Gold & Silver Price Analysis – Week 2 of November 2025

- Home

- Information Center by DahabMasr

- Gold & Silver Price Analysis – Week 2 of November 2025

Gold & Silver Price Analysis – Week 2 of November 2025

Nov 18, 2025

By

Dahab Masr Research Team

0 comment(s)

Gold and Silver Market Movements – Week 2 of November 2025

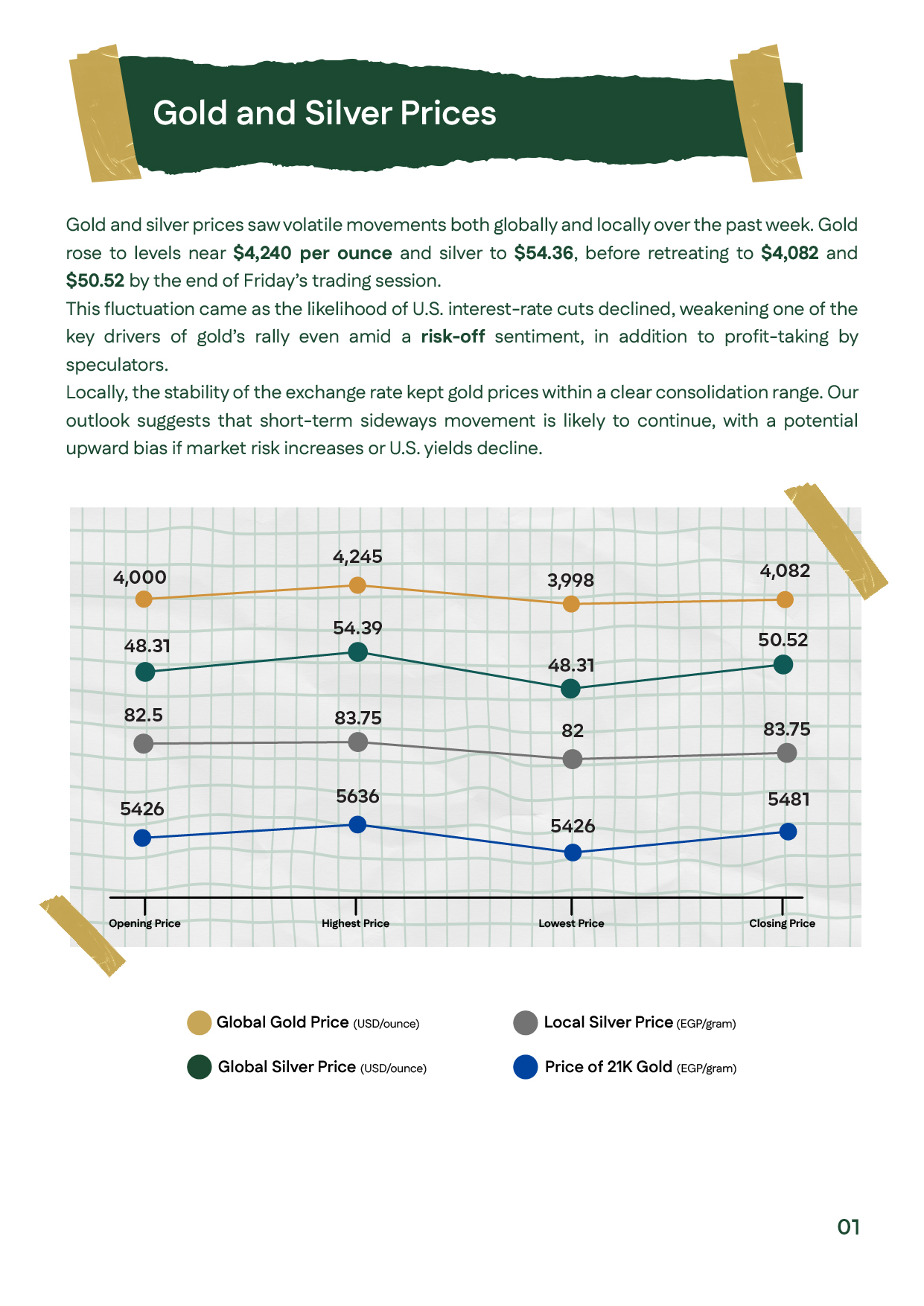

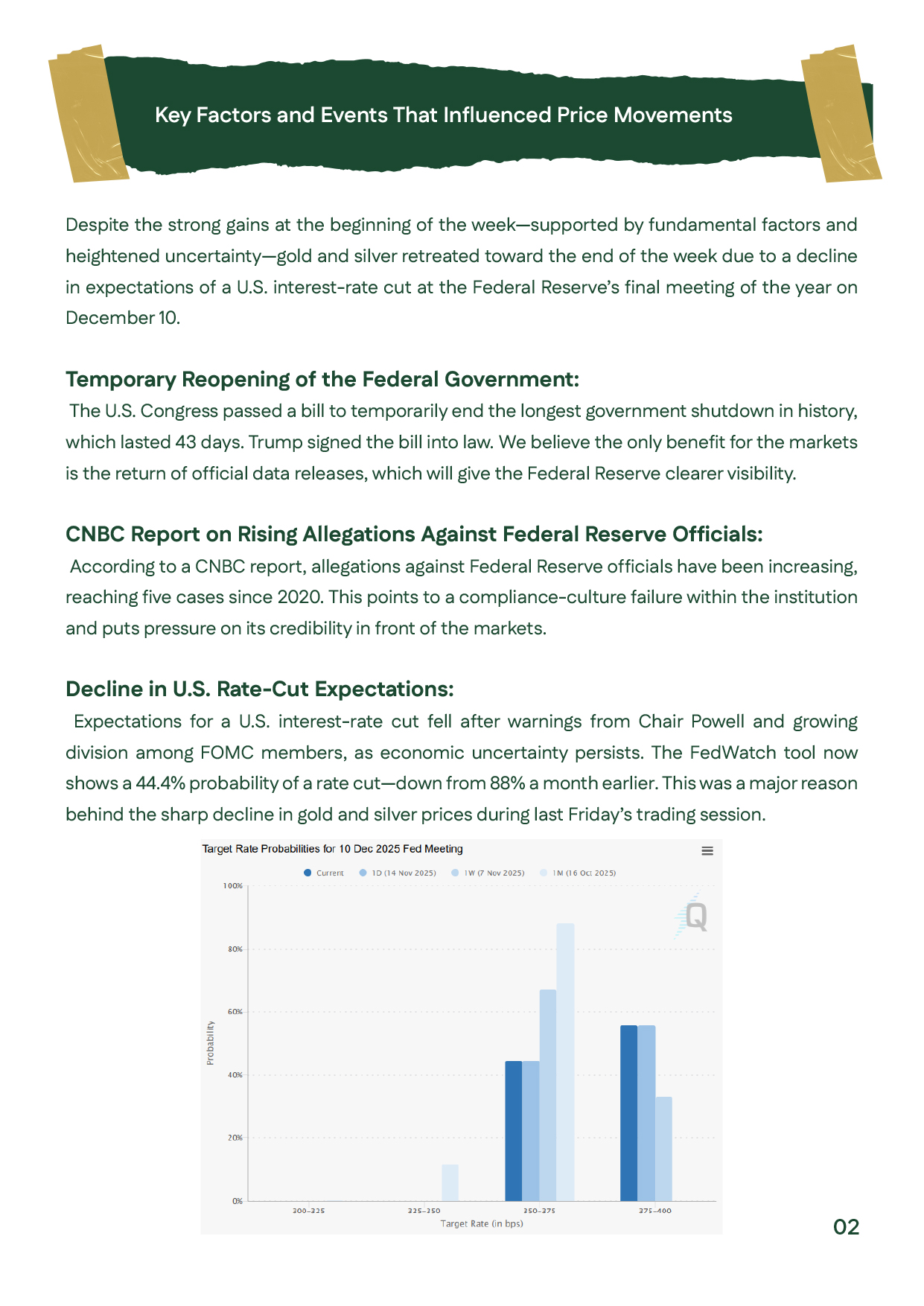

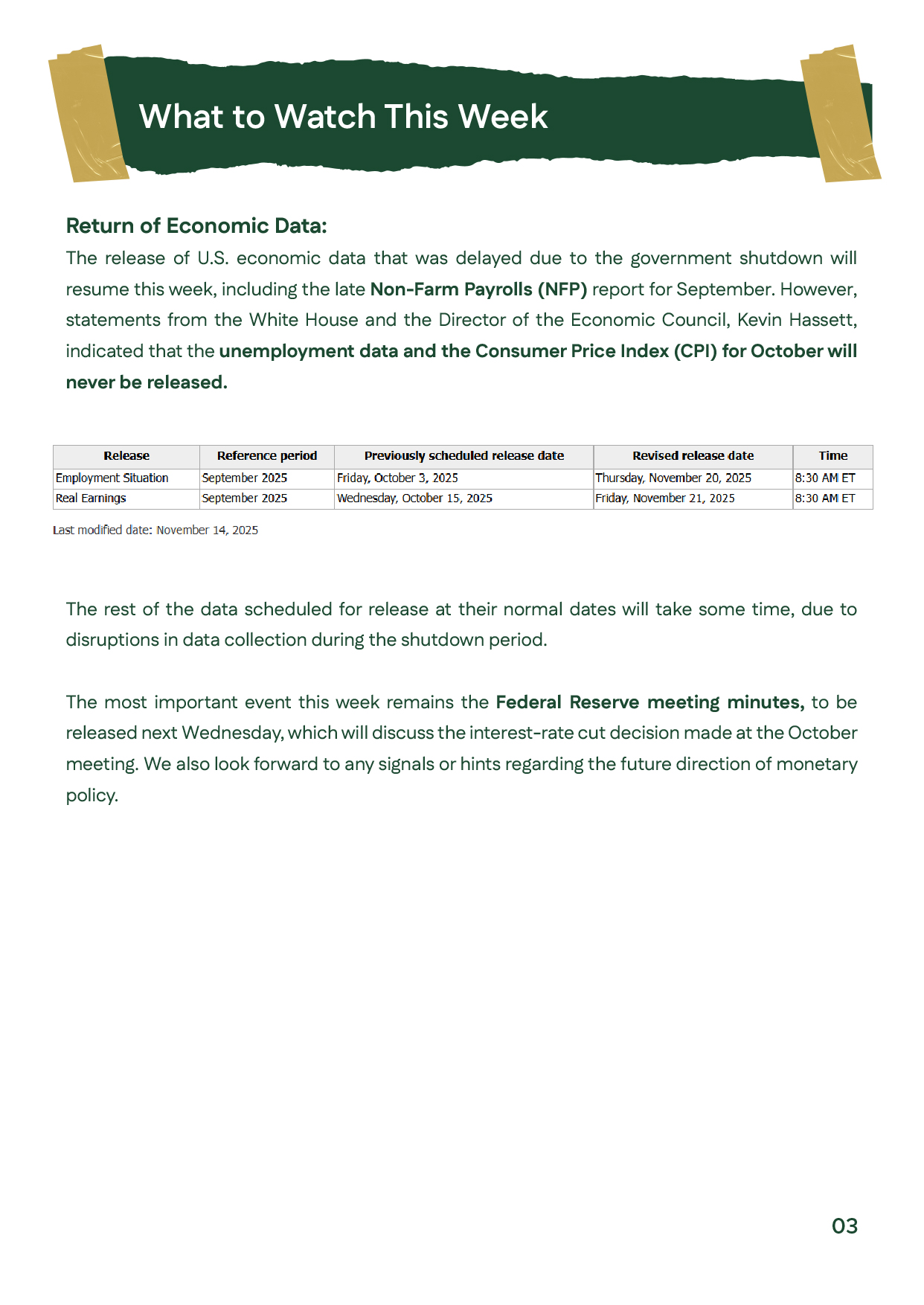

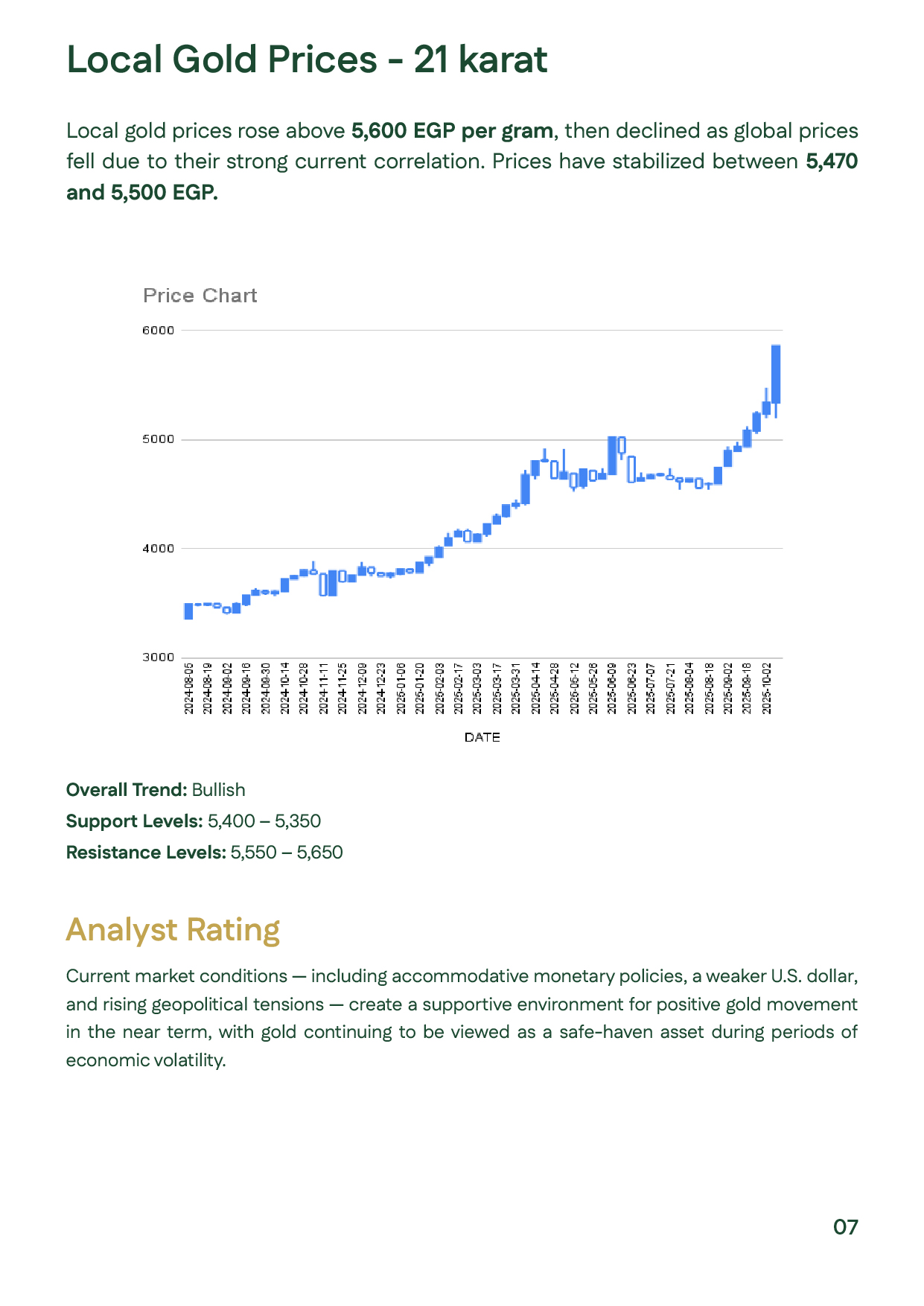

