Silver & Gold Price Analysis – Week 4 of October 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis – Week 4 of October 2025

Silver & Gold Price Analysis – Week 4 of October 2025

Oct 28, 2025

By

Dahab Masr Research Team

0 comment(s)

Silver & Gold Price Movements in Week 4 – October 2025

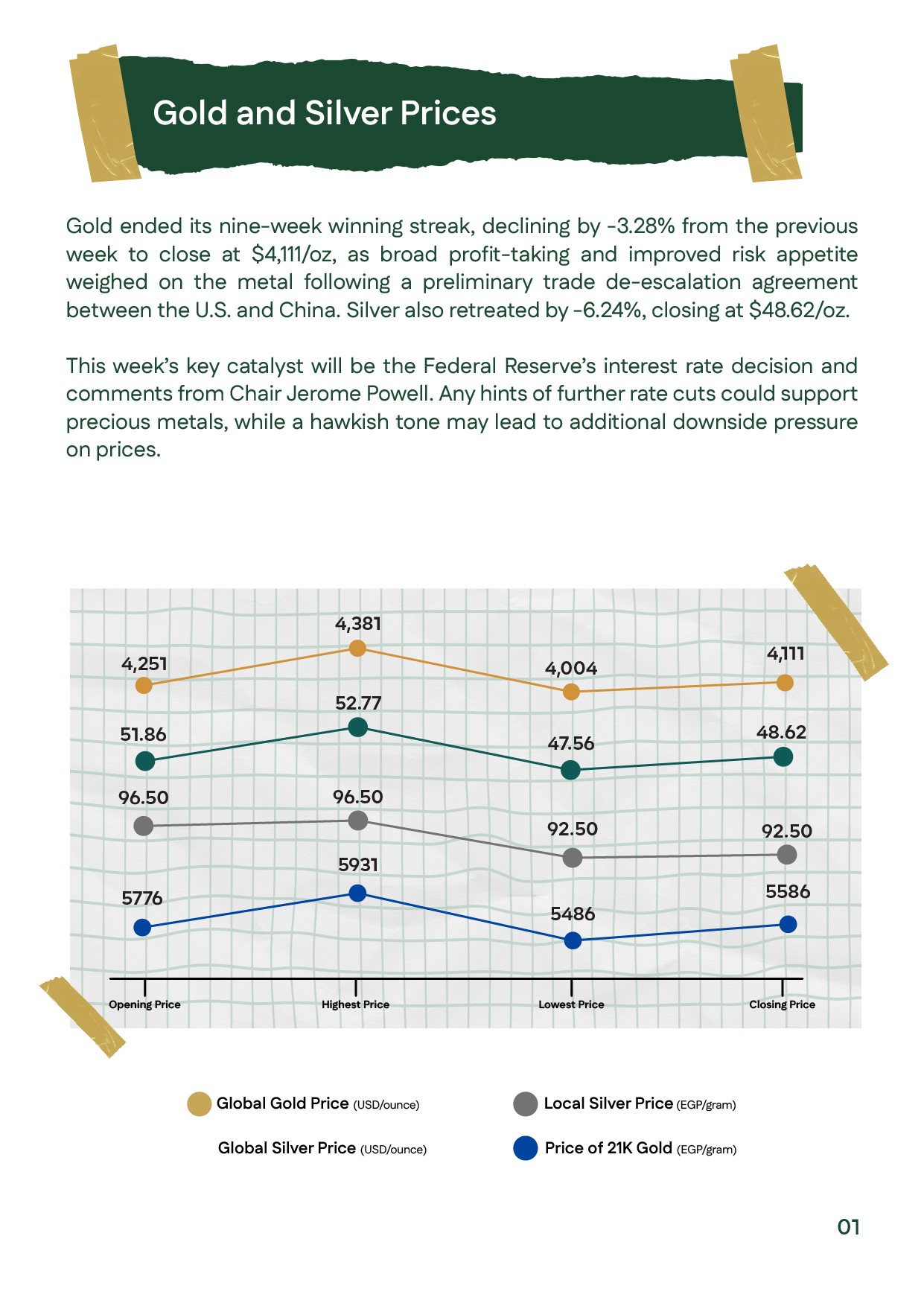

