Where is Silver Heading in 2024?

- Home

- Information Center by DahabMasr

- Where is Silver Heading in 2024?

Where is Silver Heading in 2024?

Overall Performance of Silver:

Silver's performance is gearing up to outperform gold this year, with rising demand expectations for the metal supported by accelerating global industrial production and countries moving towards a green economy. Unlike gold, which typically thrives during economic weakness and uncertainty, silver is more sensitive to economic changes and tends to outperform gold during strong economic expansions.

Global Demand:

The Silver Institute, in its latest report issued in April 2024, forecasts global silver demand to reach 1.219 billion ounces in 2024, recording the second highest level ever compared to about 1.195 billion ounces in 2023. This increase is driven by strong industrial applications and a rebound in demand for jewelry and silverware. The report also notes a 9% annual increase in industrial silver demand in 2024, after reaching 654.4 million ounces last year. The main drivers of this year's growth are the photovoltaic and automotive industries, alongside 5G networks and consumer electronics sectors (including AI applications in transportation, biotechnology, nanotechnology, and data centers), which provide an additional boost to the industrial silver market.

Global Silver Production:

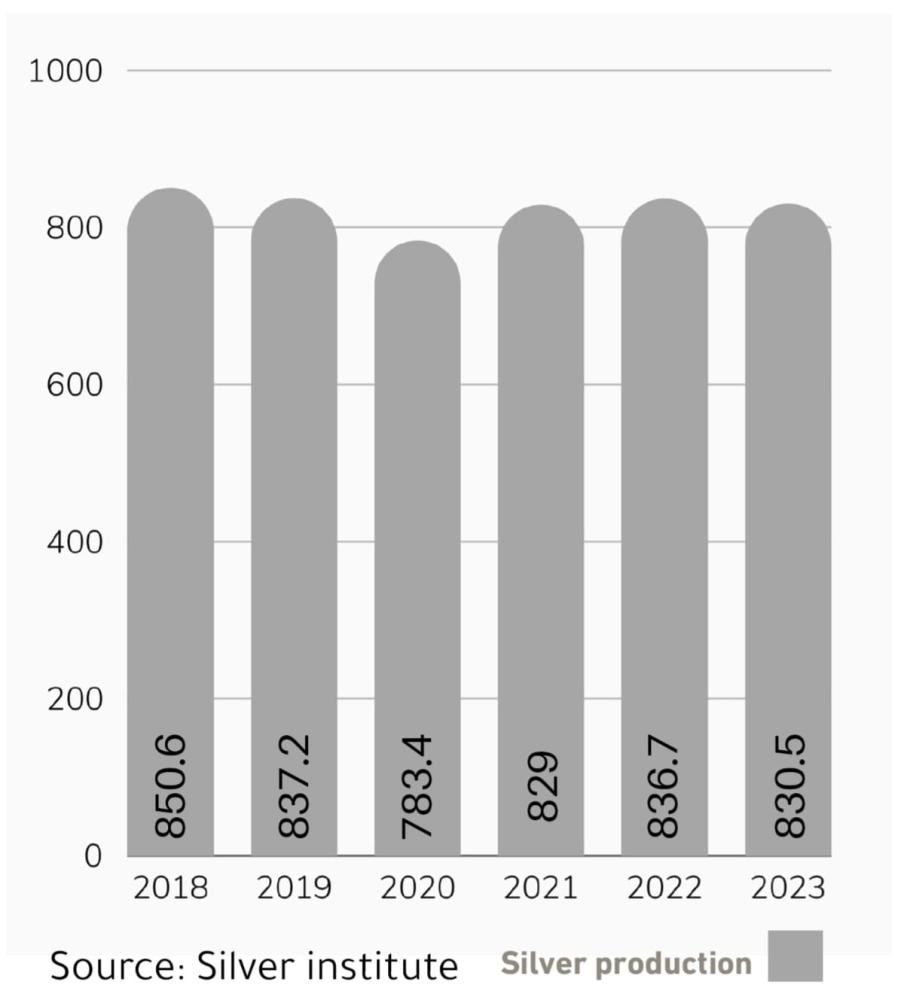

Global mine production of silver is expected to decrease in 2024 to 823.5 million ounces, down from 830.5 million ounces in 2023, led by production in Mexico, the United States, and Morocco.

