Silver & Gold Price Analysis for October 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis for October 2025

Silver & Gold Price Analysis for October 2025

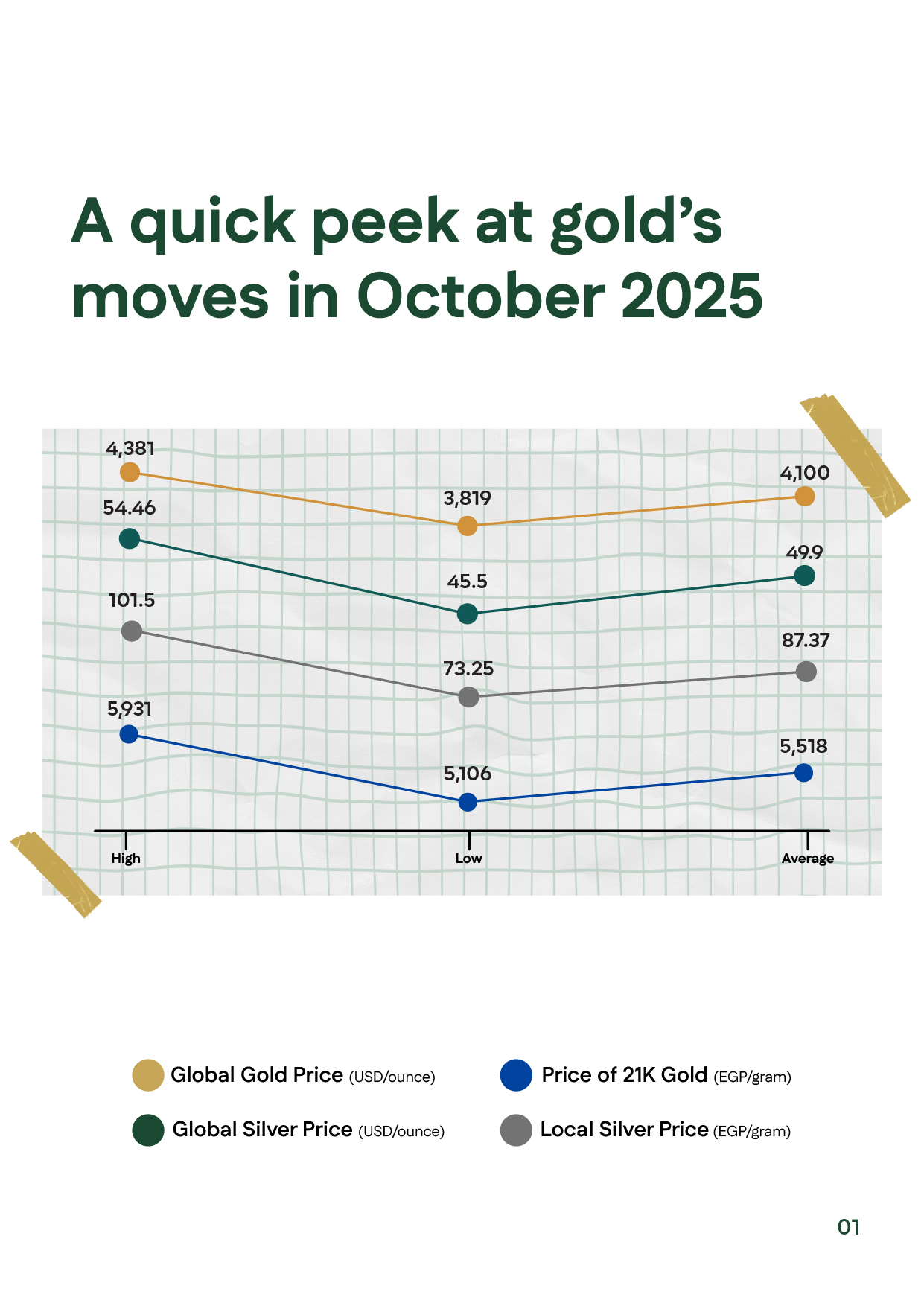

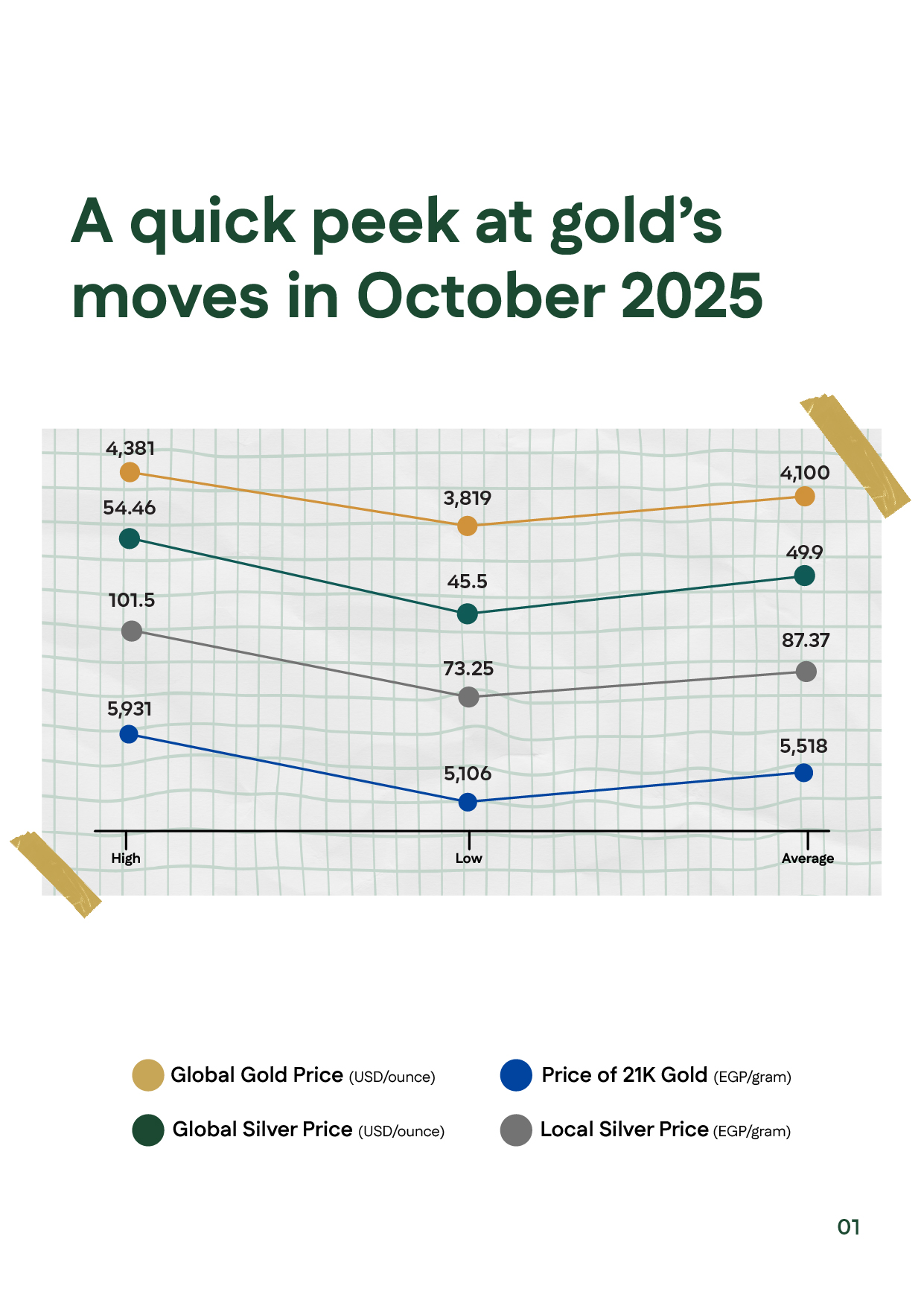

Gold and Silver Price Movements in October 2025