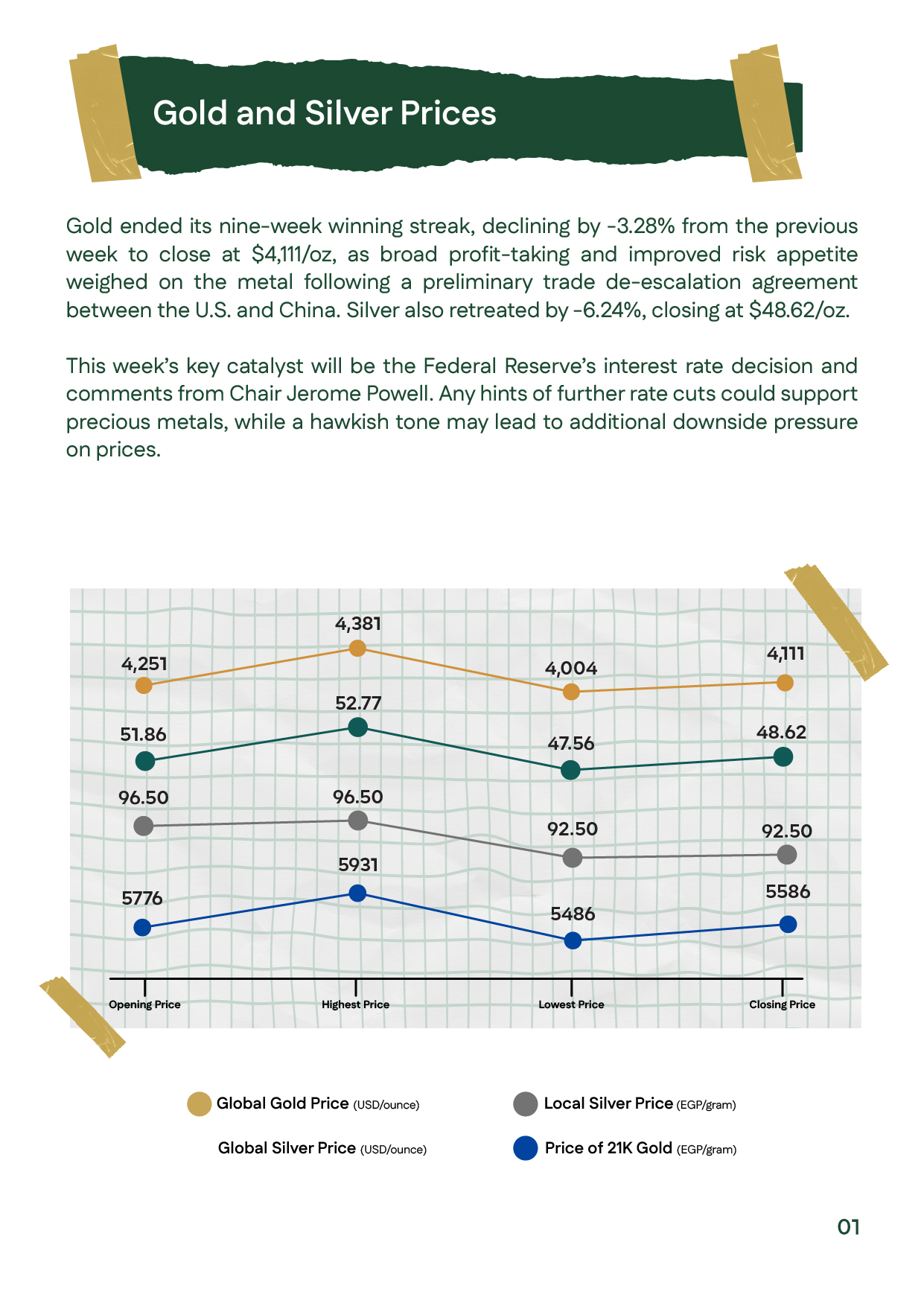

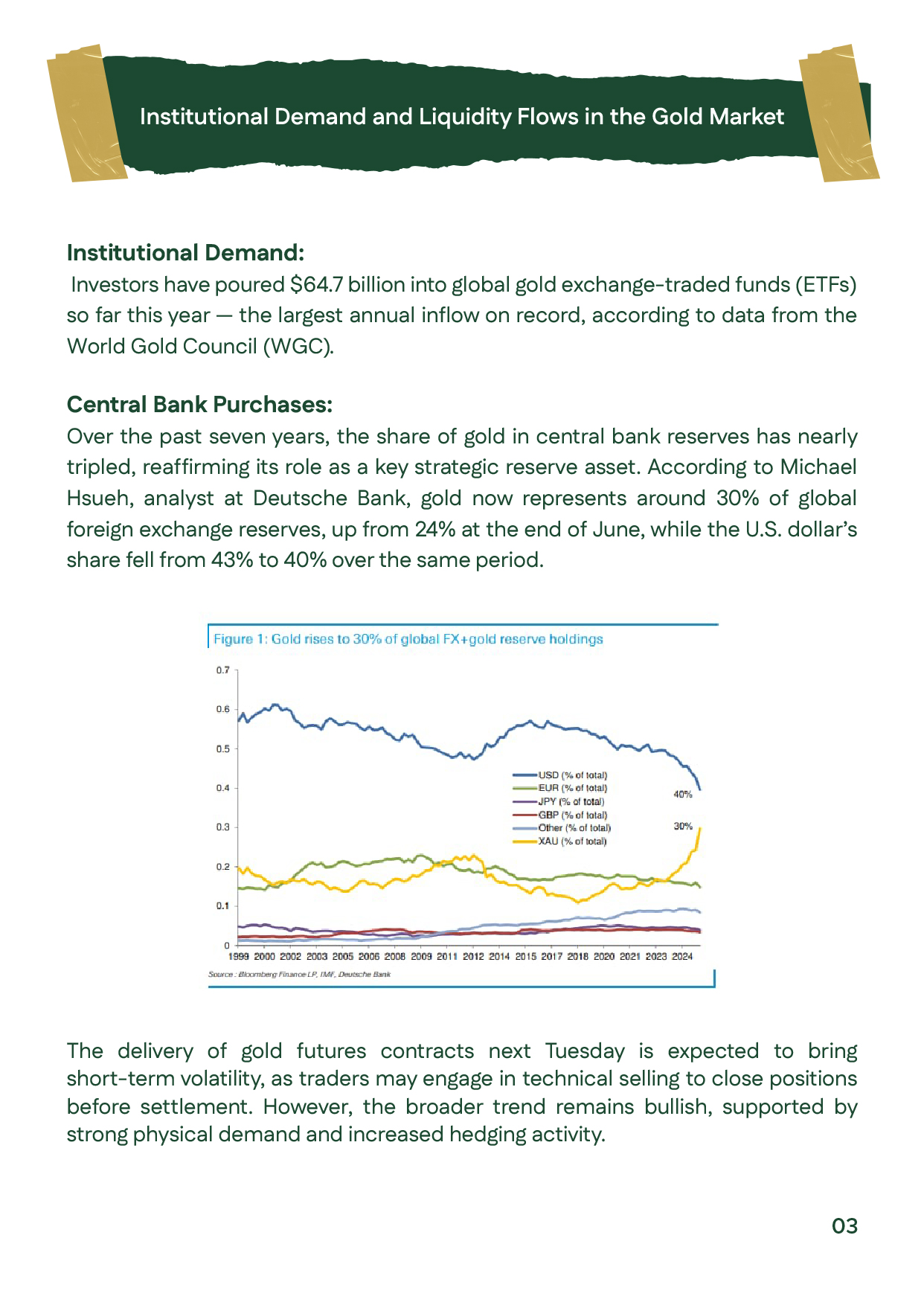

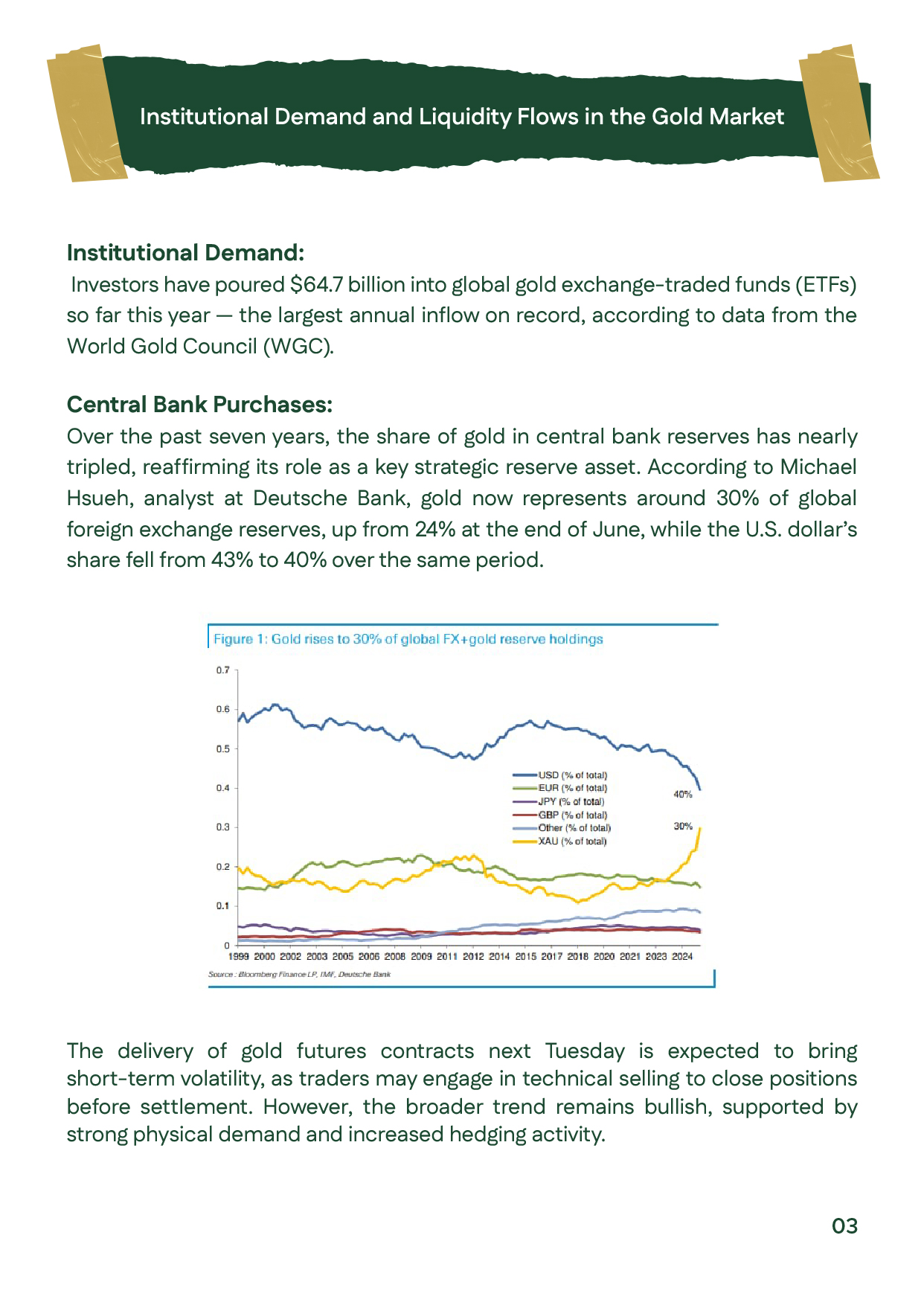

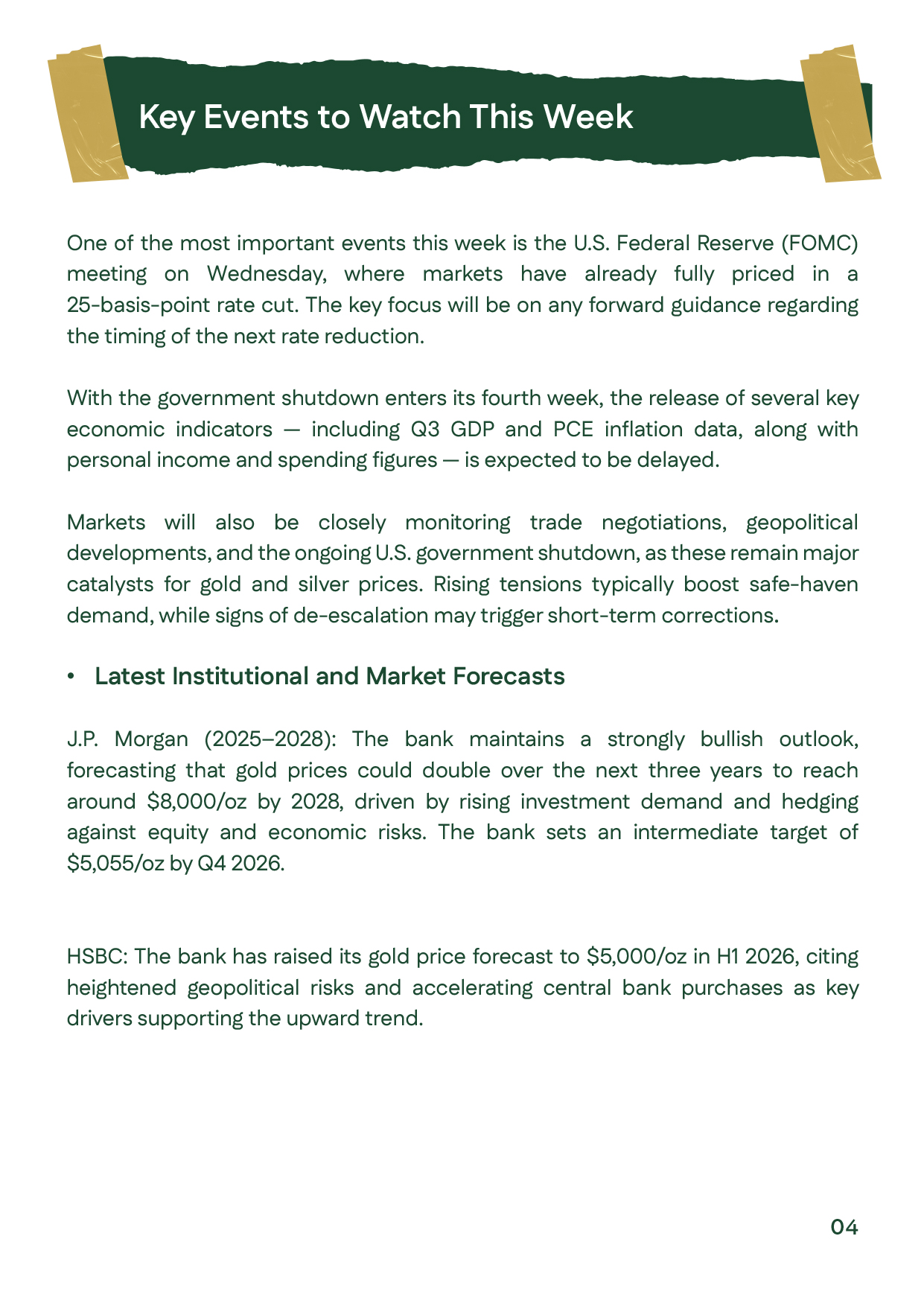