The report data indicates that the deficit (the difference between demand and supply) this year will rise by 16.8% to 215.3 million ounces, compared to 184.3 million ounces in 2023, remaining exceptionally high by historical standards.

On the other hand, the U.S. Geological Survey – a government agency specializing in geological and geographical operations – estimated global mine production last year at 832 million ounces compared to the actual production of 819.2 million ounces in 2022, with global reserves around 19.5 billion ounces in 2023.

Price:

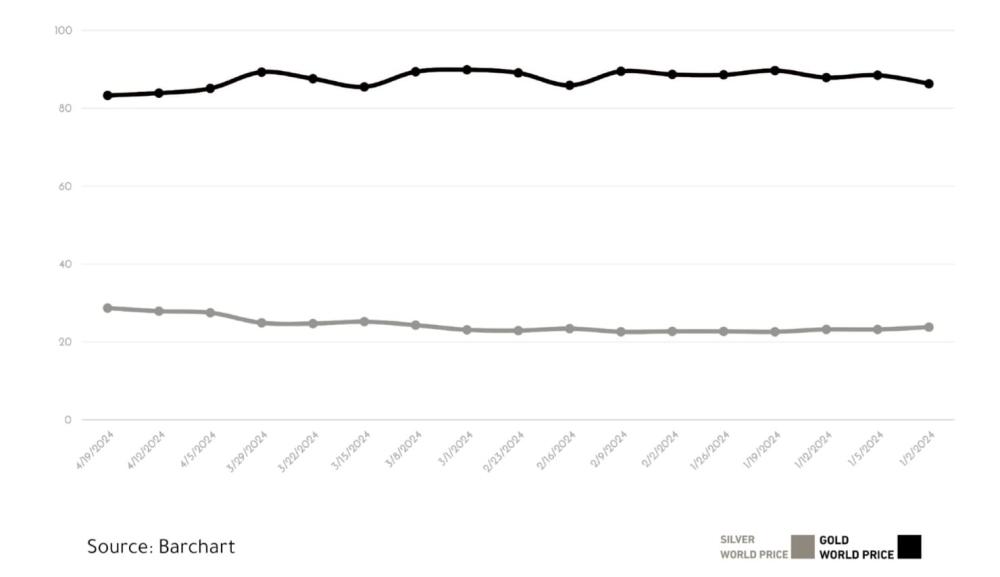

Spot silver contracts on the New York Stock Exchange started at $23.5 per ounce in early January 2024, rising to $28.7 per ounce by the end of trading on April 19; while June futures contracts surged to touch $29 per ounce, supporting the likelihood of significant positive movements in the coming days. Also, the gold-to-silver ratio - the number of silver ounces equivalent to one ounce of gold - rose to 83.3% by the end of trading on Friday, April 19, compared to 86.3% in early January, reflecting the rise in global silver prices concurrent with an increase in the price of gold. This ratio is used to gauge future trends as it indicates the current performance of silver relative to its association with gold. JP Morgan Bank expects spot prices for the precious industrial metal to rise to $30 by the end of this year, while UBS and Citibank predict silver to reach $32 per ounce in the second half of the year.

In the local market, the buying price of a gram of silver at the beginning of this year was 42.5 Egyptian pounds compared to 46 pounds at the end of transactions on April 19, an increase of 8.2%

Disclaimer:

This document presents an analysis prepared by the Research and Analysis Department of Dahab Masr, based on data obtained from several highly credible sources. However, Dahab Masr does not guarantee the accuracy of this information and data as it is not responsible for their preparation or collection, and therefore, Dahab Masr does not assume responsibility for any direct or indirect damages or losses that may result from reliance on the content herein. The use of this analysis and any decisions arising from it are solely the responsibility of the reader. Dahab Masr also recommends that readers consult a professional financial advisor before making any investment decisions.

عربي

عربي