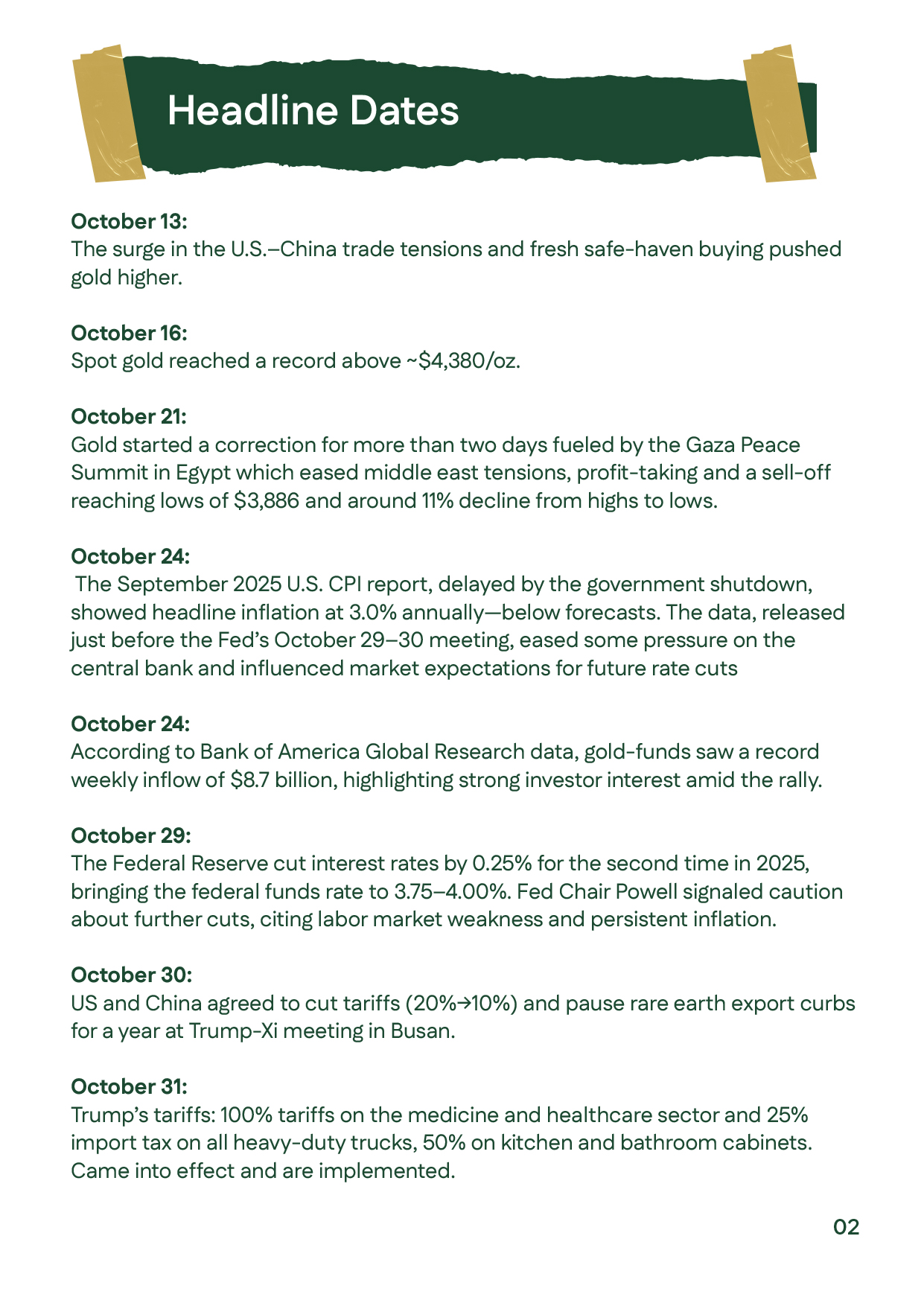

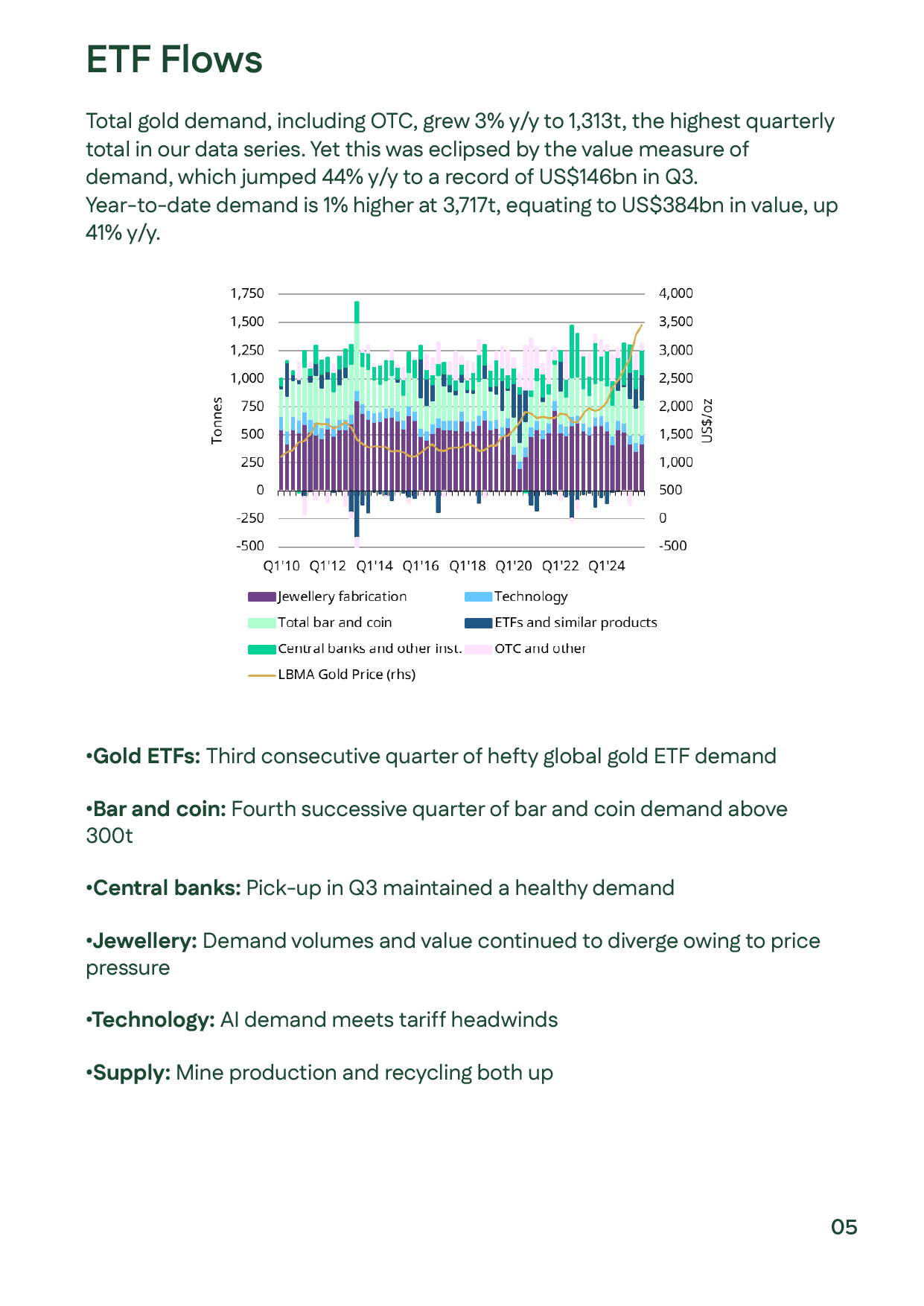

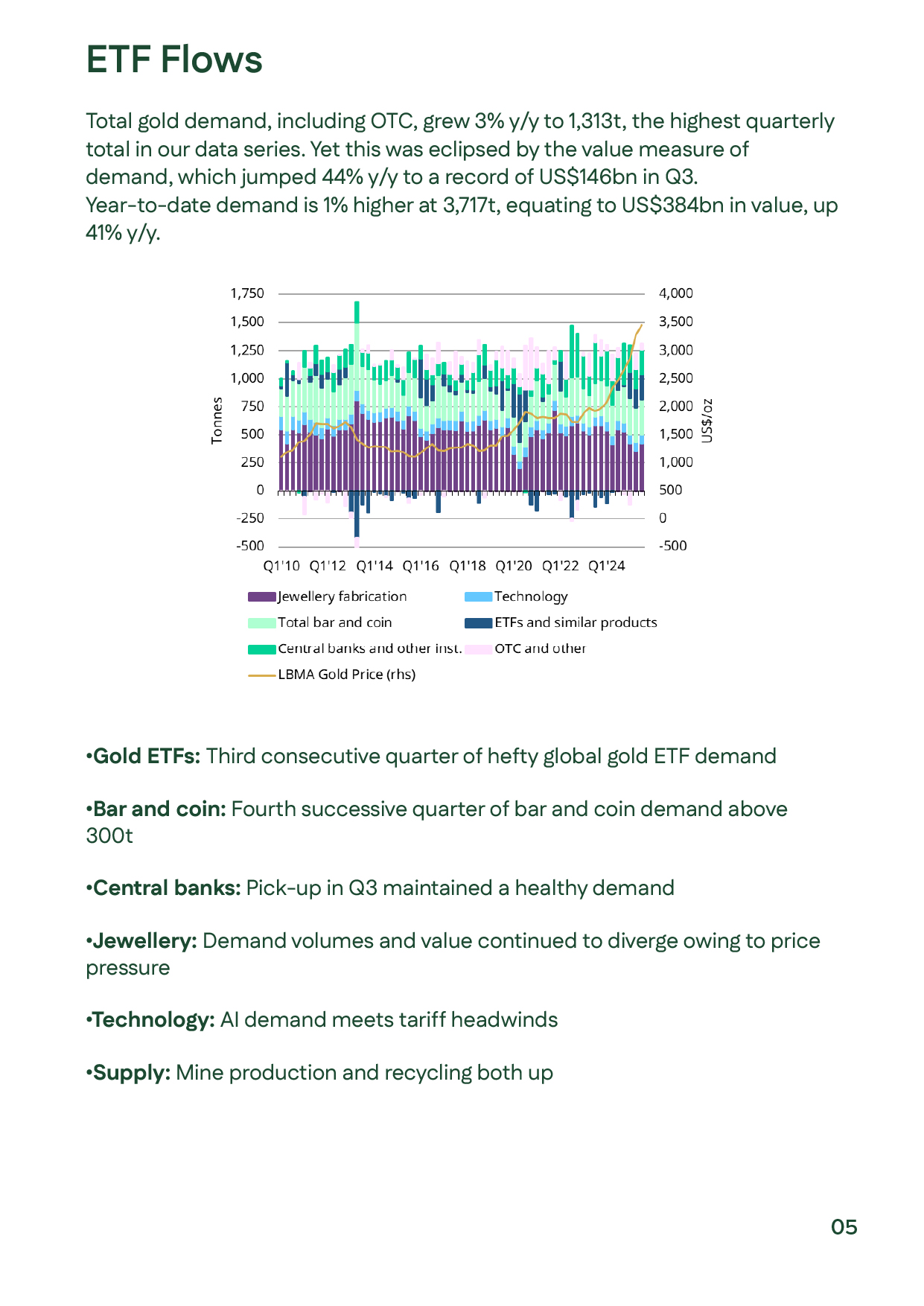

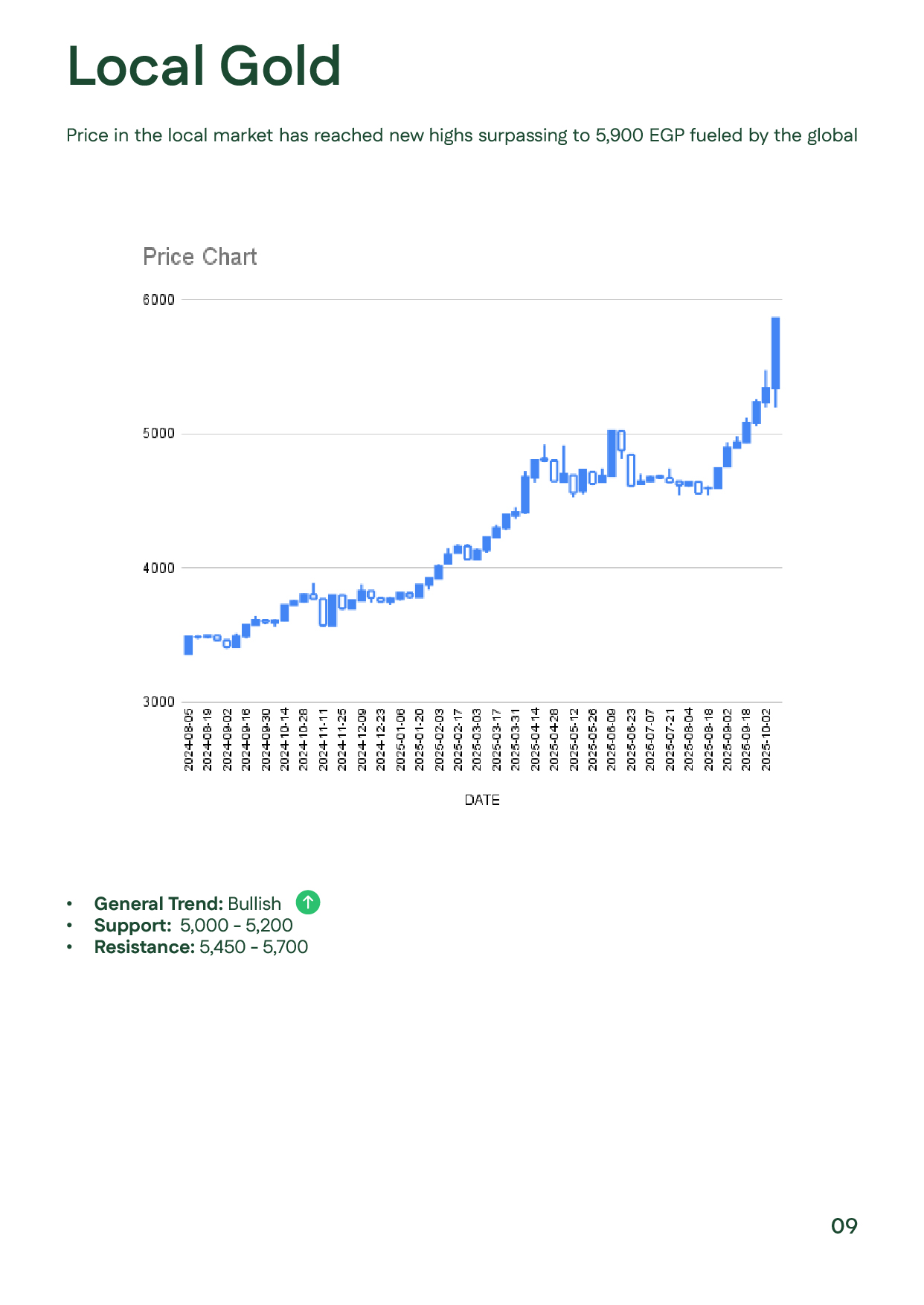

