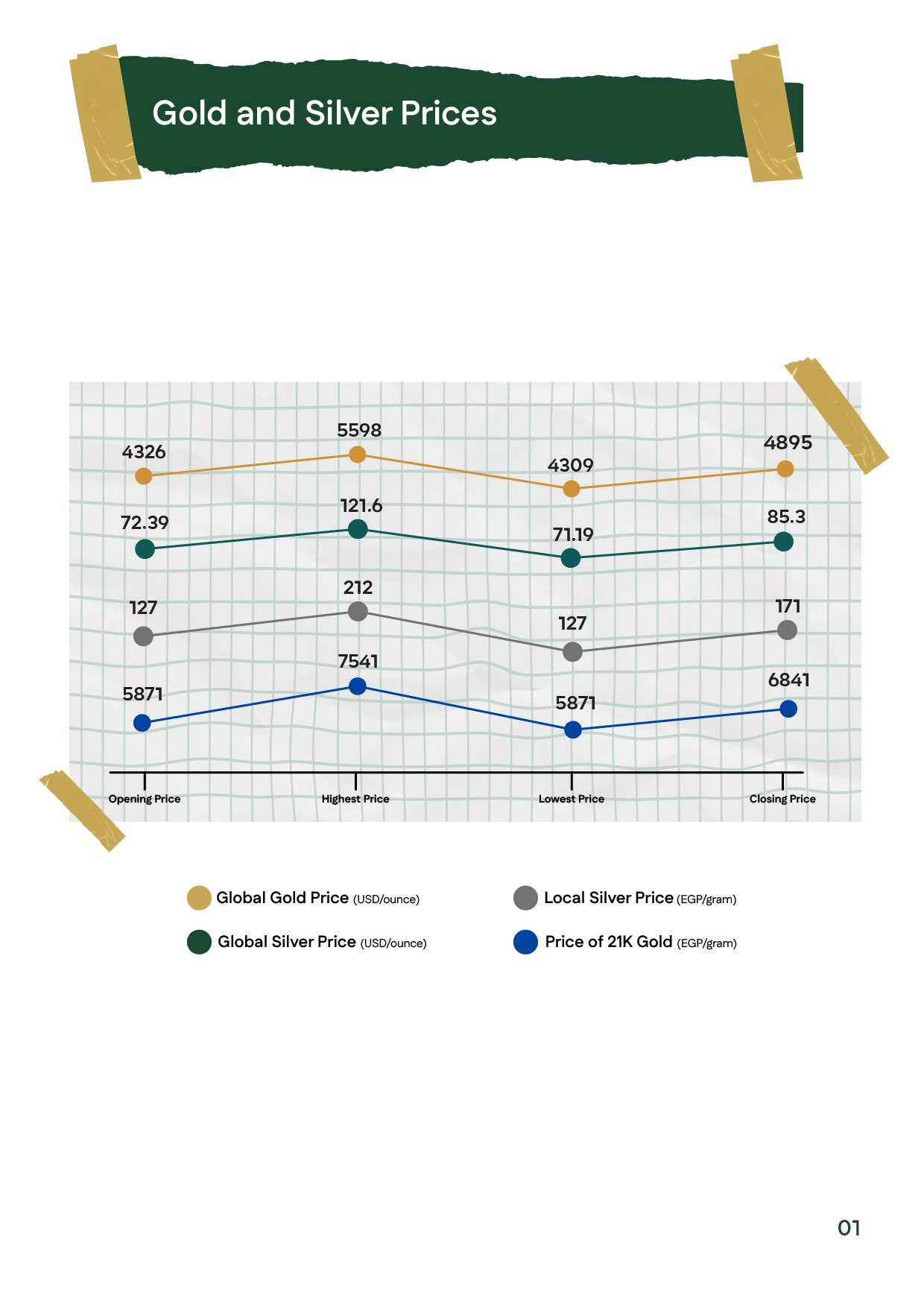

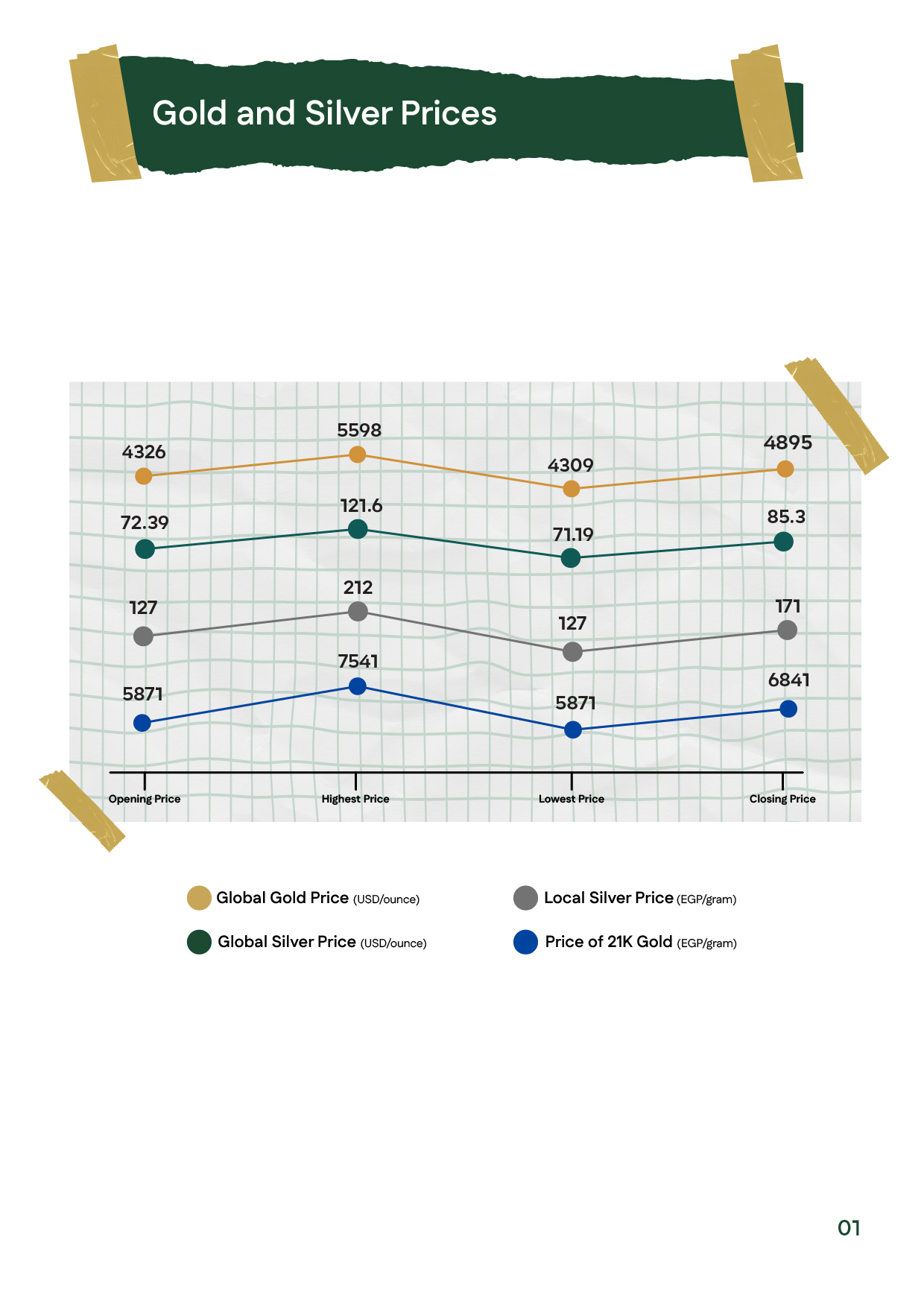

Gold and Silver Price Movements in January 2026

Gold ended January 2026 amid unprecedented volatility, after posting record highs above $5,598/oz driven by strong safe-haven flows, geopolitical tensions, and heightened uncertainty over U.S. monetary policy. Late in the month, prices corrected sharply, closing near $4,895/oz, following key political developments and rising U.S. bond yields.

