Gold & Silver Price Analysis – Week 1 of November 2025

- Home

- Information Center by DahabMasr

- Gold & Silver Price Analysis – Week 1 of November 2025

Gold & Silver Price Analysis – Week 1 of November 2025

Nov 11, 2025

By

Dahab Masr Research Team

0 comment(s)

Gold and Silver Price Movements in Week 1 of November 2025

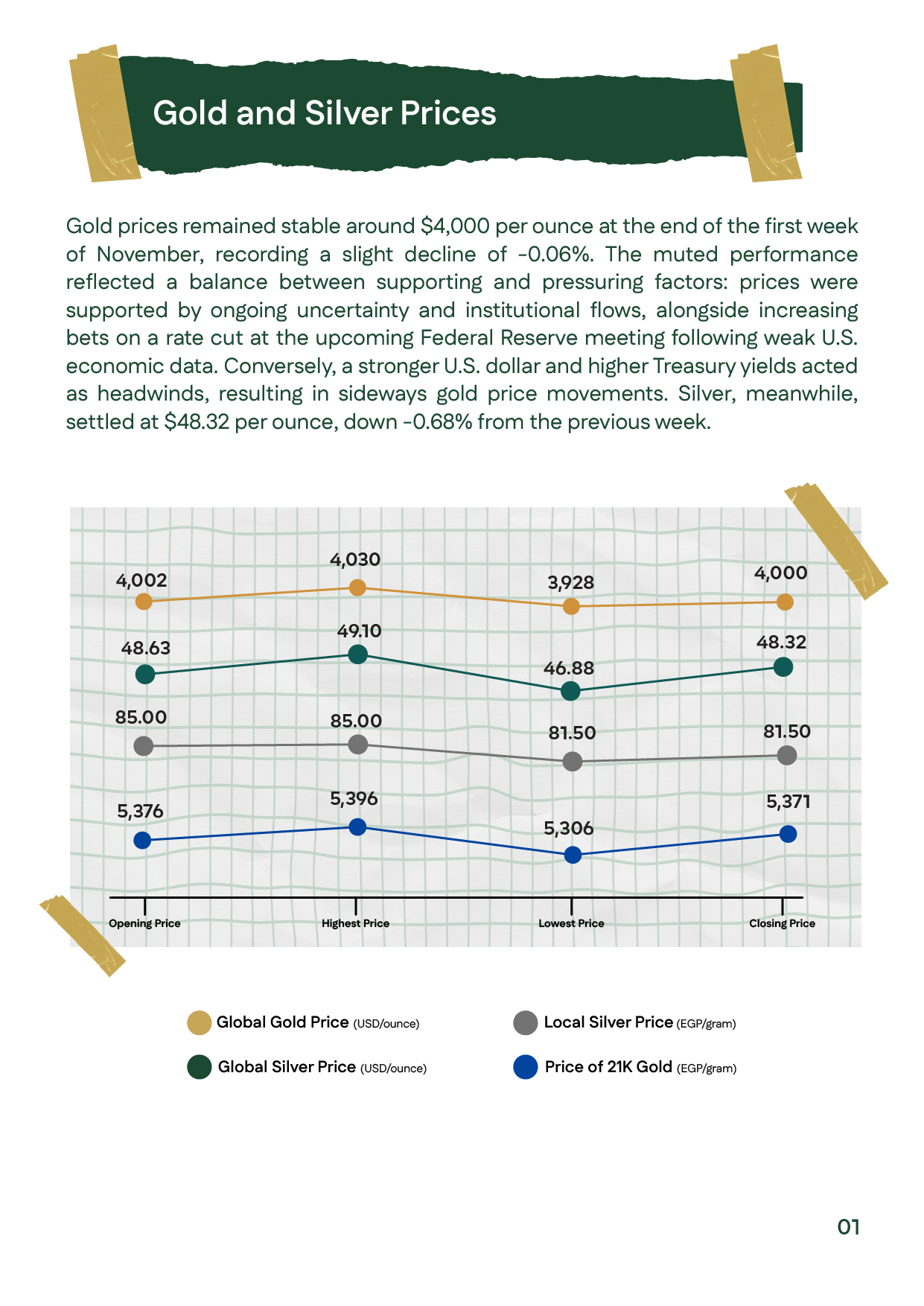

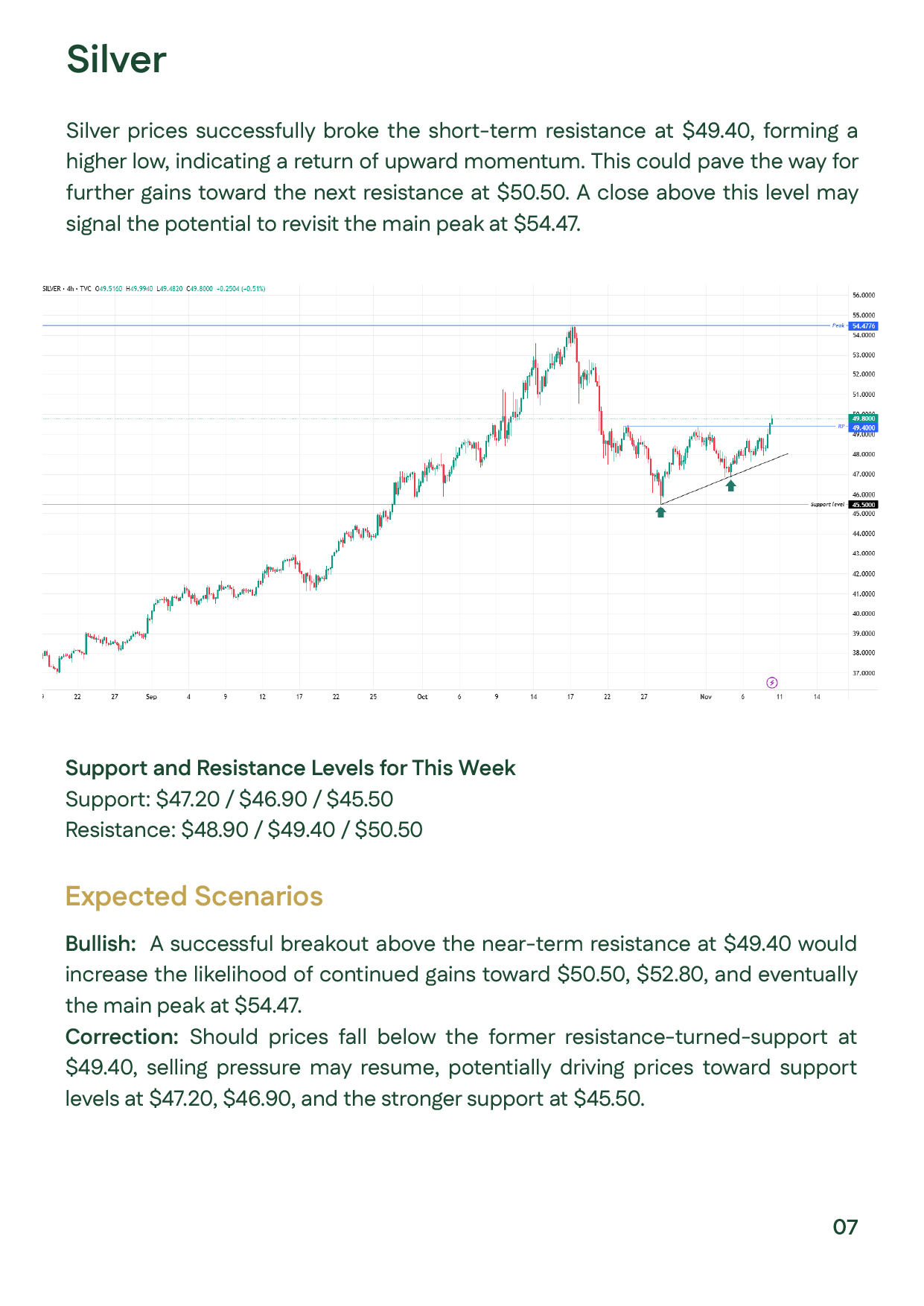

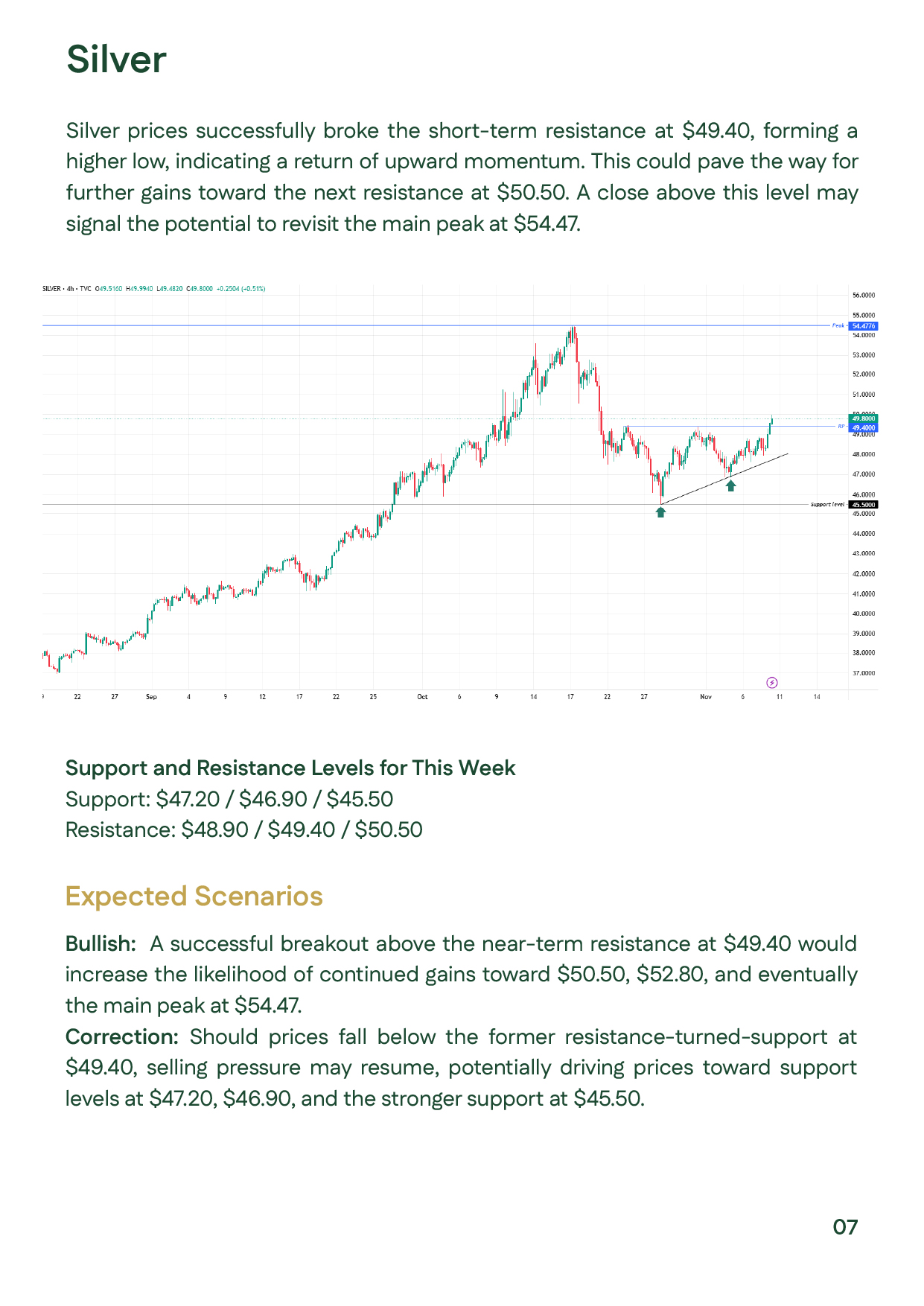

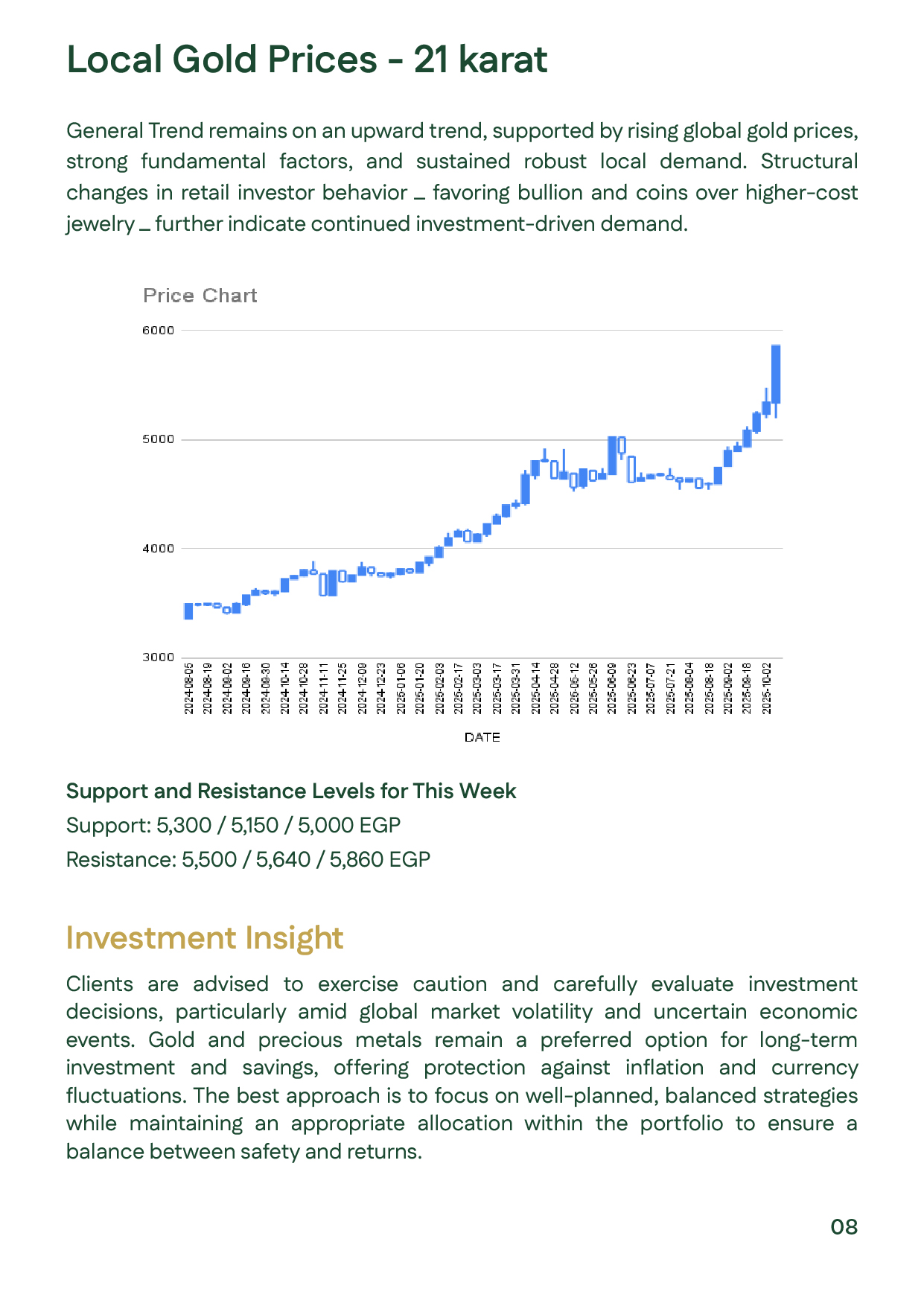

