Silver & Gold Price Analysis for November 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis for November 2025

Silver & Gold Price Analysis for November 2025

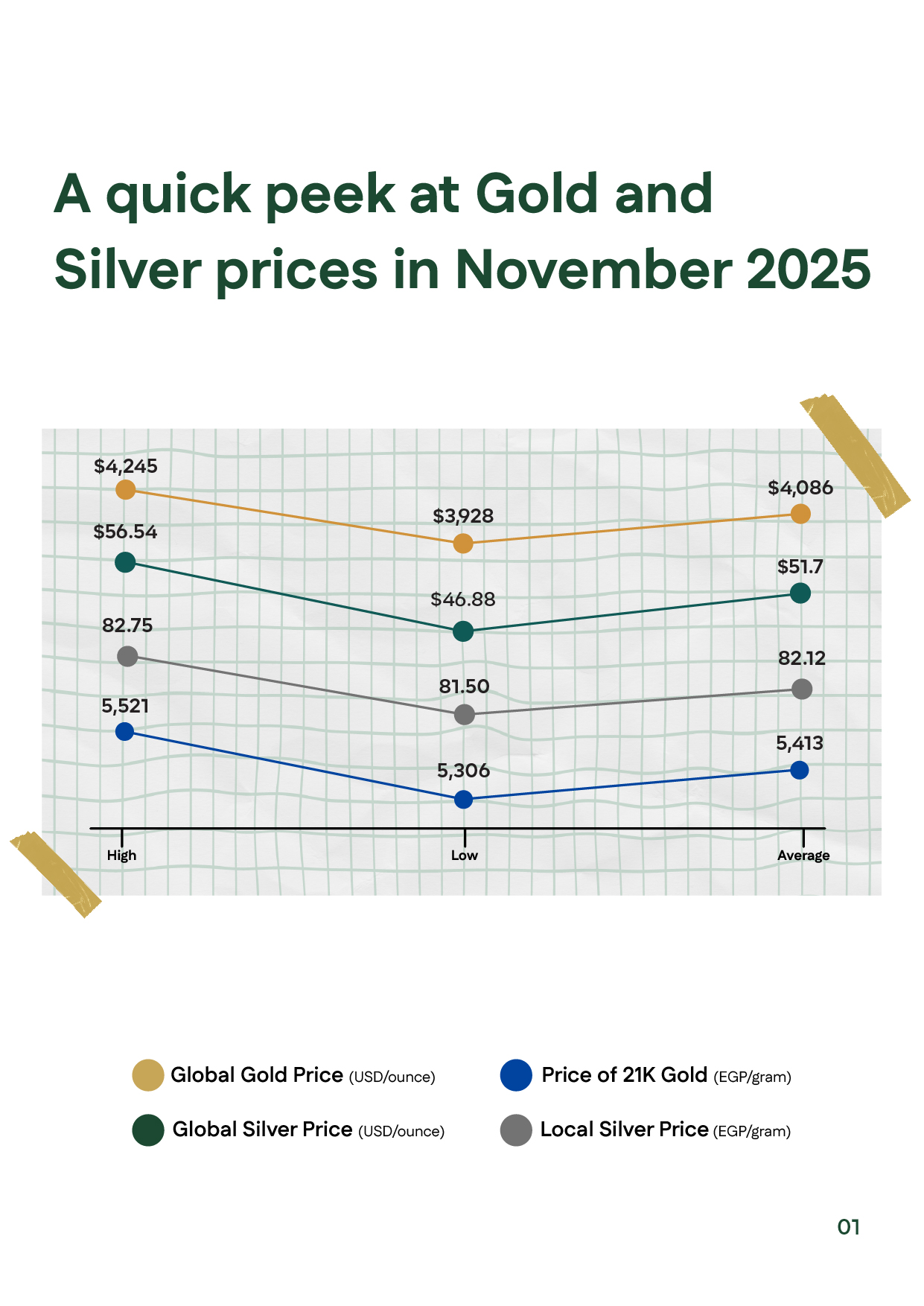

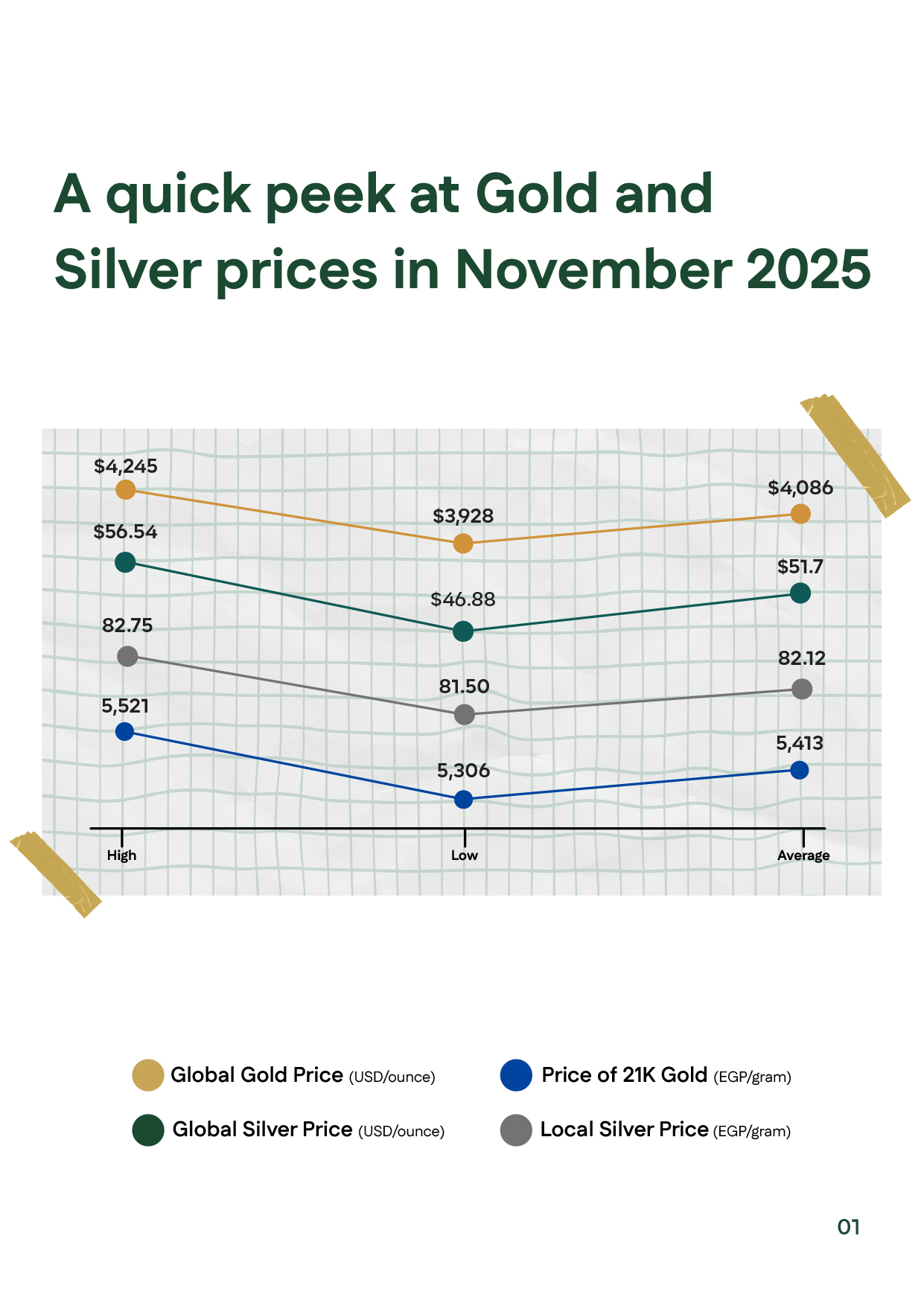

Gold and Silver Price Movements in November 2025

