Is BRICS Challenging the Dollar with a New Gold-Based Global System?

- Home

- Information Center by DahabMasr

- Is BRICS Challenging the Dollar with a New Gold-Based Global System?

Is BRICS Challenging the Dollar with a New Gold-Based Global System?

The BRICS group was established in 2009, initially consisting of four countries: Brazil, Russia, India, and China. South Africa joined the following year. The group's objective is to enhance economic and trade cooperation among its member countries, coordinate stances on global and regional issues, and promote sustainable development. It also aims to reform the global financial system and strengthen its role in the decision-making process.

In 2014, the BRICS summit held in Brazil decided to establish a development bank and adopt a treaty to set up an emergency reserve, while the members supported the idea of creating a unified currency among the states; this marked the beginning of efforts to create a multipolar global system instead of the unipolar system led by the United States.

Will BRICS succeed in changing the global energy landscape and overthrowing the dollar?

In August 2023, the BRICS alliance agreed to expand its membership to 10 countries by early 2024 to include Egypt, Saudi Arabia, the UAE, Ethiopia, and Iran; the alliance also announced the development of a new currency that could eliminate the use of the U.S. dollar in international and oil trade. This step was part of the group's plan to accelerate the pace of replacing the dollar as the oil currency by inviting major oil-producing countries to join them, thus changing the global energy trajectory.

Will the BRICS currency restore gold to its status in the global financial system?

The new currency is expected to be backed by gold, which may boost demand for the precious metal and support its upward trend over the coming years, thereby introducing a new influential factor in the global gold markets; it is likely that gold will serve as a framework for the confrontation between BRICS countries and the U.S. dollar for some time, with increasing momentum to launch and support the new currency.

Gold as the basis of the financial system

In 1971, U.S. President Richard Nixon (the Nixon Shock) announced the cancellation of the direct international conversion of the dollar to gold, a move that effectively led to the collapse of the post-World War II Bretton Woods international monetary system (established in 1944) – which was based on the gold standard where the U.S. dollar could be converted into gold at a rate of 35 dollars per ounce - and other major currencies were pegged to the dollar at fixed rates. This decision led to the adoption of the current system of floating exchange rates.

Is U.S. sanctions on Moscow a positive incentive to accelerate the replacement of the dollar?

Meanwhile, Russia and China have gradually moved away from the dollar: With the onset of the Russian-Ukrainian war and the imposition of sanctions on Russian monetary assets, the country has been looking for other financial alternatives to stabilize its economy, and it appears that gold is the ideal alternative. China's trade in yuan instead of the dollar has encouraged other countries to use their local currencies (like India) and store gold as a monetary reserve to support their currency prices. With the trend of the BRICS group to expand to enhance its weight in the global economy and the increasing reliance on gold in establishing its financial system, alongside the continued fight against the green currency, the dollar will become threatened, and the precious metal will regain its position as the most secure financial asset.