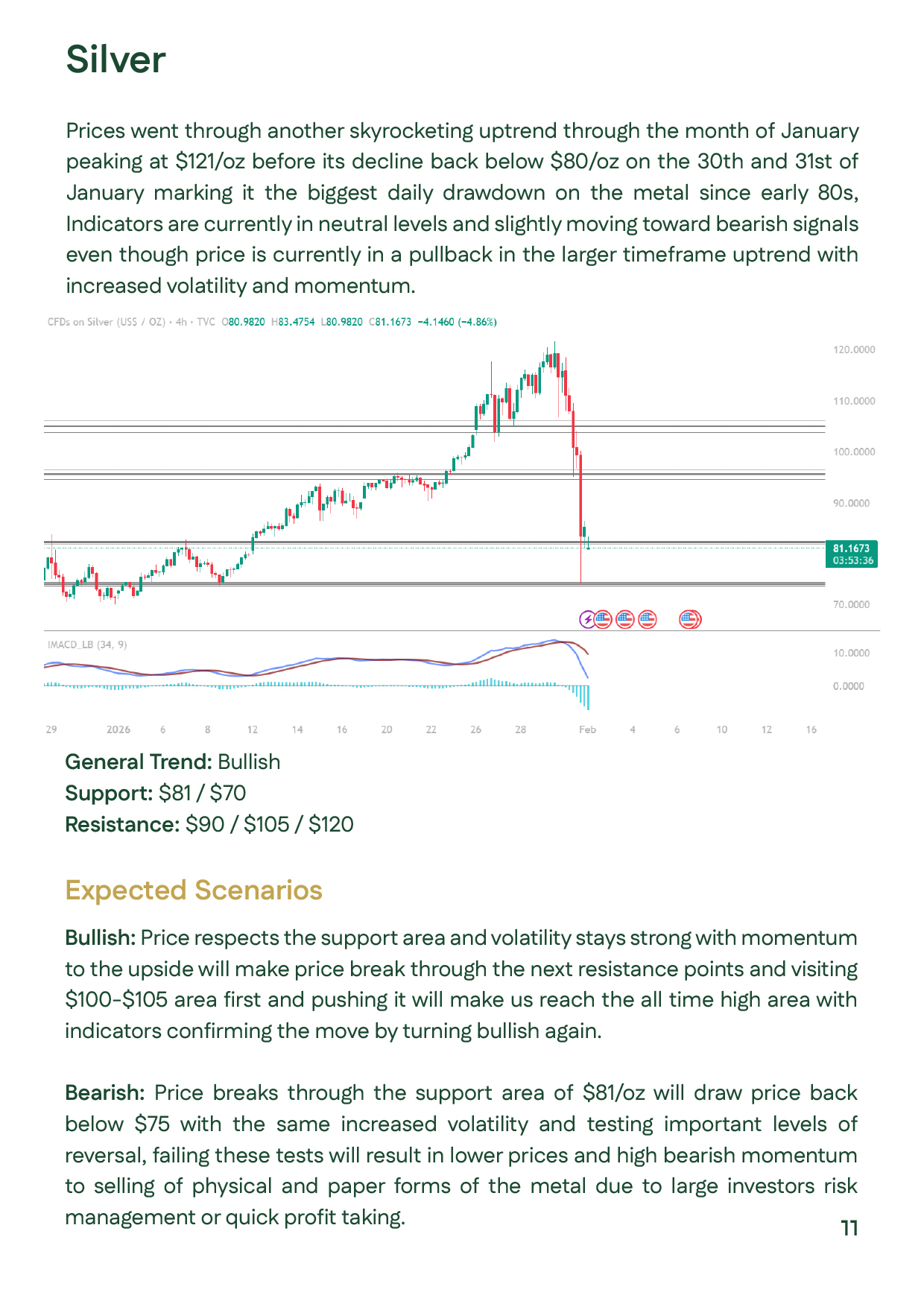

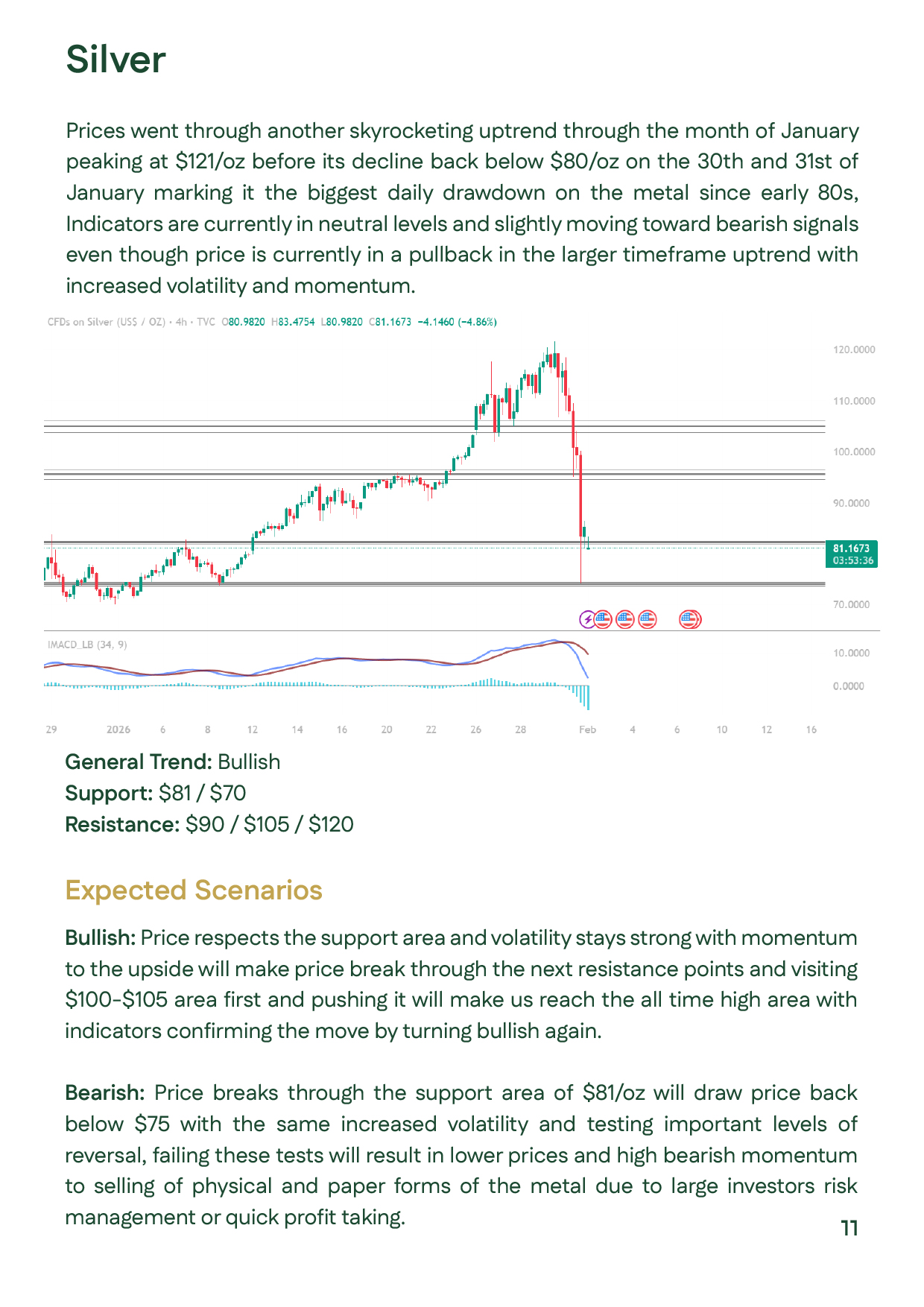

Silver delivered exceptional performance, rallying into triple-digit territory above $120/oz before retreating below $80/oz due to profit-taking and higher margin requirements. Locally, Egyptian gold prices continued to rise, supported by investment demand and currency pressures. Technically, both metals remain in long-term bullish trends despite sharp short-term corrections.

عربي

عربي