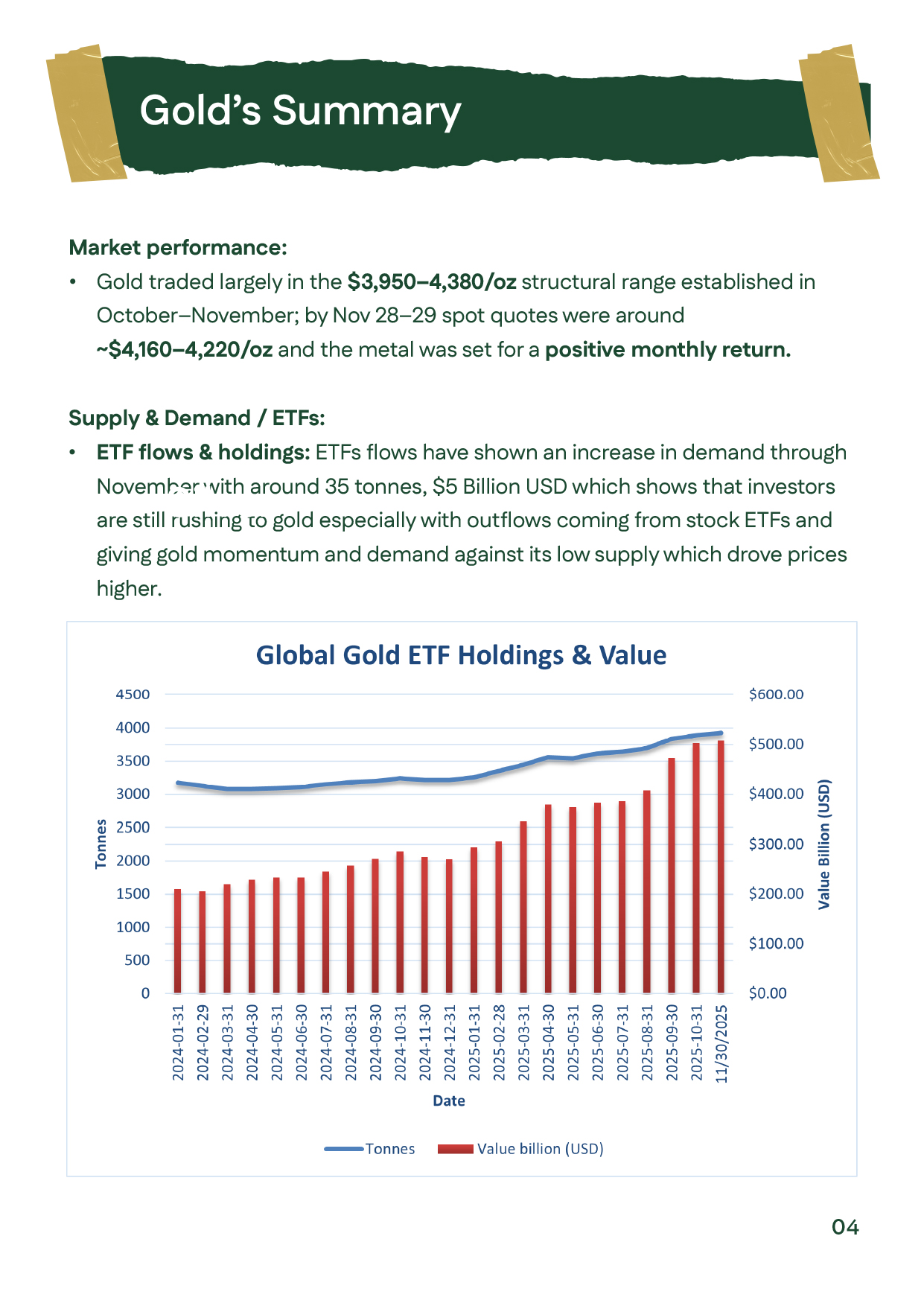

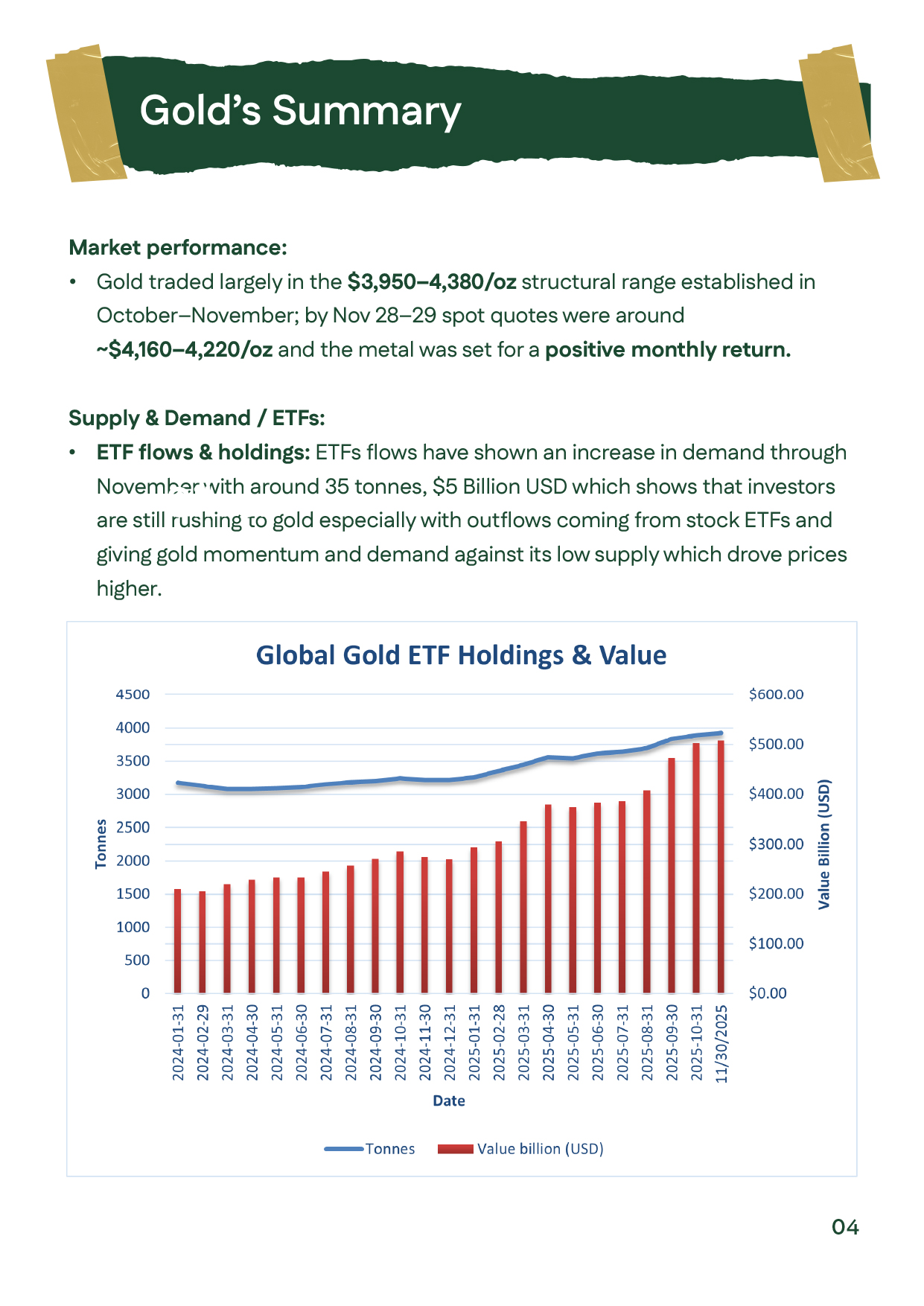

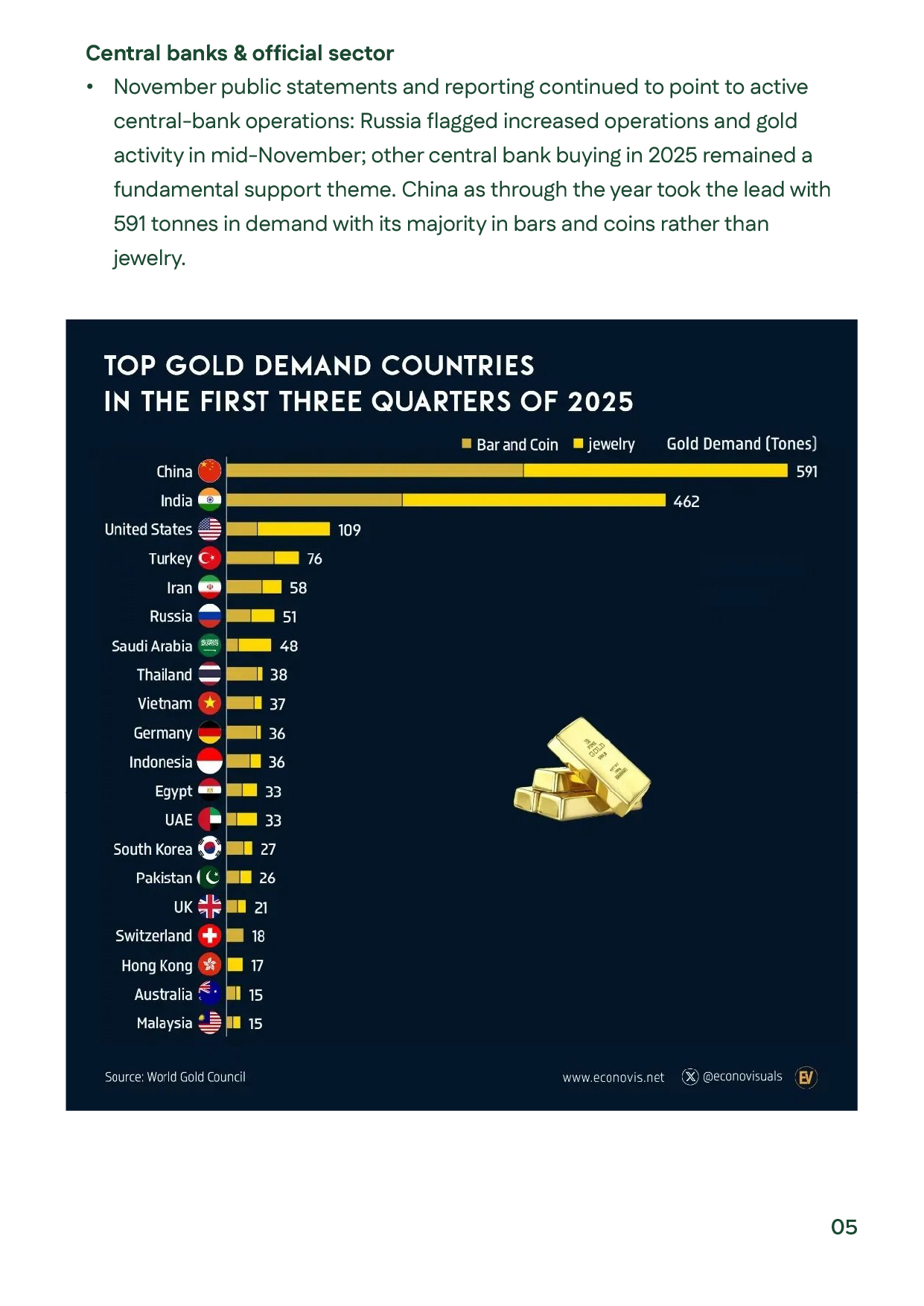

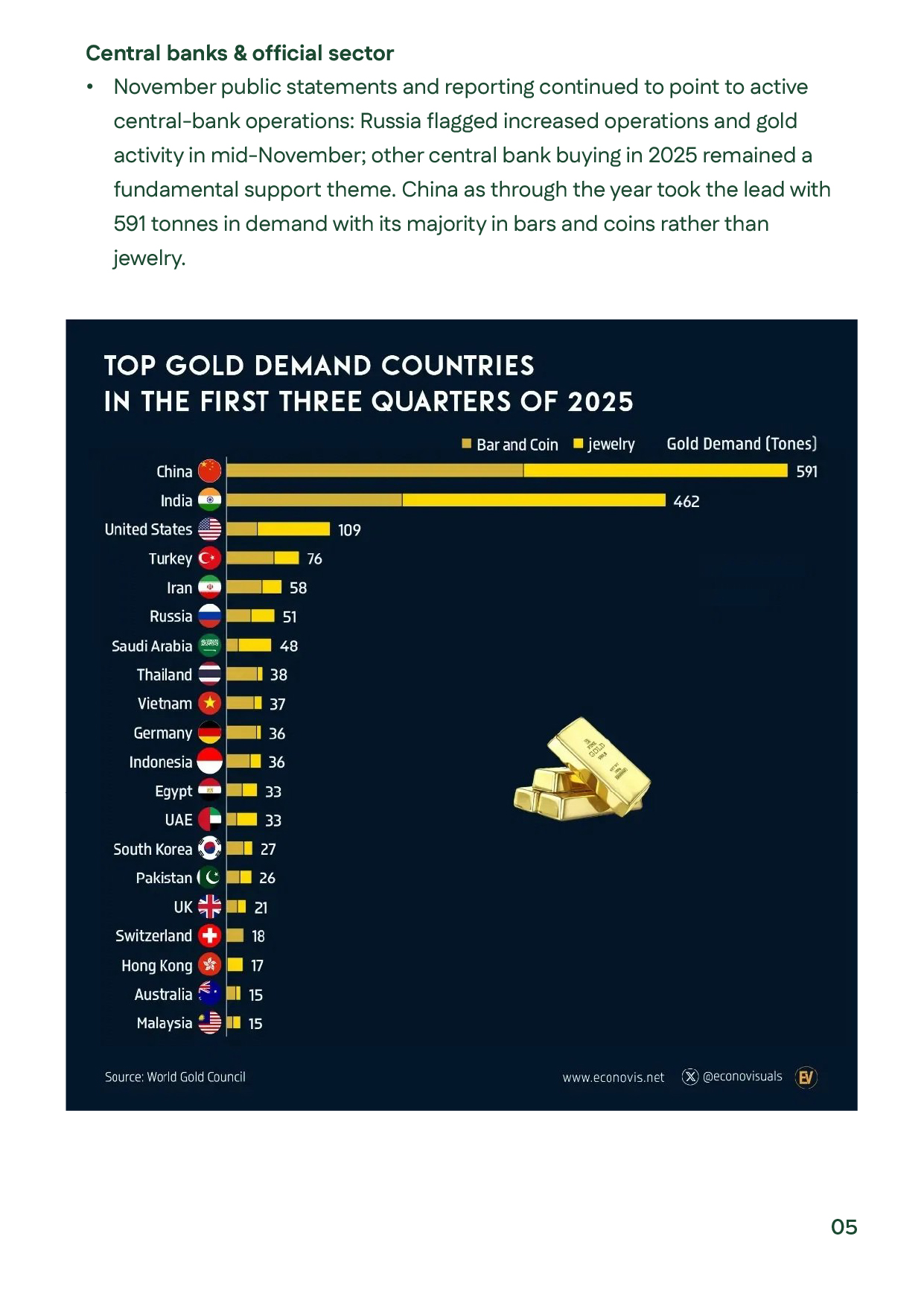