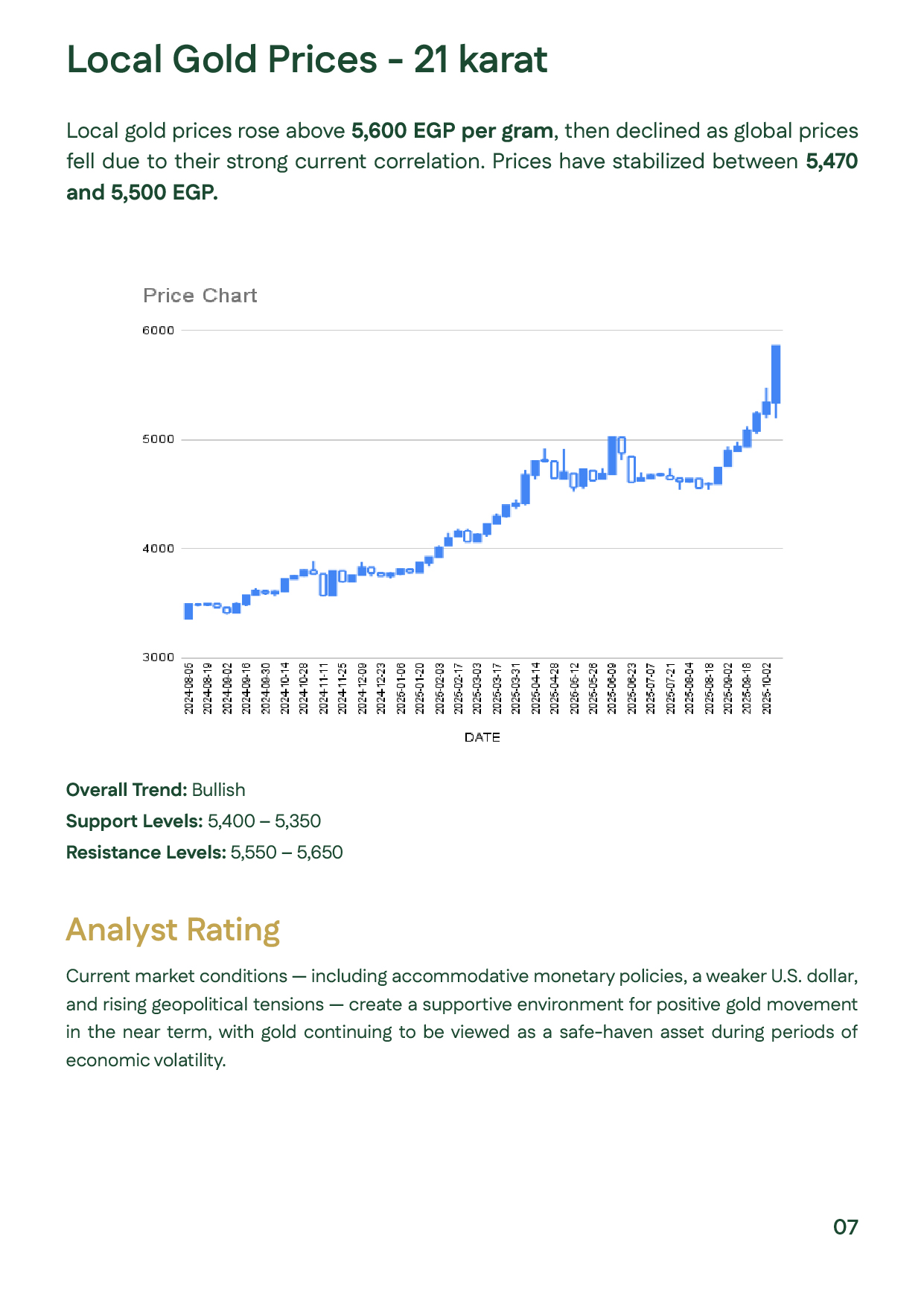

Gold prices showed notable volatility, reaching $4,240 before retreating toward $4,100 as expectations of a U.S. rate cut weakened and safe-haven flows eased. Silver also reacted to tightening market liquidity and a temporary backwardation phase, which supported short-term gains before profit-taking pushed prices back near $50. In Egypt, 21-karat gold held steady between 5,470 and 5,500 EGP, supported by a stable exchange rate and firm investment demand. Markets now await the Federal Reserve minutes for clues on monetary policy direction. Technically, gold is trading sideways above key supports at $4,040 and $4,000, with resistance at $4,100 and $4,150, signaling potential bullish momentum if global risk sentiment escalates.

عربي

عربي