Silver & Gold Price Analysis – Week 2 of October 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis – Week 2 of October 2025

Silver & Gold Price Analysis – Week 2 of October 2025

Oct 14, 2025

By

Dahab Masr Research Team

0 comment(s)

Silver & Gold Price Movements - Week 2 – October 2025

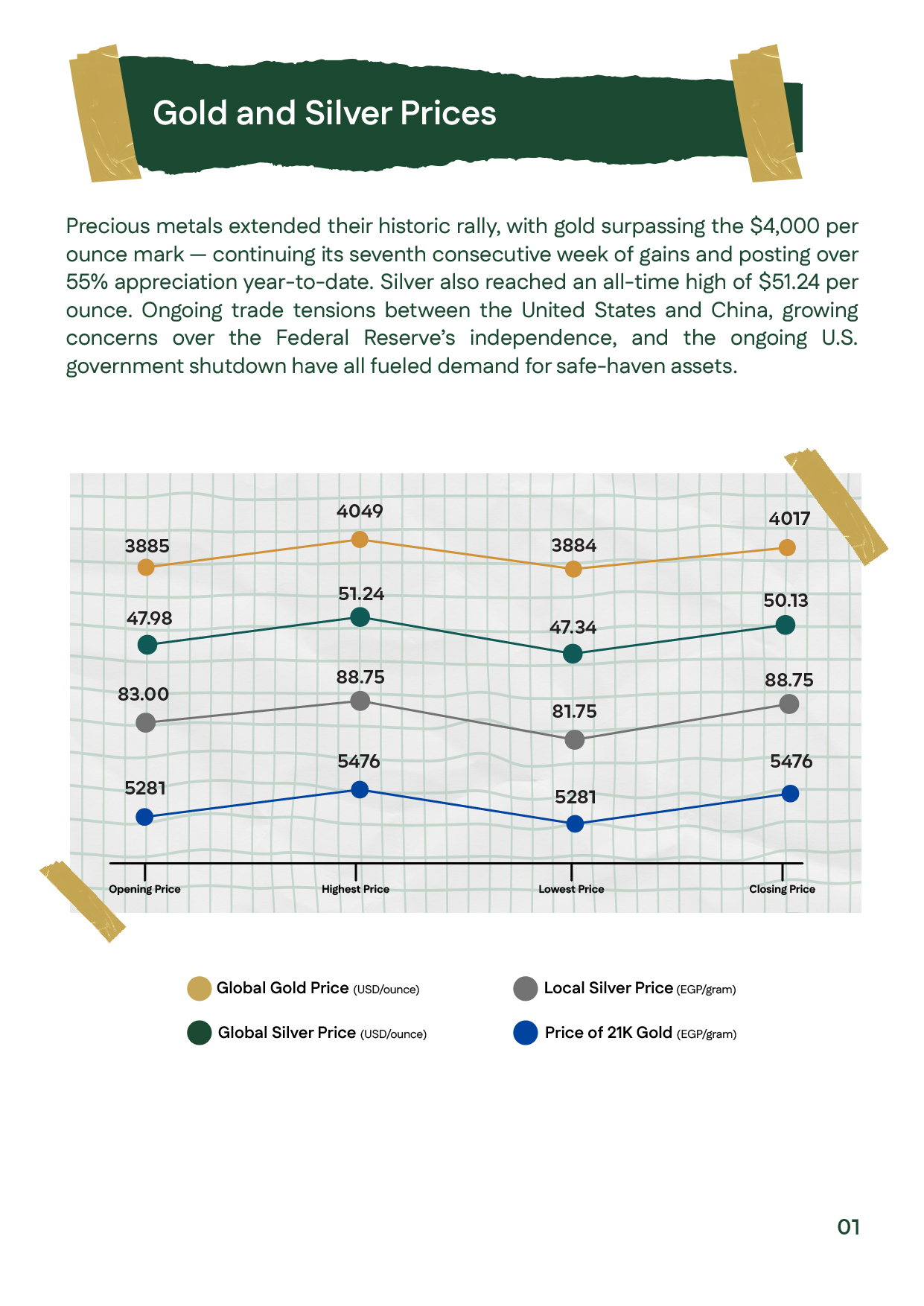

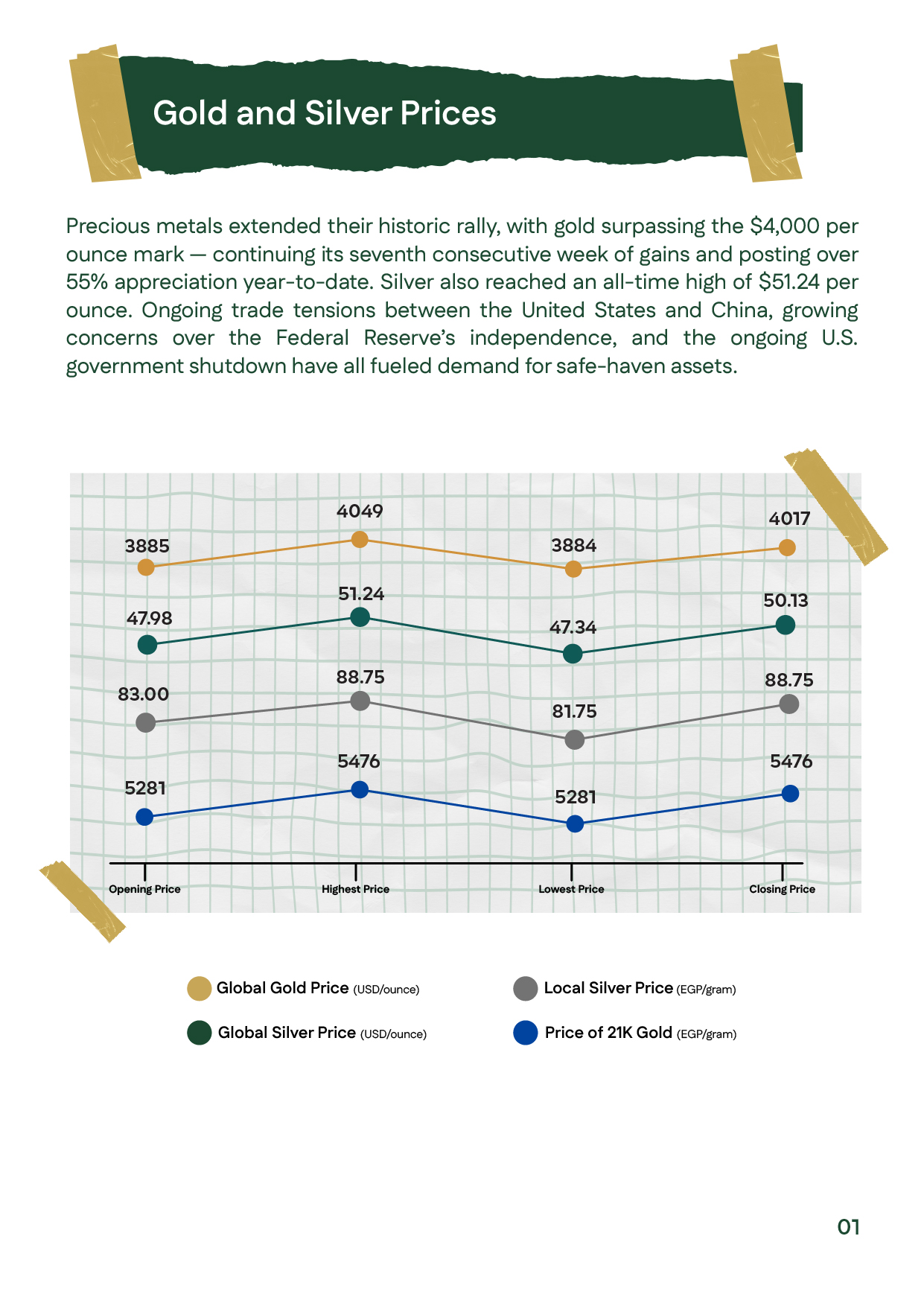

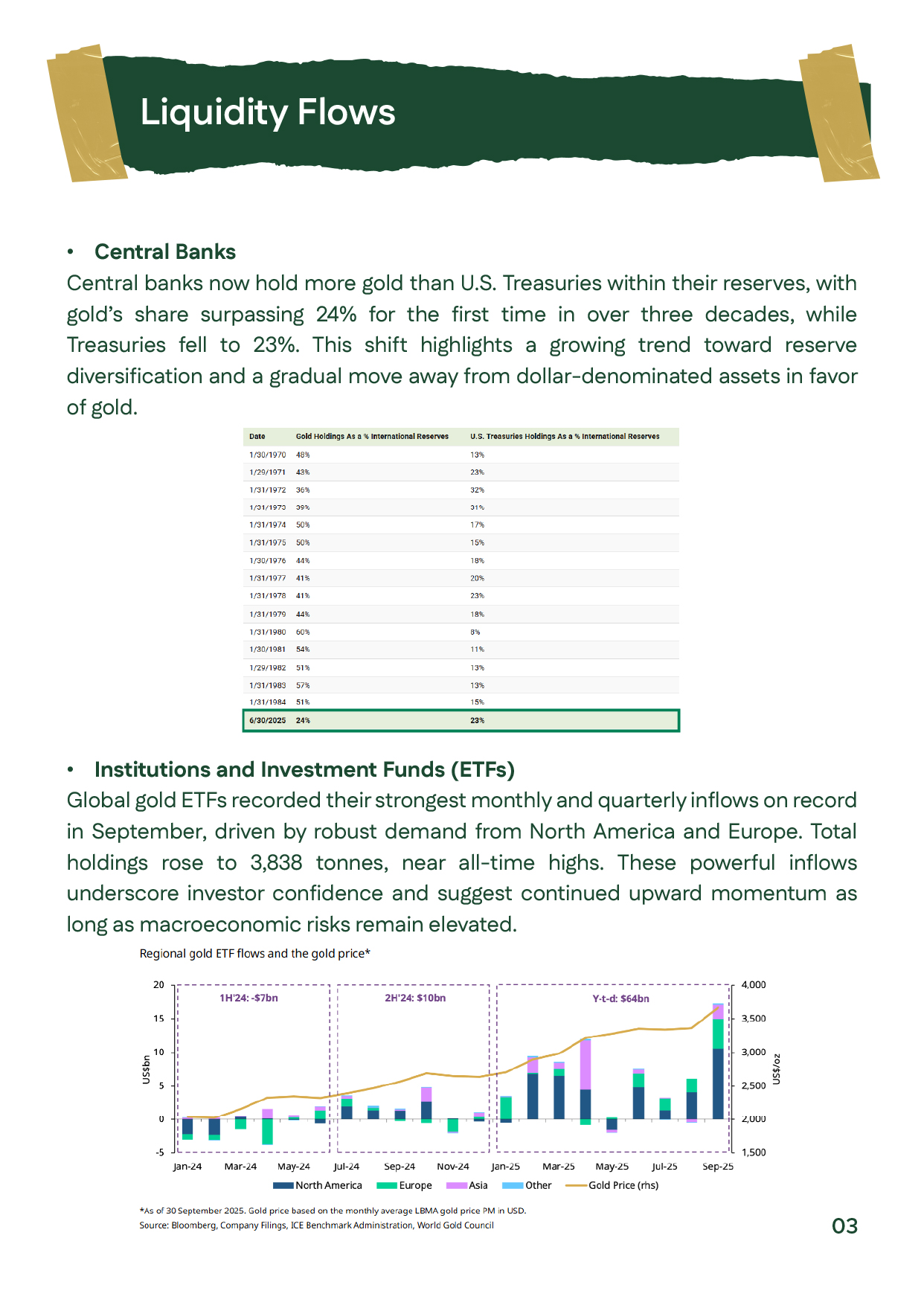

