Silver & Gold Price Analysis – Week 3 of October 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis – Week 3 of October 2025

Silver & Gold Price Analysis – Week 3 of October 2025

Oct 21, 2025

By

Dahab Masr Research Team

0 comment(s)

Silver & Gold Price Movements in Week 3 – October 2025

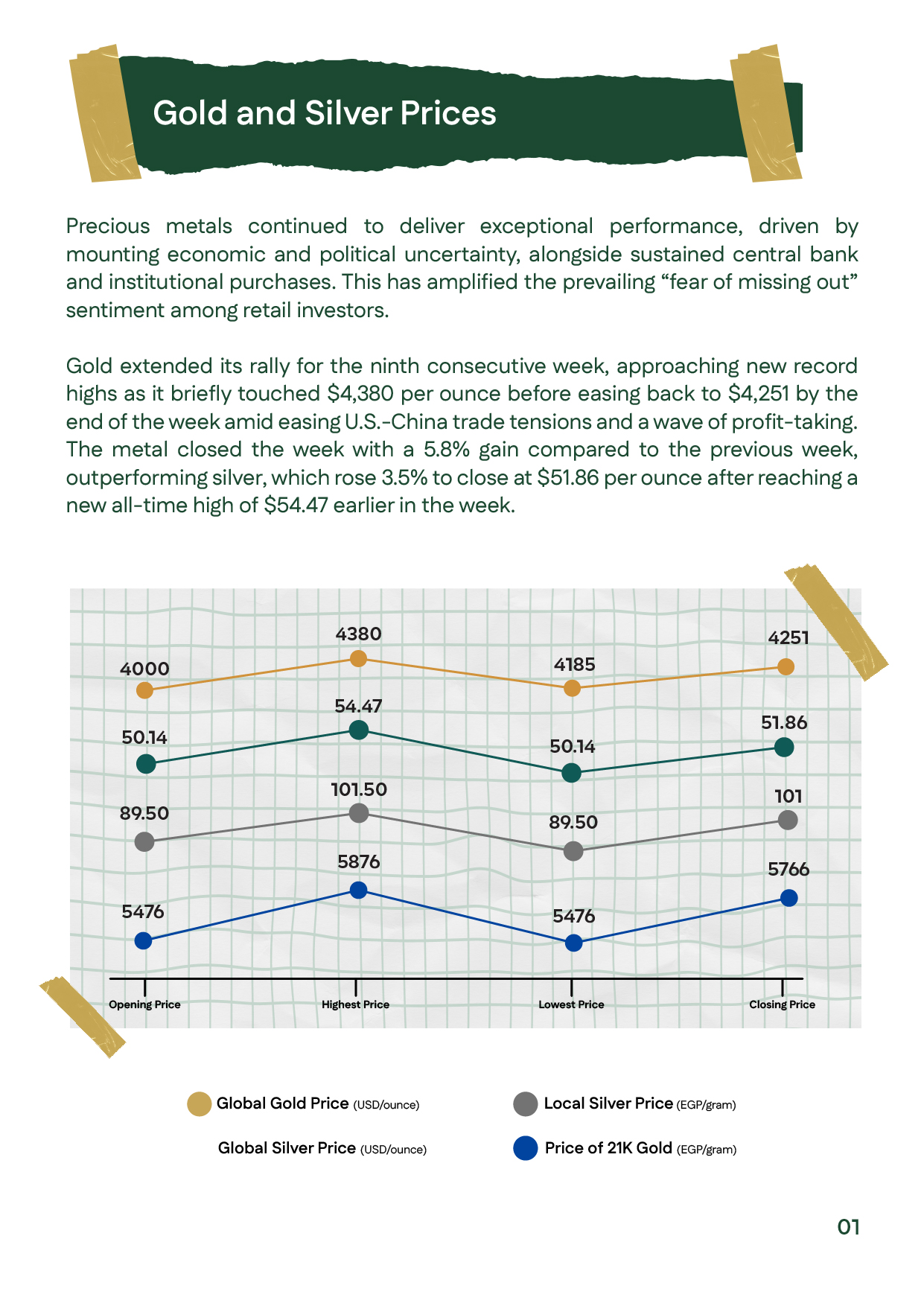

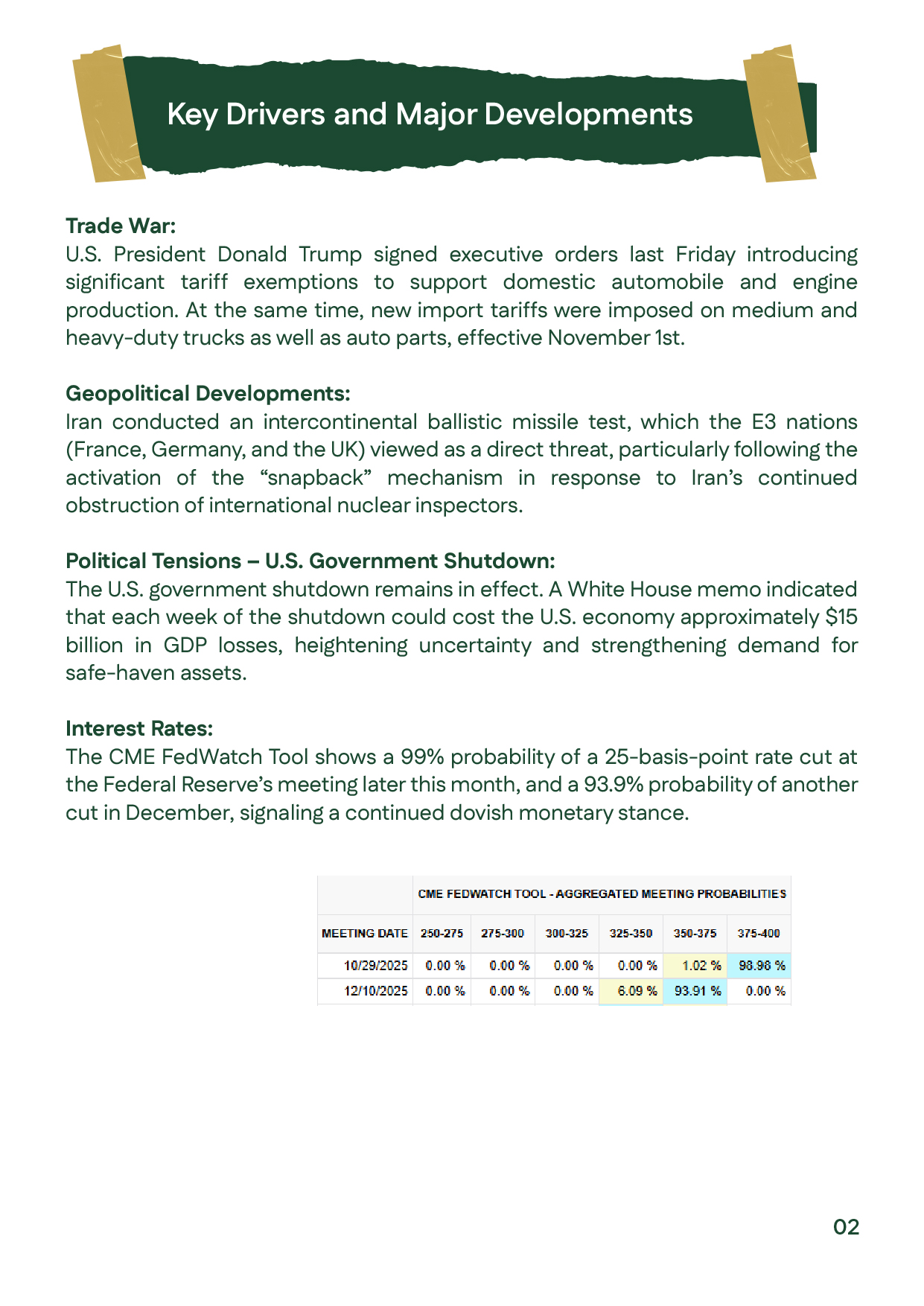

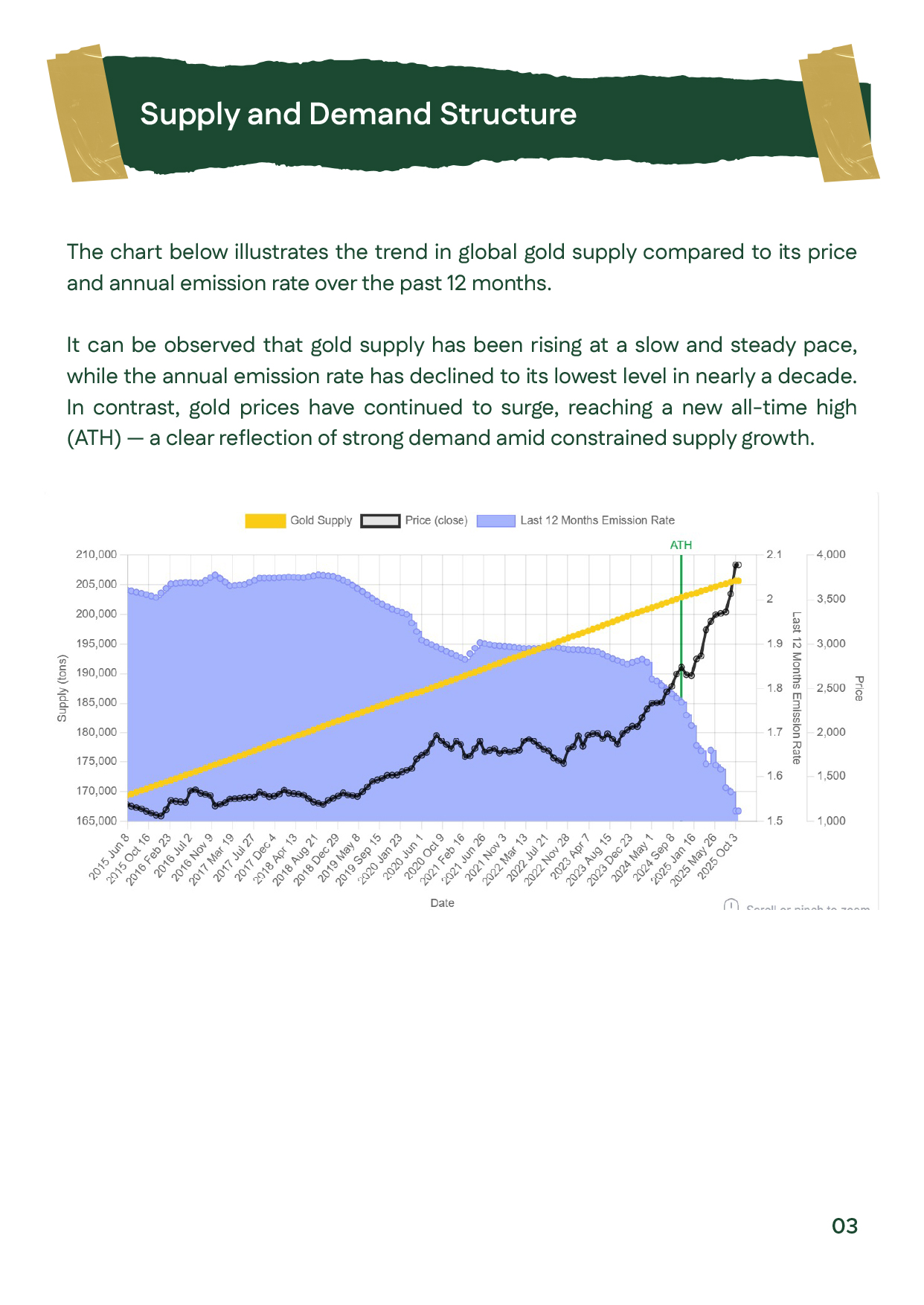

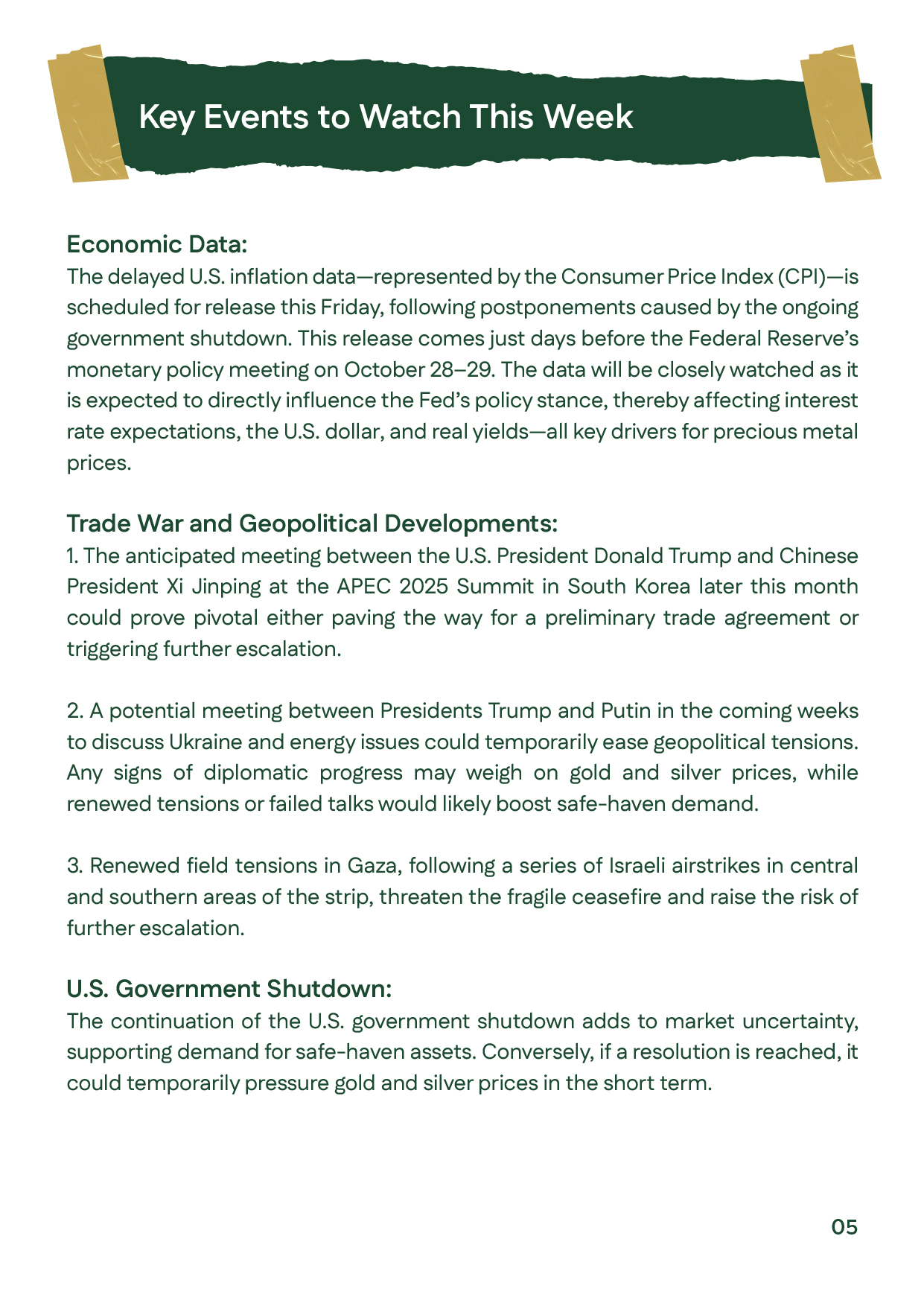

Gold prices rose globally for the ninth consecutive week, touching $4,380 per ounce, driven by strong central bank purchases and ongoing economic and geopolitical uncertainty. Meanwhile, silver gained 3.5% to reach $54.47 per ounce, marking new record highs. Locally, 21-carat gold continued to rise amid strong investment demand, with buyers favoring bullion and coins over jewelry. These moves come as the U.S. Federal Reserve is expected to cut interest rates by month-end, while the U.S. government shutdown adds to uncertainty. Technically, the uptrend remains intact with strong support around $4,000 and resistance near $4,380–$4,400 per ounce

عربي

عربي