Gold & Silver Price Analysis – Week 3 of November 2025

- Home

- Information Center by DahabMasr

- Gold & Silver Price Analysis – Week 3 of November 2025

Gold & Silver Price Analysis – Week 3 of November 2025

Nov 25, 2025

By

Dahab Masr Research Team

0 comment(s)

Gold and Silver Market Movements – Week 3 of November 2025

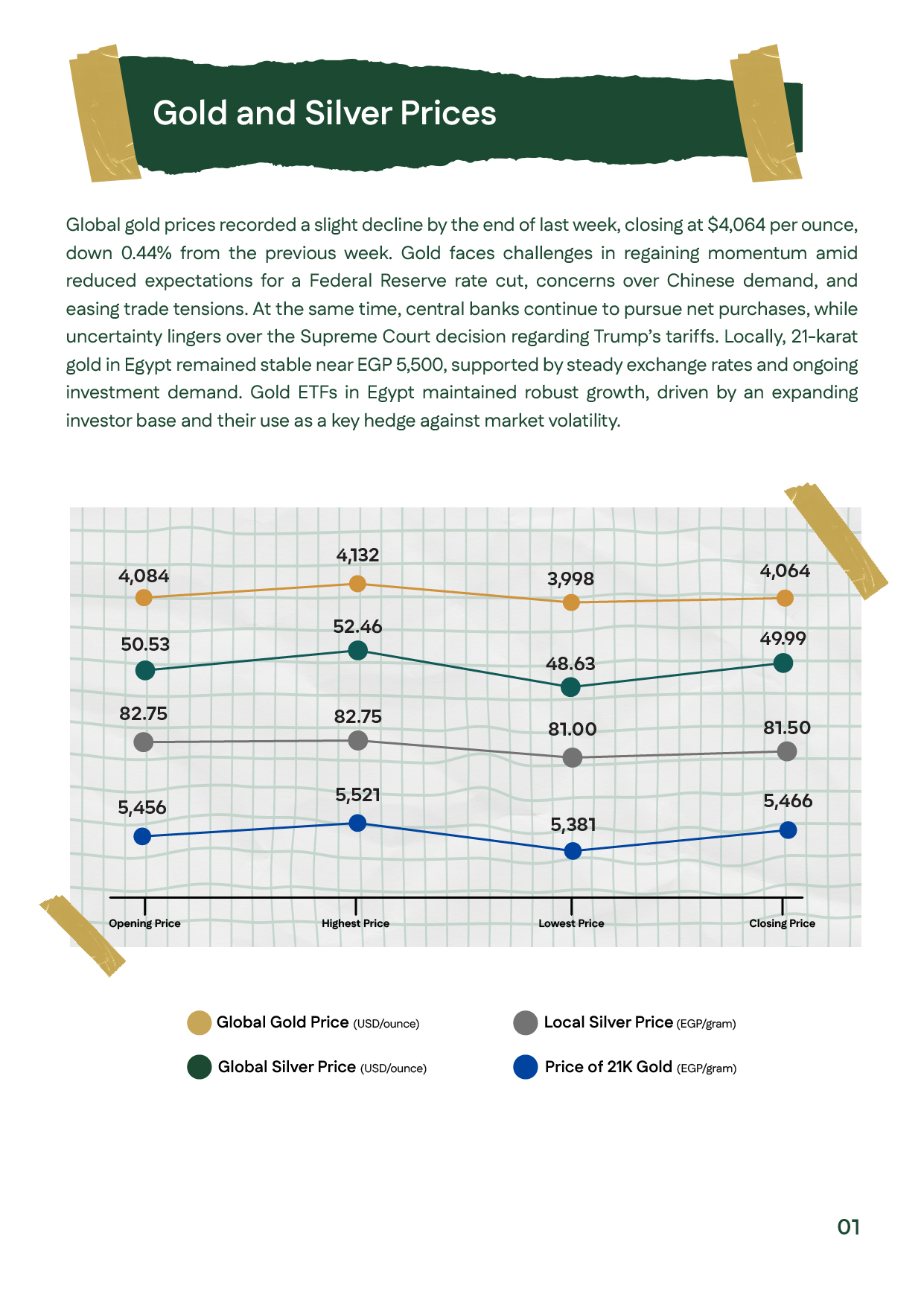

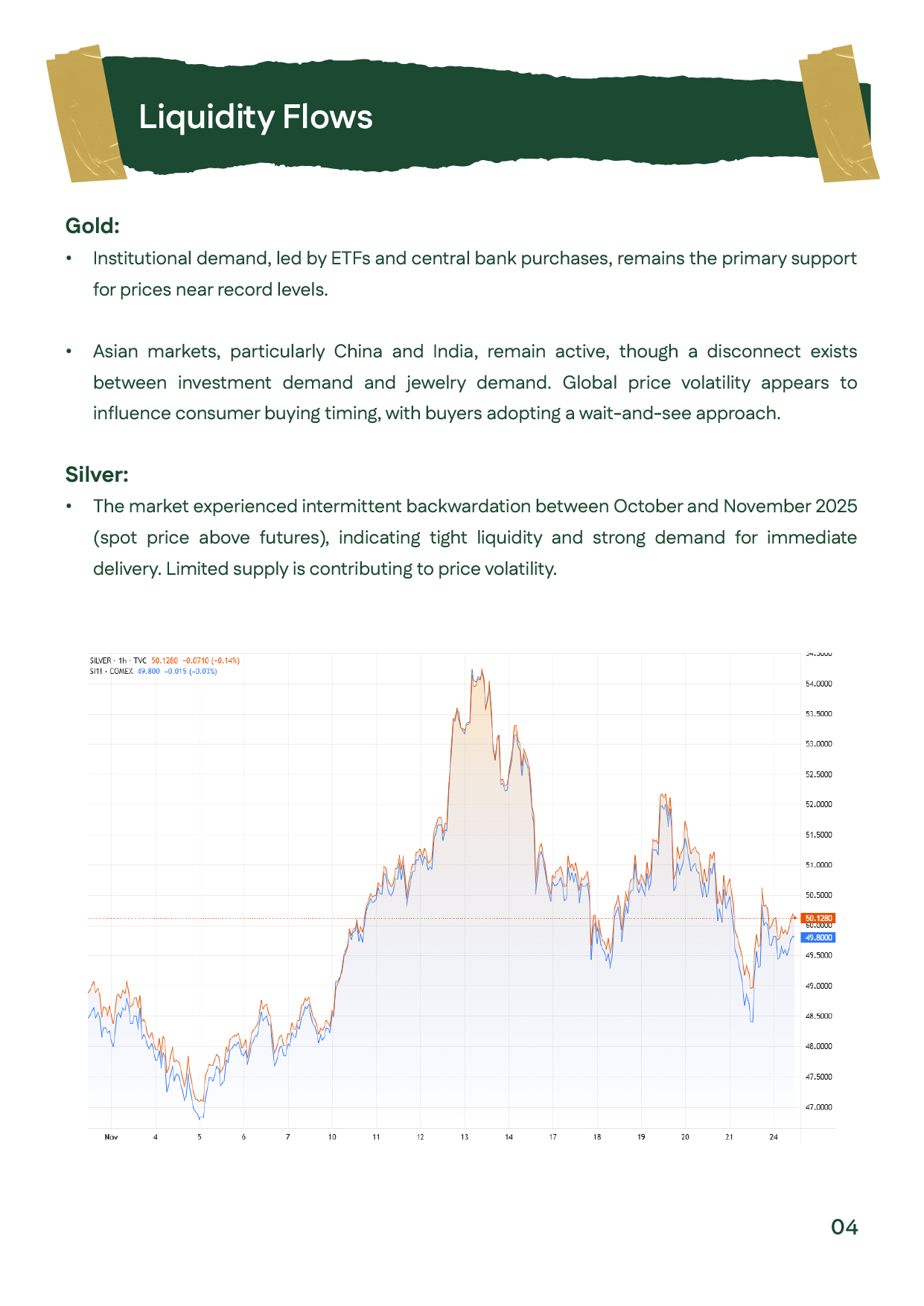

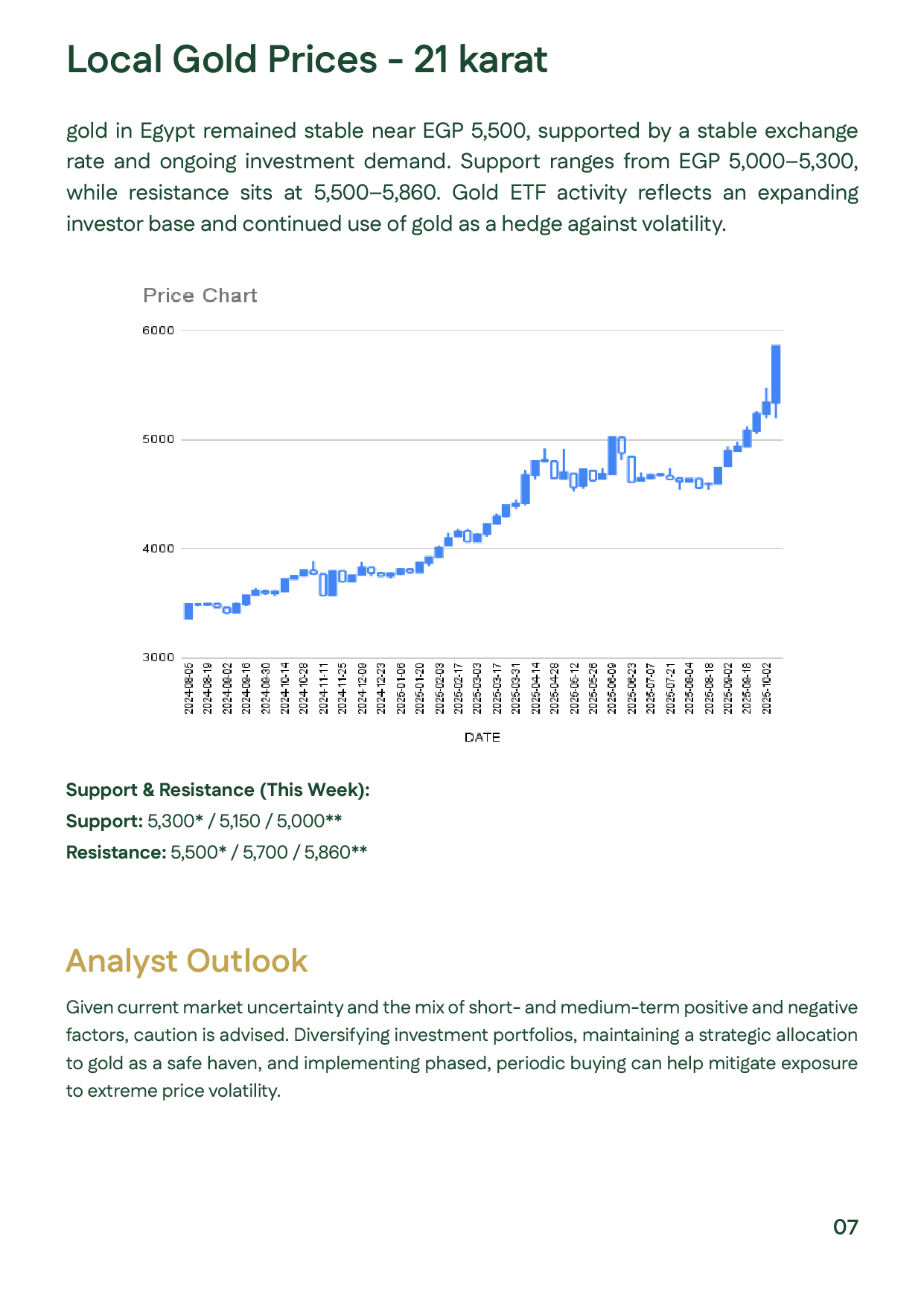

During the third week of November 2025, global gold prices softened slightly, closing at $4,064 per ounce (-0.44%) amid fading expectations of a near-term Fed rate cut, weaker Chinese demand, and reduced trade-related risks. In Egypt, 21K gold remained stable around EGP 5,500, supported by steady exchange rates and strong investment appetite, particularly through expanding Gold ETFs attracting more local investors.