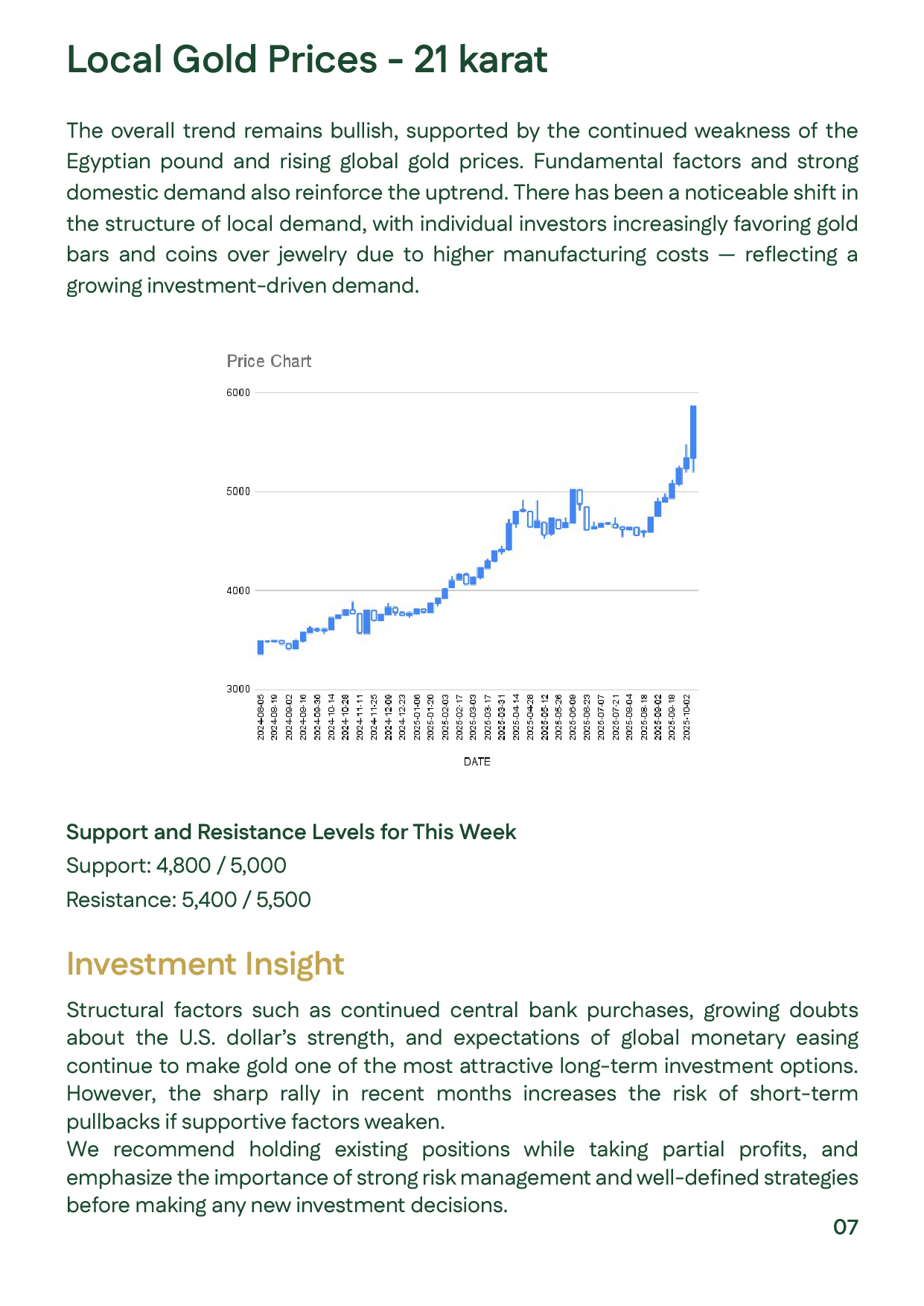

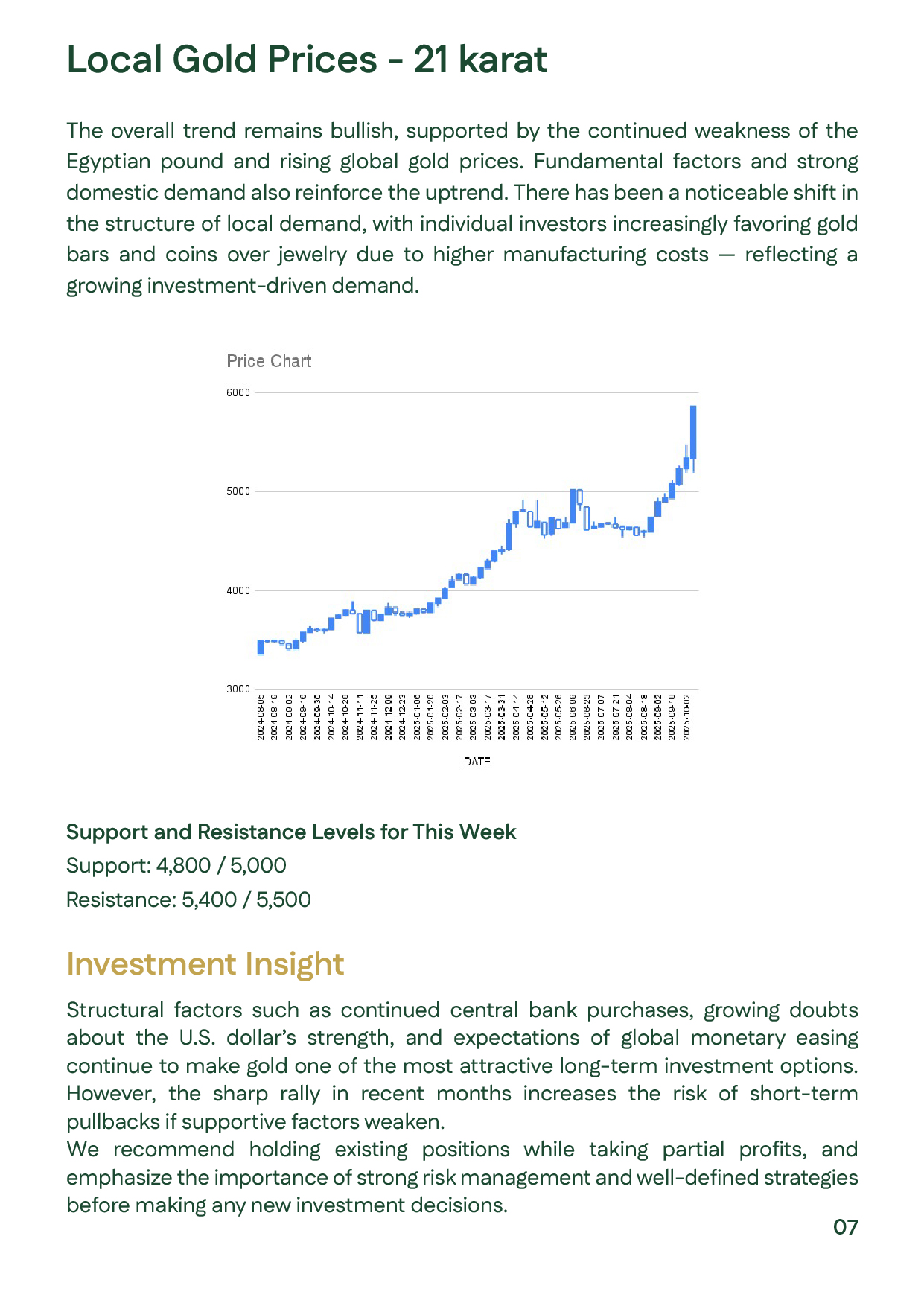

Gold prices declined 3.28% to $4,111/oz in the fourth week of October 2025, ending a nine-week rally. The drop was driven by profit-taking and improved investor sentiment following signs of easing U.S.–China trade tensions. Silver fell 6.24% to $48.62/oz. Locally, gold remained supported by EGP weakness and rising investment demand for bars and coins. Persistent central bank buying, geopolitical uncertainty, and ongoing U.S. monetary easing continue to support gold in the medium term. Technically, support is seen near $4,050 and resistance at $4,300, suggesting a potential correction before resuming the broader uptrend.

عربي

عربي