Comprehensive Analysis of Gold Performance in the First Quarter of 2024

- Home

- Information Center by DahabMasr

- Comprehensive Analysis of Gold Performance in the First Quarter of 2024

Comprehensive Analysis of Gold Performance in the First Quarter of 2024

Gold Performance in the First Quarter of 2024

Gold, referred to here as the yellow metal, demonstrated notable performance with three months of strong gains, increasing by approximately 8.5% quarterly, and by about 9.2% in March alone, marking the best monthly performance in four years. It opened trading in January at $2043 and closed in March at $2230; meanwhile, the dollar index rose by 3.1% on a quarterly basis to end the first quarter at 104.5 points from 101.4 points at the start of January.

Gold: The Talk of Global Investment Banks

As a result, major global institutions have raised their gold price forecasts several times over the first quarter of the year amid economic and geopolitical uncertainties and increasing purchases by central banks. The latest forecasts are as follows:

- Citigroup predicts gold could jump to $3000 within the next 6-18 months, with increasing investment demand flows coinciding with the start of the interest rate cut cycle in the second half of the current year, and the potential recession scenario in 2025 which would provide further momentum to the yellow metal.

- Goldman Sachs revised its forecast to $2700 from an earlier forecast of $2300, attributing the reason to the repercussions of sanctions imposed on Moscow since mid-2022, where most of the rise in gold prices was driven by new additional factors such as "fear" of maintaining the monetary system, and currency devaluation by central banks in emerging markets.

- Bank of America raised its forecast to $3000, citing increased demand from central banks and Chinese investors.

- UBS's forecasts indicate that gold could reach $4000 (double the current price) within two years, as gold begins a recovery round after breaking a new high in March, taking 13 years to return to its highest level in 2011 at $1900, according to the rule "history repeats itself."

Do Central Banks Know What Investors Don't?

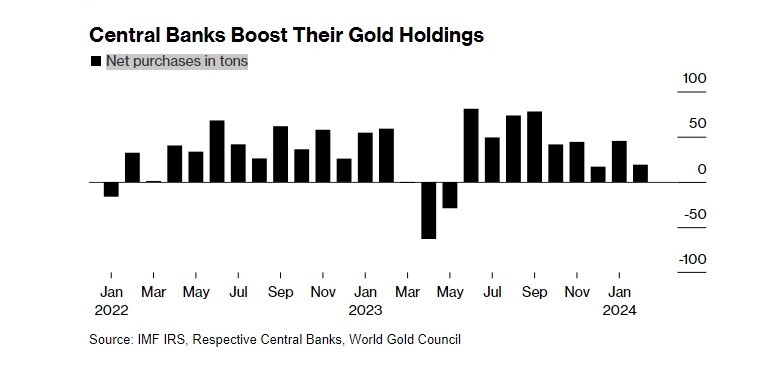

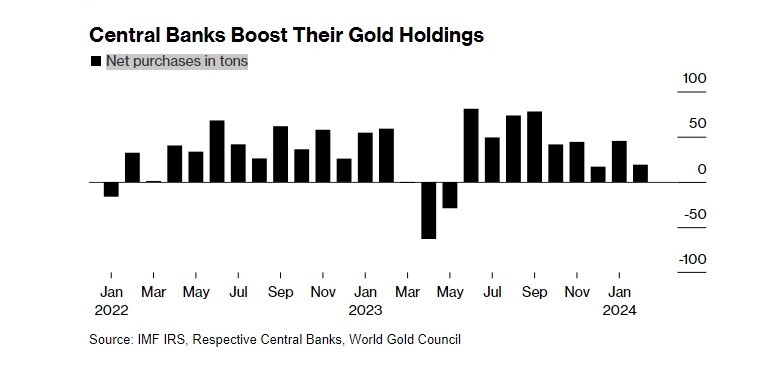

Meanwhile, the sharp rise in gold prices contrasts with the outflows from traded gold funds (ETFs), where most of the selling flows were driven by investment advisors liquidating their buying positions and moving towards stocks and U.S. Treasury bonds, while purchases by central banks increase as one of the repercussions of the Ukrainian war on a global scale. In this regard, global gold reserves have increased by 2% since mid-2022 - and the BRICS alliance's move to establish a new global system based on gold, reducing the dominance of the dollar in trade transactions and international reserves.

Price Expectations for the Second Quarter: Another Historical Peak or a Corrective Wave?

It's unusual for gold prices to have positive relationships with the dollar and the yields of U.S. bonds for 5 and 10 years, but these tend to be temporary, suggesting they might last about 3 - 6 months.

First Scenario: Gold responds to the Federal Reserve's expectations once again, likely leading to a decline against the U.S. dollar, reflecting the policies of the Federal Reserve and the European Central Bank in the coming months. The European Central Bank is set to begin its monetary easing policy in June, followed by the Federal Reserve later (September), with lowered expectations regarding interest rate cuts in the U.S. during the recent weeks amid ongoing inflationary pressures. Consequently, the Egypt Gold Research Team expects a corrective wave in gold prices during the second quarter, potentially reaching levels between $2300-$2350, with prices expected to rise back to around $2500 in the second half of the current year.

Second Scenario: The exacerbation of geopolitical events in the Middle East, in this case, global markets may experience turmoil, which in turn sharply drives investors towards gold as a safe haven, potentially pushing the price beyond $2400 in the next three months.

Data Sources:

Disclaimer:

This document presents an analysis prepared by the Research and Analysis Department of Dahab Masr, based on data obtained from several highly credible sources. However, Dahab Masr does not guarantee the accuracy of this information and data as it is not responsible for their preparation or collection, and therefore, Dahab Masr does not assume responsibility for any direct or indirect damages or losses that may result from reliance on the content herein. The use of this analysis and any decisions arising from it are solely the responsibility of the reader. Dahab Masr also recommends that readers consult a professional financial advisor before making any investment decisions.

عربي

عربي