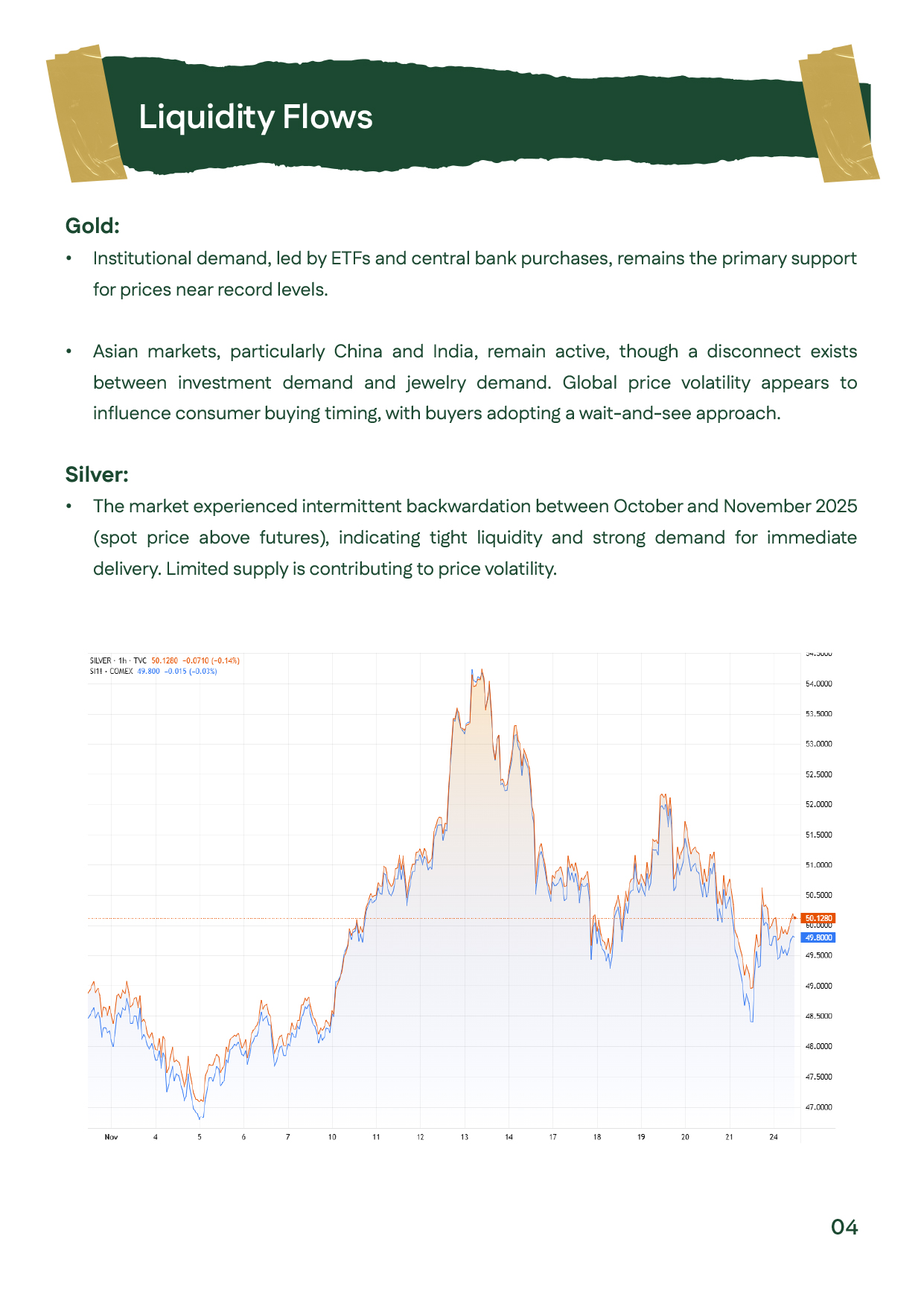

Markets also reacted to mixed U.S. labor data, declining consumer sentiment, and statements from Federal Reserve members that reinforced uncertainty ahead of the December meeting. Silver saw intermittent periods of backwardation, indicating tight supply and elevated demand for immediate delivery. Technically, the $4,000 level remains a key support for gold, with major resistance zones near $4,185 and $4,245.

عربي

عربي