Silver & Gold Price Analysis – Week 3, September 2025

- Home

- Information Center by DahabMasr

- Silver & Gold Price Analysis – Week 3, September 2025

Silver & Gold Price Analysis – Week 3, September 2025

Sep 24, 2025

By

Dahab Masr Research Team

0 comment(s)

Silver & Gold Price Movements in Week 3 – September 2025

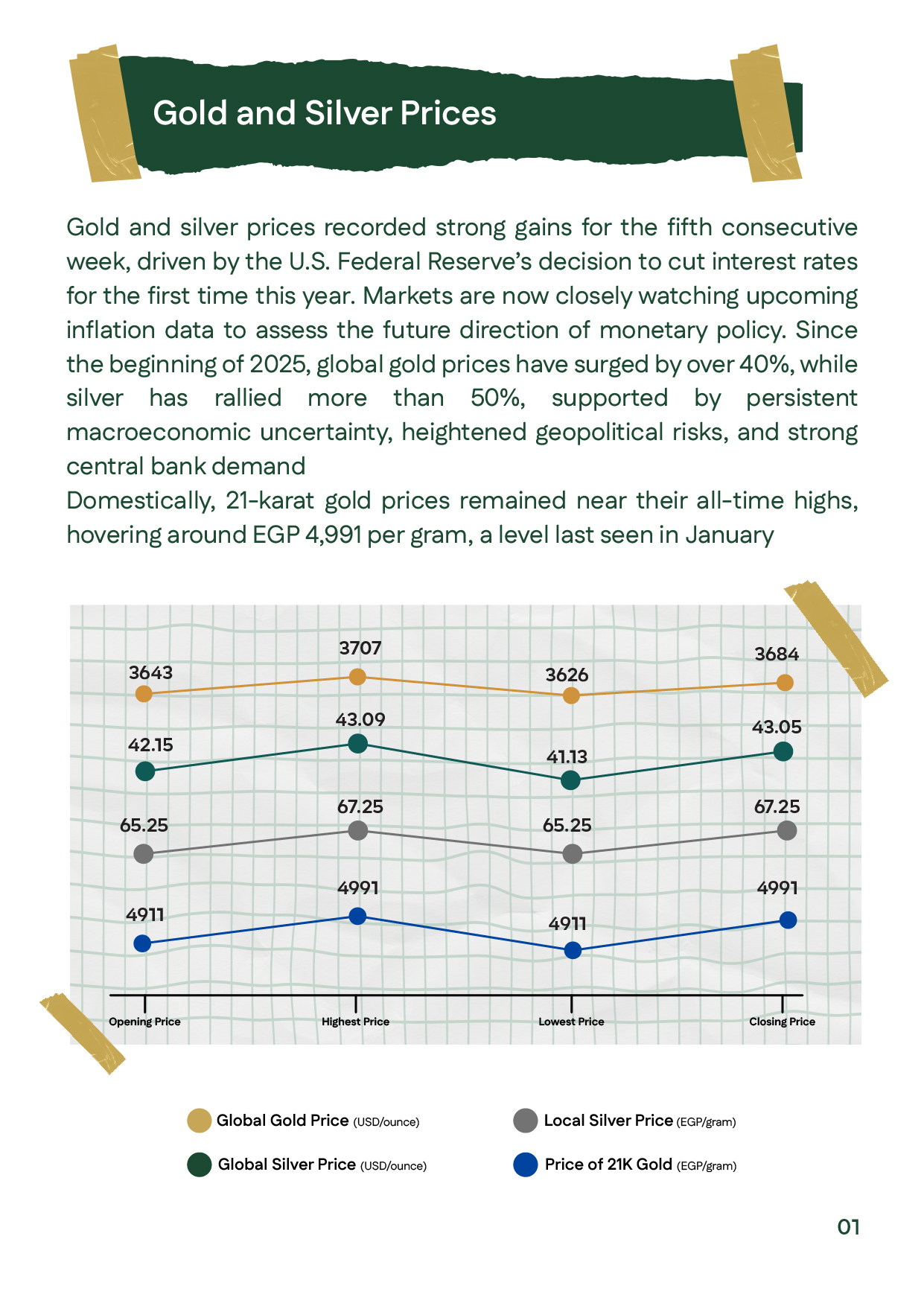