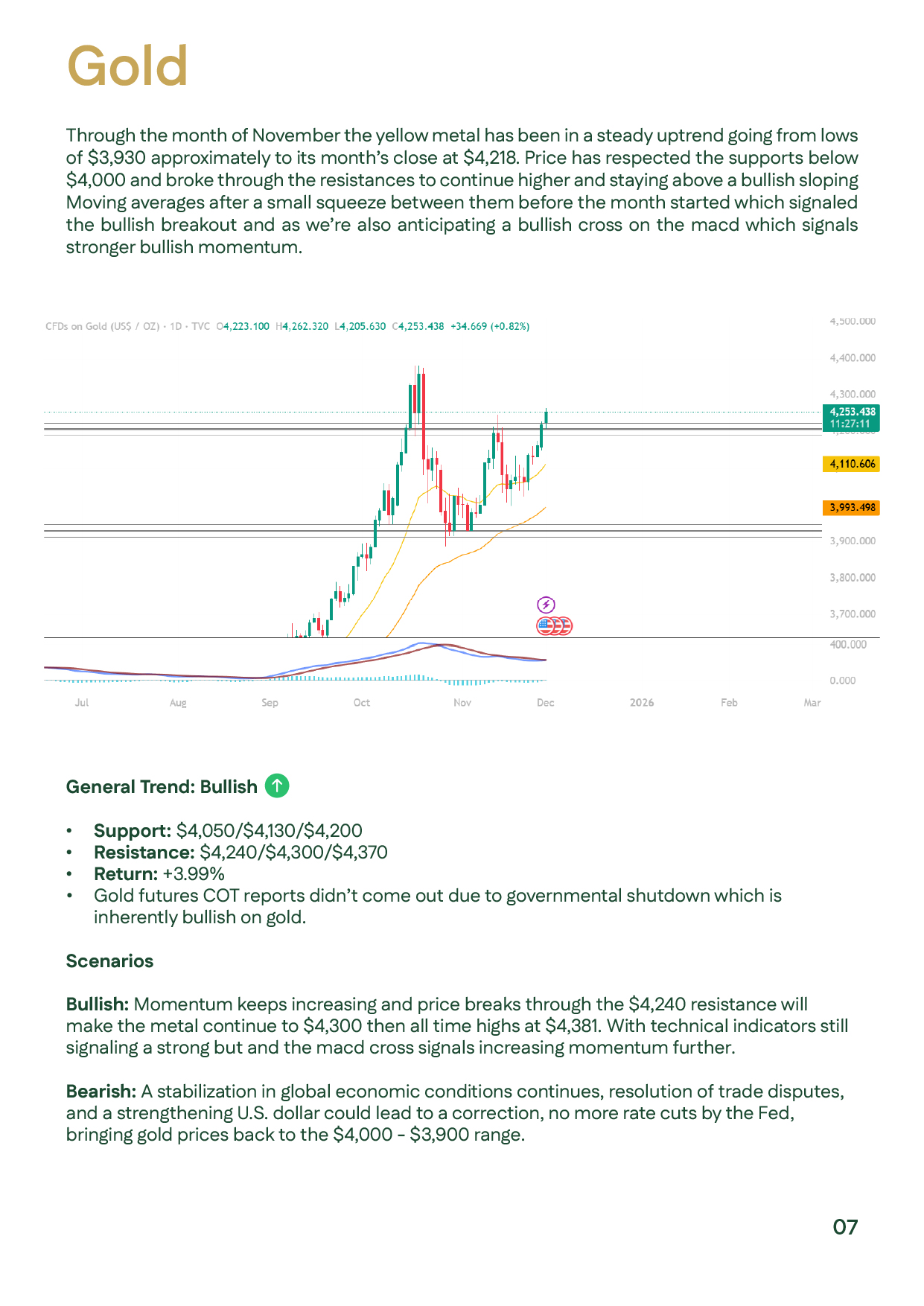

Gold posted a strong performance in November 2025, trading between $3,928 and $4,380 before closing near $4,218, supported by renewed expectations of Fed rate cuts, aggressive central bank buying led by China and Russia, and heightened geopolitical risk. The metal also benefited from a drop in 10-year U.S. yields to 4.01% by month-end.Silver surged sharply, reaching a record high of $56.37 per ounce as deliverable inventories tightened, industrial demand remained elevated, and trading disruptions at COMEX amplified volatility.