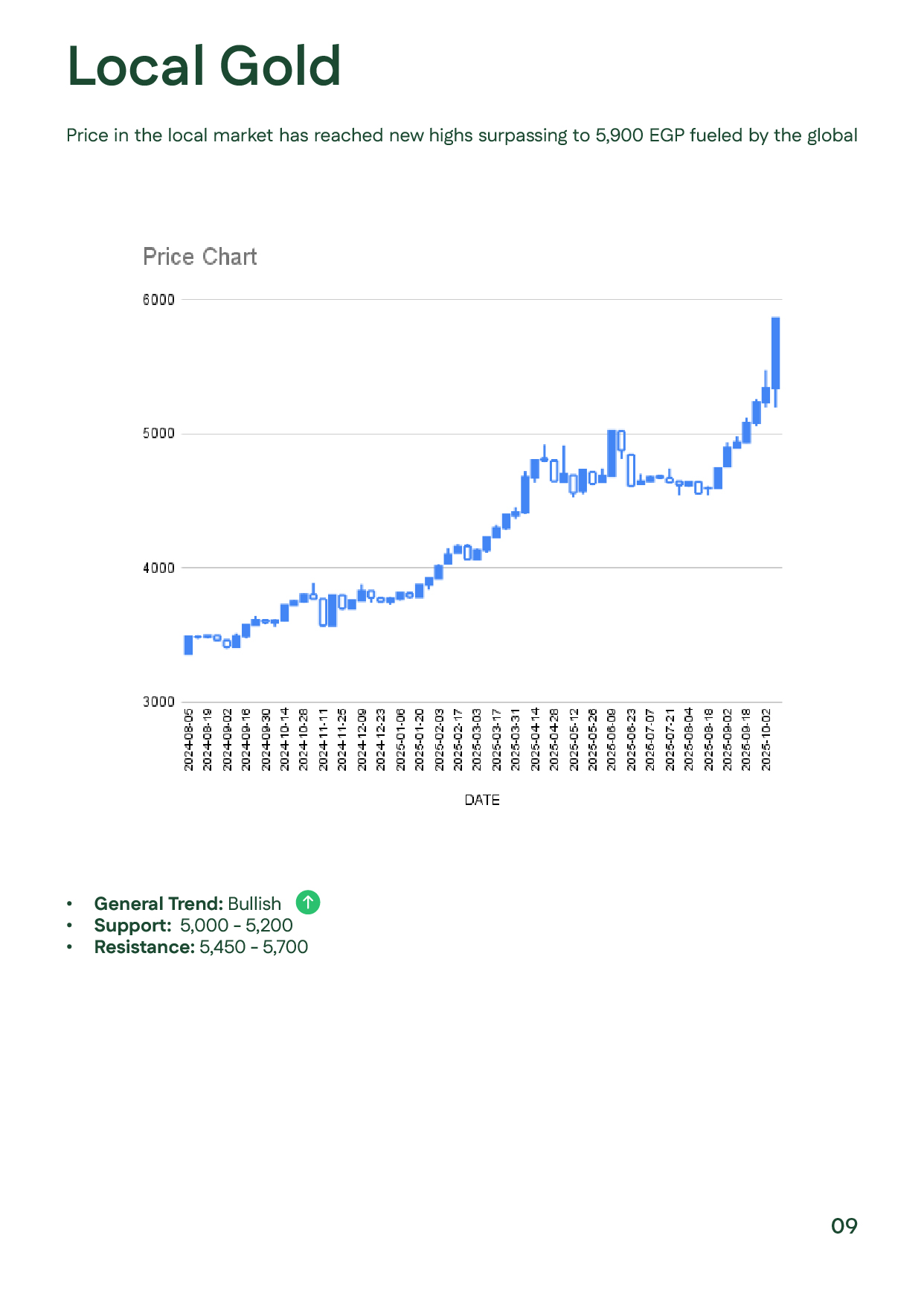

Gold ended October up 3.7%, closing at $4,002/oz after reaching an all-time high of $4,381/oz, driven by safe-haven demand, central bank purchases exceeding 220 tons, and persistent geopolitical and trade tensions. Silver hit $54.4/oz mid-month before easing to $48.65/oz due to profit-taking. In Egypt, 21K gold peaked at EGP 5,931 before settling near EGP 5,200 by month-end. Technically, gold maintains a bullish outlook, supported by a weaker dollar, expectations of further Fed rate cuts, and resilient investor demand across global and local markets.

عربي

عربي