Gold as an alternative to the dollar in central bank reserves

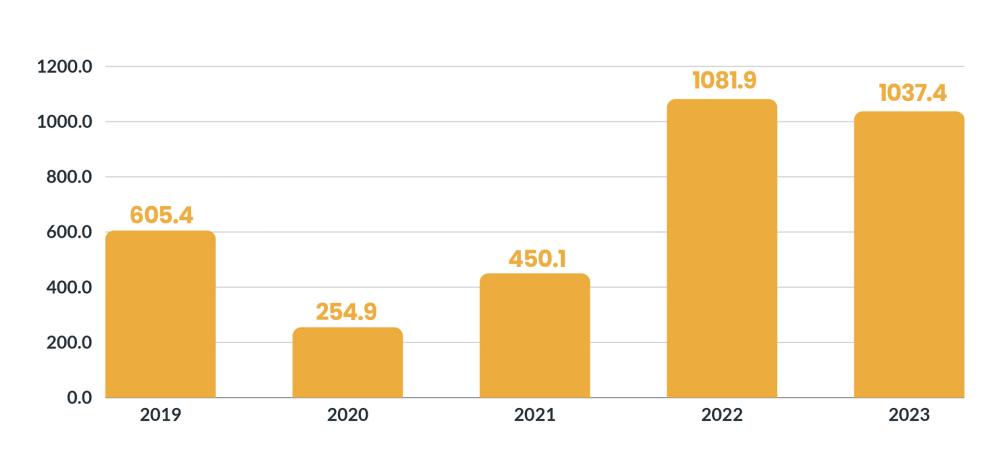

Data from the World Gold Council shows that central bank purchases continued to rise in January last year by about 39 tons, led by Turkey (12 tons) and China (10 tons), and in February by about 19 tons, with the bank expecting strong demand this year to support predictions that the yellow metal could reach 3000 dollars per ounce by the end of the year. Central bank gold purchases totaled about 1037.4 tons last year – the second-highest level ever - compared to 1081.9 tons during 2022, In 2023, central banks in Asia took the lion's share of gold purchases, followed by Europe in second place. China 225 tons, Singapore 77 tons, Poland 130 tons. Central banks around the world are moving to hold more of the precious metal following the Russian-Ukrainian war and the sanctions imposed from freezing Moscow's monetary assets, and with the rise in external debts and the increasing cost of interest to service government debt under the tight monetary policy followed since 2022.

Global Central Banks' Gold Purchases Chart

Key Factors Influencing Gold in the Global Arena

A) The purchasing momentum of central banks for gold causes an imbalance between global demand and supply:

The latest data from the International Monetary Fund shows that global reserve currencies have reached approximately 12 trillion dollars, while central bank purchases of available gold were estimated at about 3 trillion dollars, according to the Canadian research institution Alpine Macro.

B) Chinese investors are turning to gold as a safe haven following the collapse of the real estate and stock markets during 2022-2023, where data indicates a shift away from real estate investment as house prices fall and supply increases, along with predictions of a population decline in the coming years.

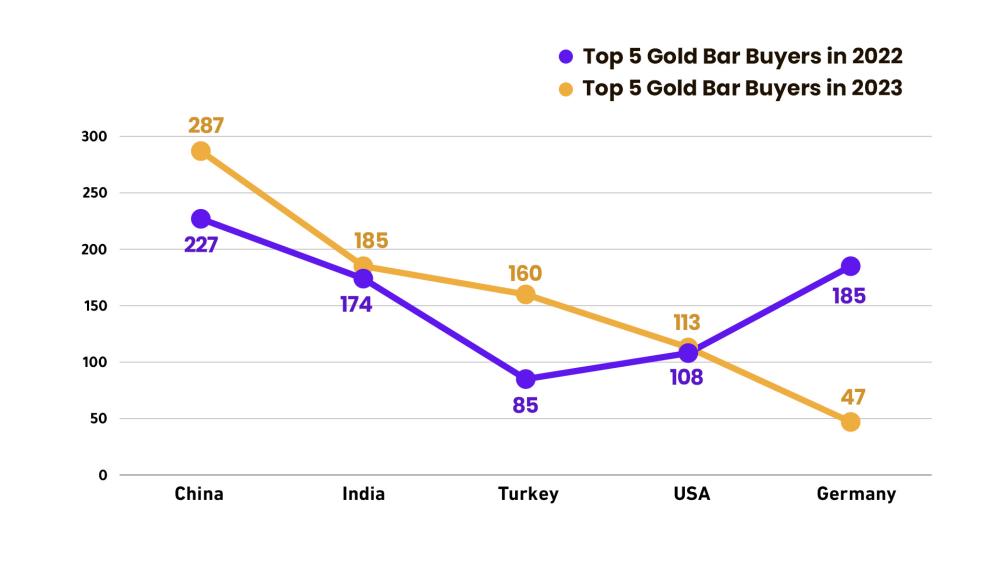

Chart of the Top 5 Countries' Bullion Purchases 2022 – 2023

Disclaimer:

This document presents an analysis prepared by the Research and Analysis Department of Dahab Masr, based on data obtained from several highly credible sources. However, Dahab Masr does not guarantee the accuracy of this information and data as it is not responsible for their preparation or collection, and therefore, Dahab Masr does not assume responsibility for any direct or indirect damages or losses that may result from reliance on the content herein. The use of this analysis and any decisions arising from it are solely the responsibility of the reader. Dahab Masr also recommends that readers consult a professional financial advisor before making any investment decisions.

عربي

عربي