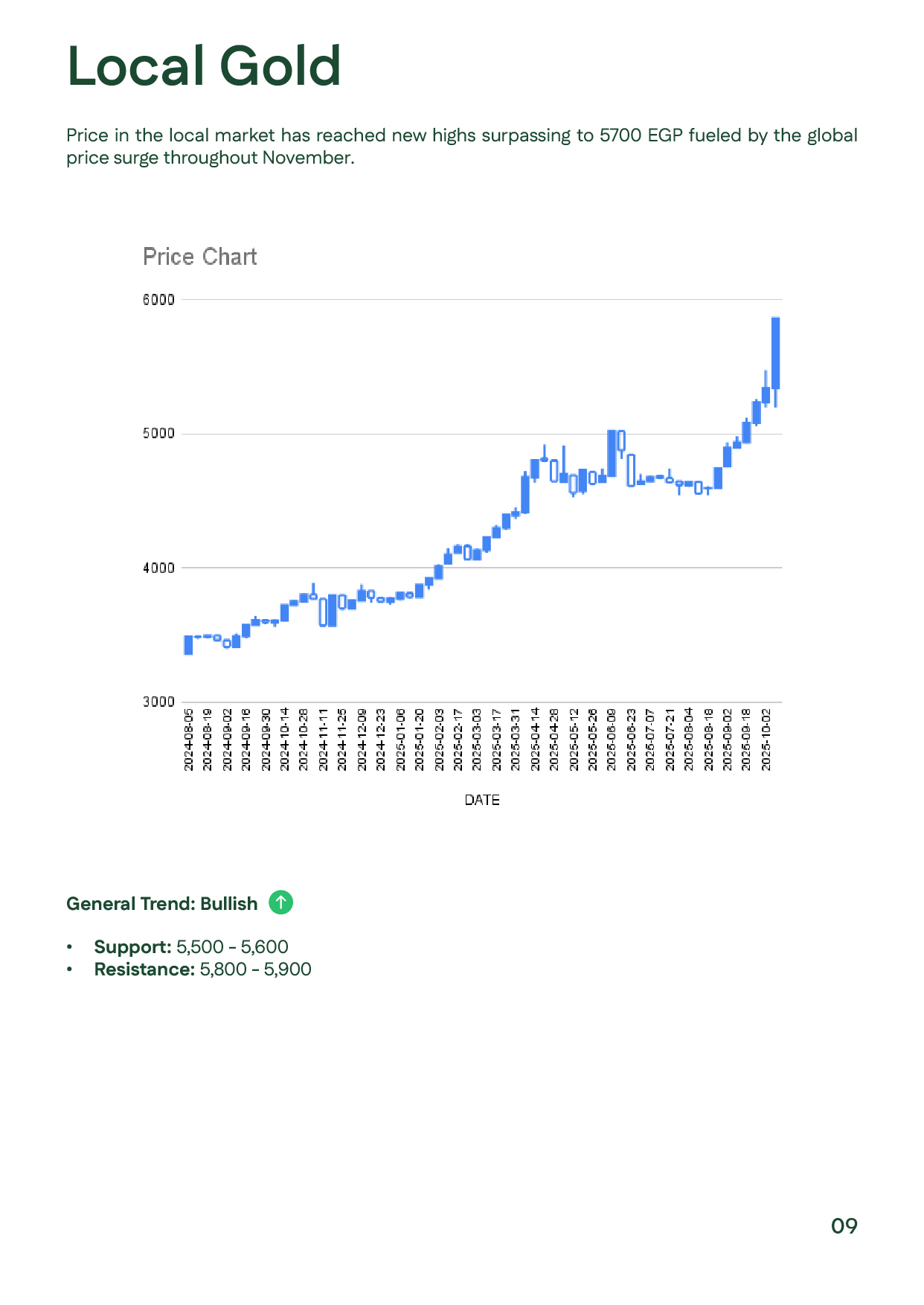

Locally, Egypt’s 21K gold climbed above EGP 5,700 amid sustained investment flows and expanding regional gold ETF activity. Technically, both gold and silver maintain a strong upward trend, supported by a weaker dollar and expectations of a more accommodative monetary stance in December.

عربي

عربي