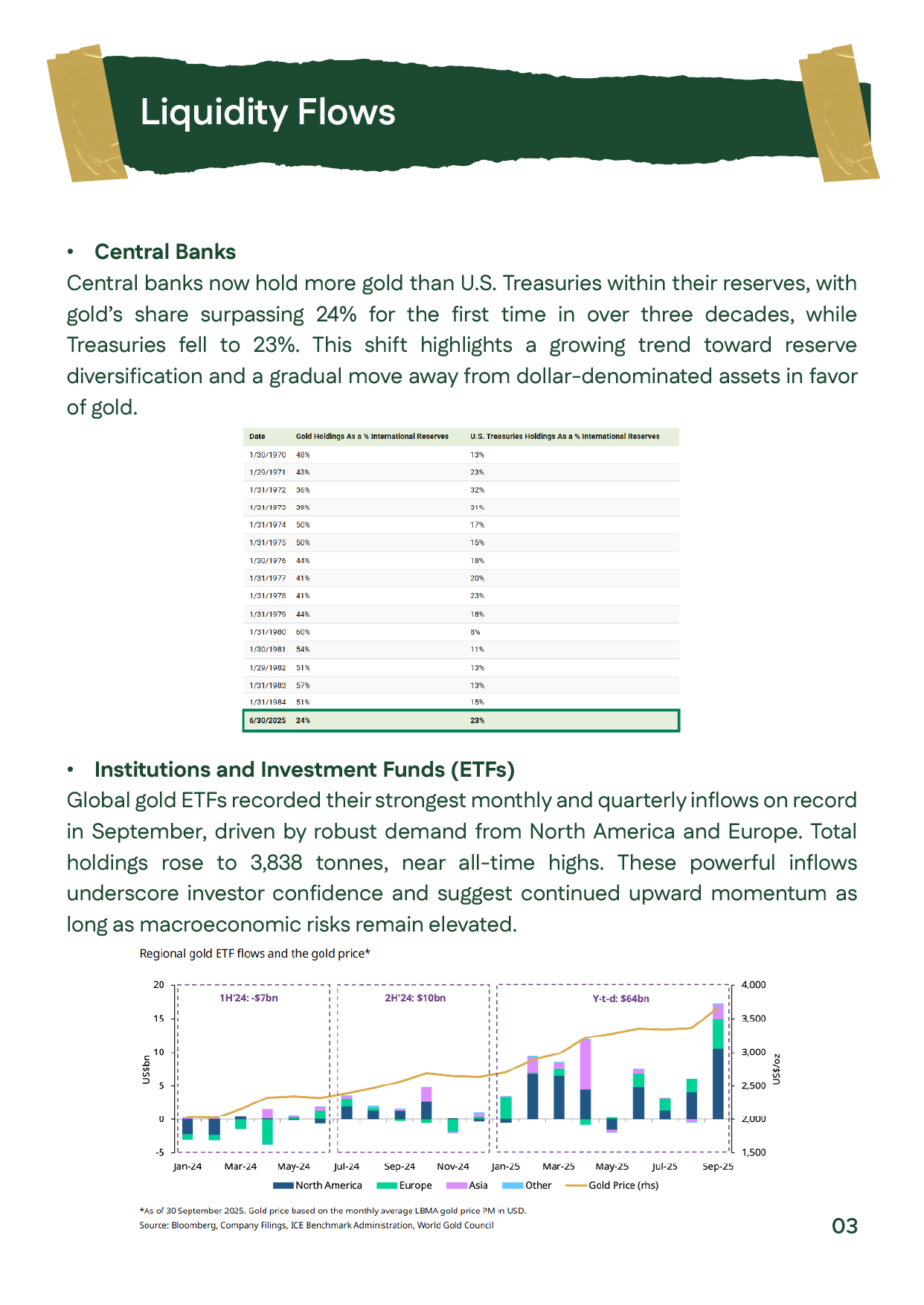

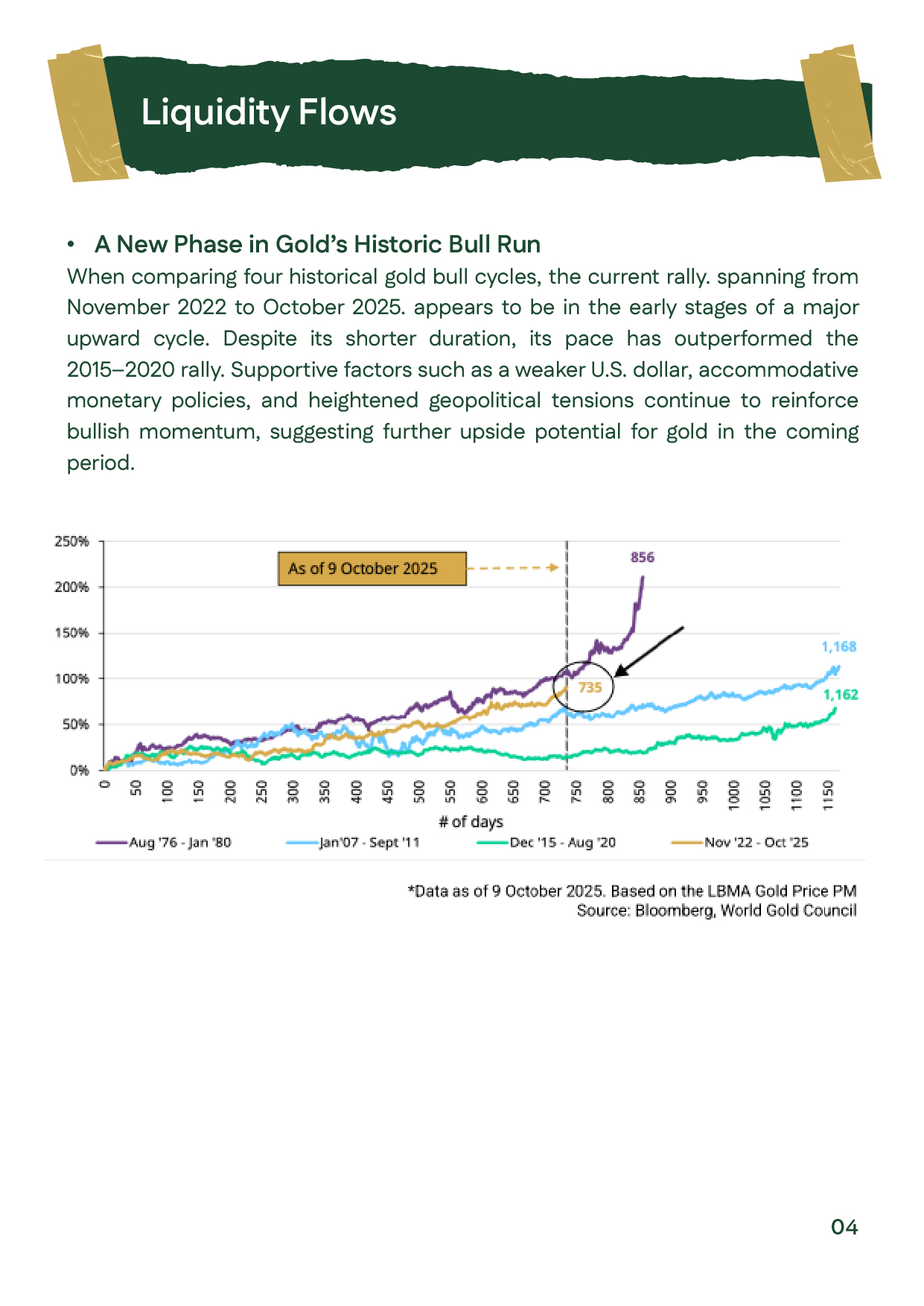

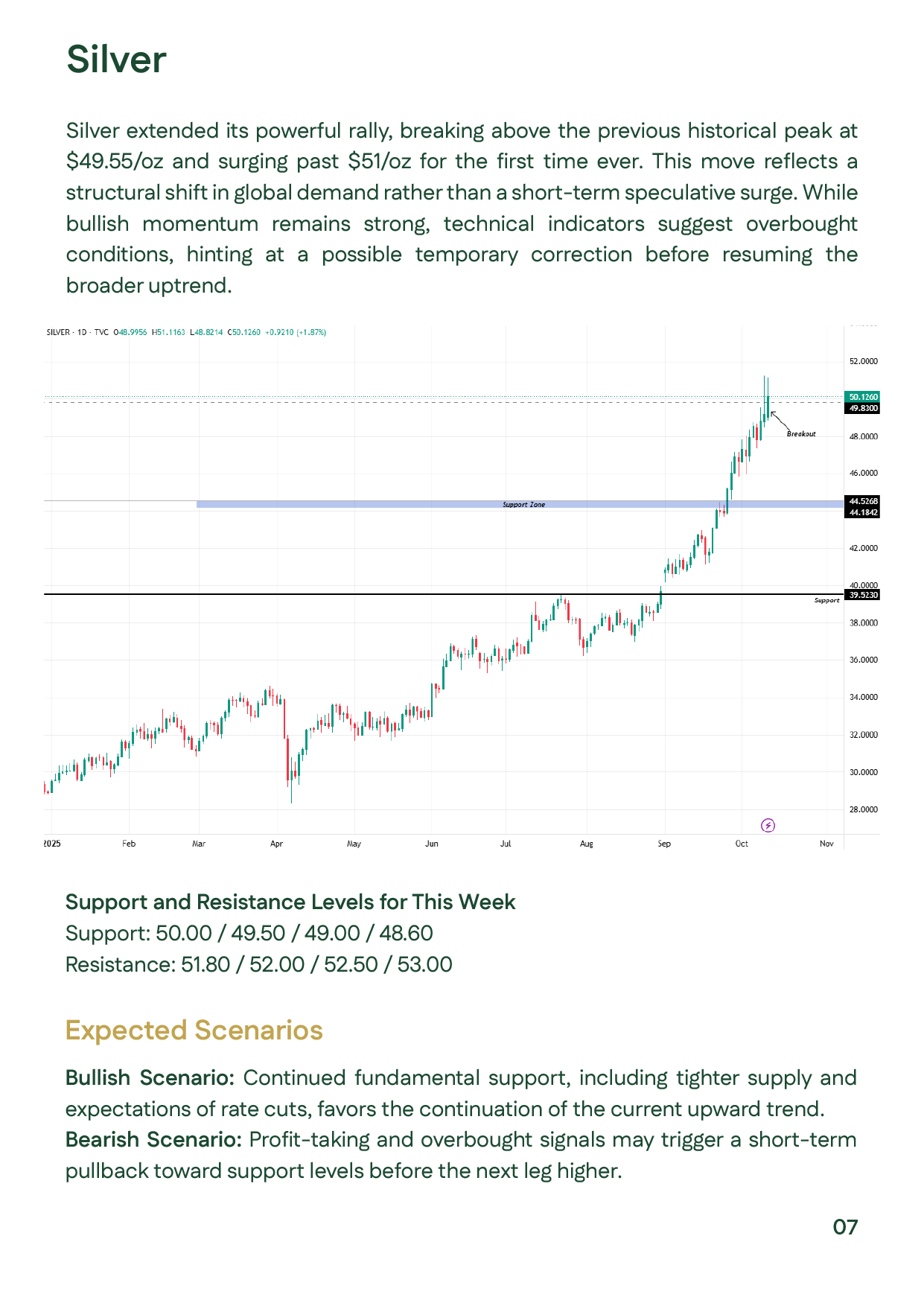

Gold and silver extended their record-setting rallies during Week 2 of October 2025, with gold breaking above $4,000/oz to close at $4,049 (+4.2%), and silver reaching an all-time high of $51.24/oz (+4.1%). The rally was fueled by central bank gold purchases, U.S.–China trade tensions, and the ongoing U.S. government shutdown, alongside strong investment demand from India and China. ETF inflows surged past 3,800 tons, reflecting investor confidence in precious metals. In Egypt, 21K gold advanced to EGP 5,476 per gram, mirroring global strength. With geopolitical risks and monetary easing expectations persisting, the uptrend in gold and silver prices is likely to continue in the near term.

عربي

عربي