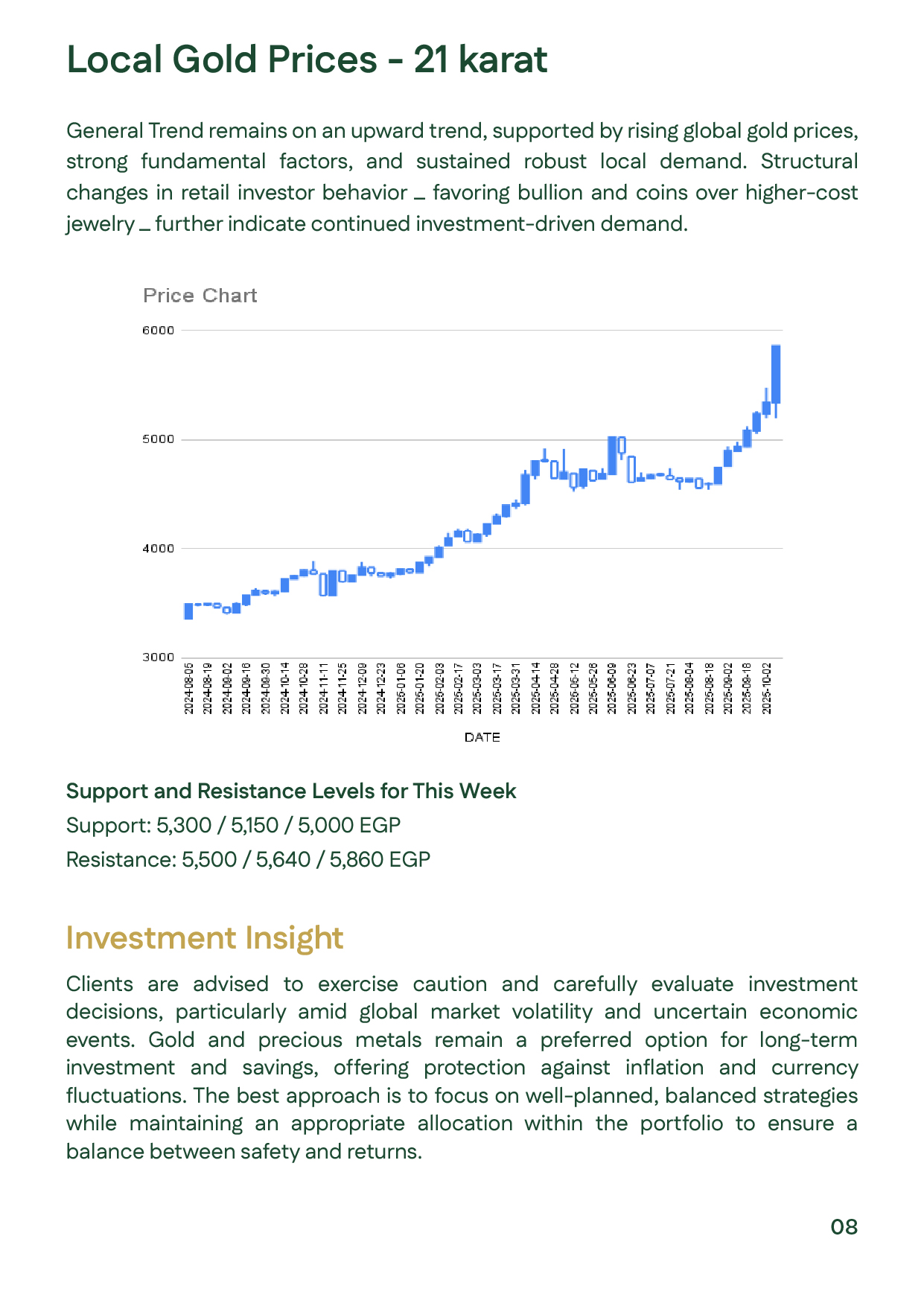

Gold hovered near $4,000/oz, posting a marginal decline of 0.06% as supportive factors such as institutional inflows and rate-cut bets offset pressure from a stronger dollar and higher Treasury yields. Silver closed at $48.32/oz (-0.68%), easing after October’s rally. Locally, 21K gold held at EGP 5,371, driven by investment demand and global momentum. Weak U.S. data — rising jobless claims and lower consumer confidence — strengthened expectations for a Fed rate cut in the upcoming meeting. Technically, gold maintains support zones at $3,950–3,890 and resistance between $4,150–4,185, indicating a potential continuation of bullish momentum into mid-November.

عربي

عربي