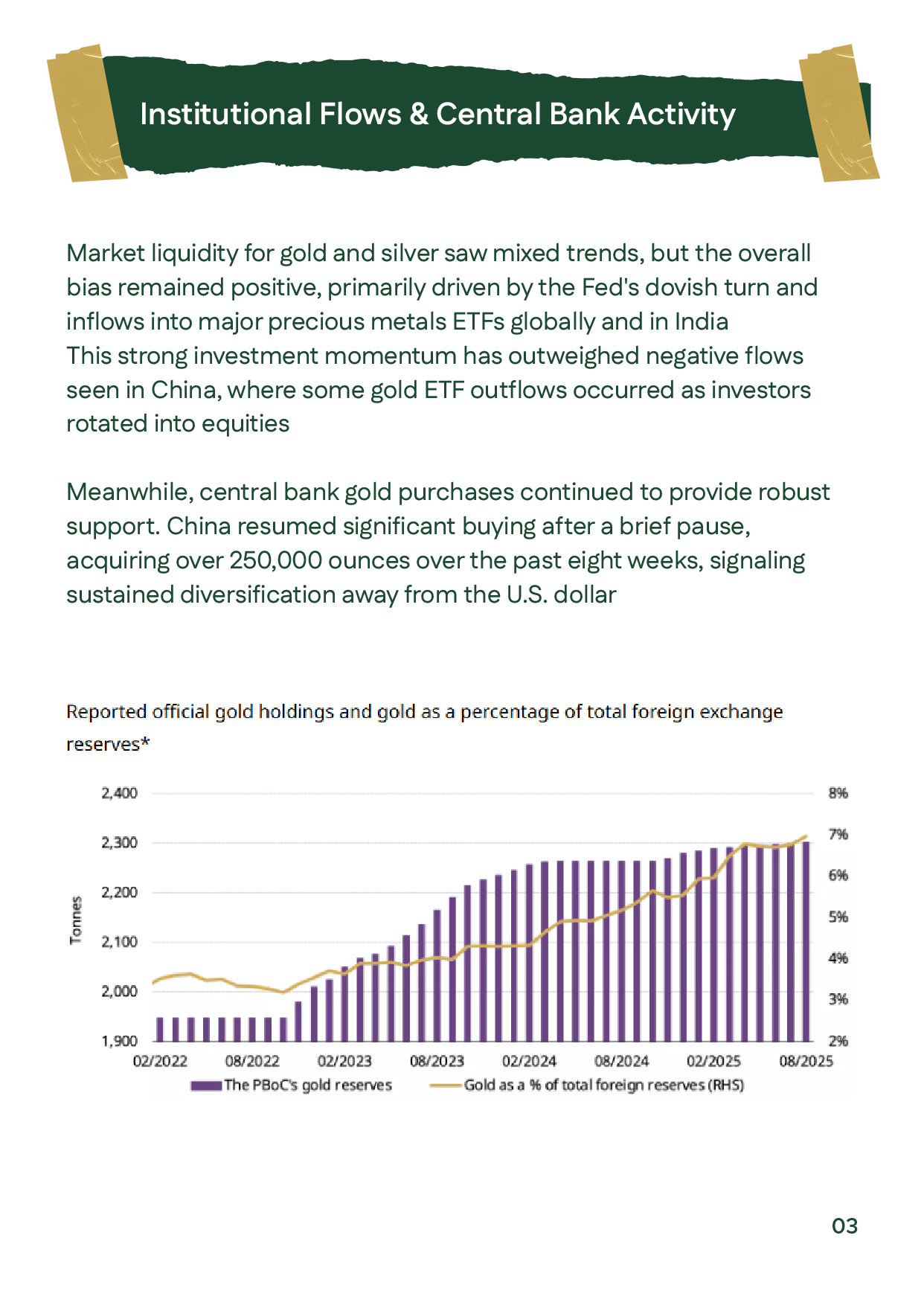

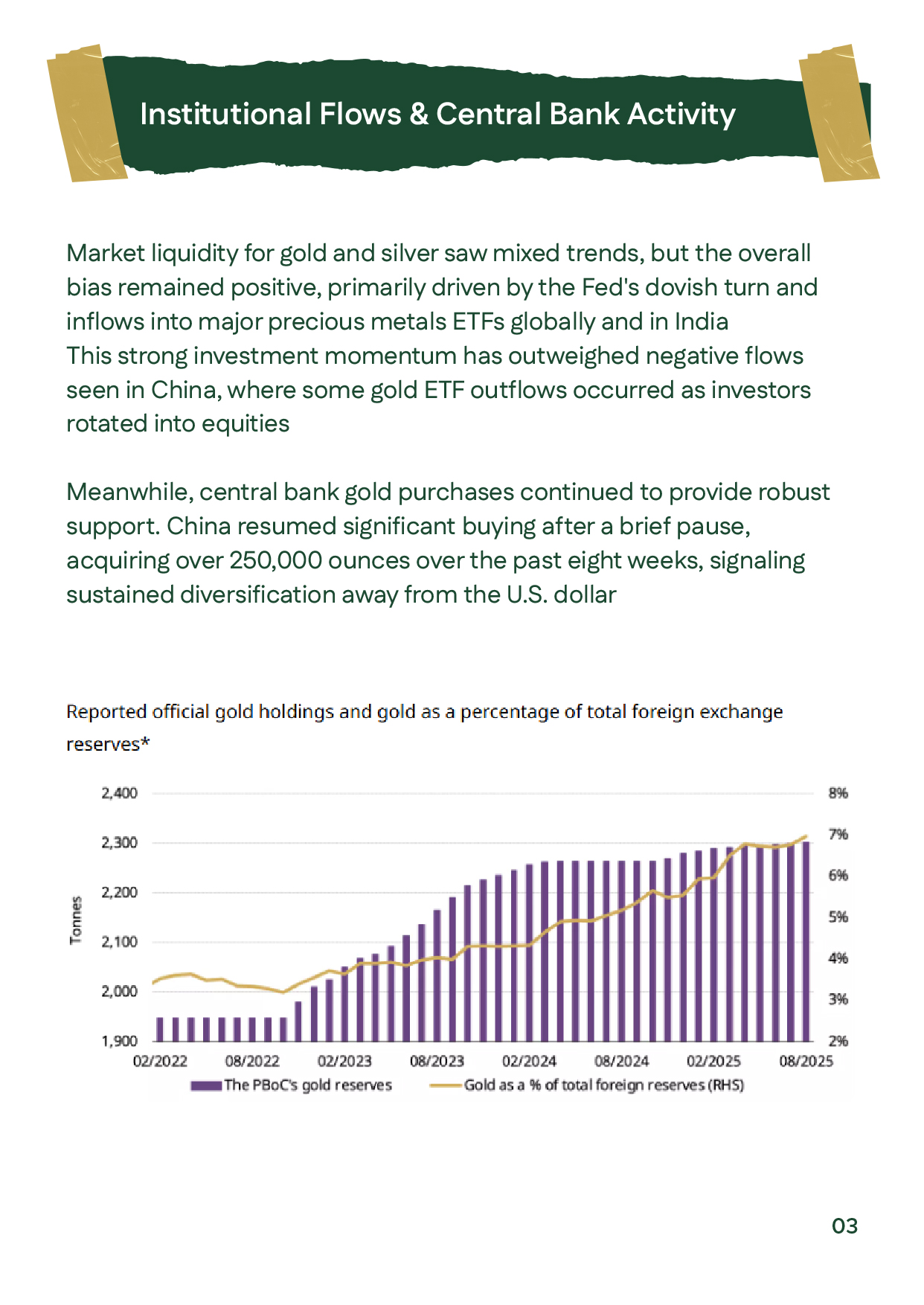

Global gold prices surged above $3,700/oz, while silver advanced past $43, fueled by the Federal Reserve’s 0.25% rate cut to 4.25% and a softer dollar. In Egypt, 21K gold traded near EGP 4,991, close to its all-time highs. Key drivers included the ongoing Russia–Ukraine war, Middle East tensions, and strong central bank demand, with China purchasing over 250,000 ounces in recent weeks. On the downside, rising risk appetite in stock markets could weigh on safe-haven flows. Technically, gold shows strong support at $3,660–$3,640 and resistance near $3,780–$3,800, while silver remains in a bullish channel with key support around $40. Outlook stays positive if momentum is maintained.

عربي

عربي