Dahab Masr team’s technical analysis and vision for gold prices in 2024

- Home

- Information Center by DahabMasr

- Dahab Masr team’s technical analysis and vision for gold prices in 2024

Dahab Masr team’s technical analysis and vision for gold prices in 2024

Overview from Dahab Masr's Analysis Team

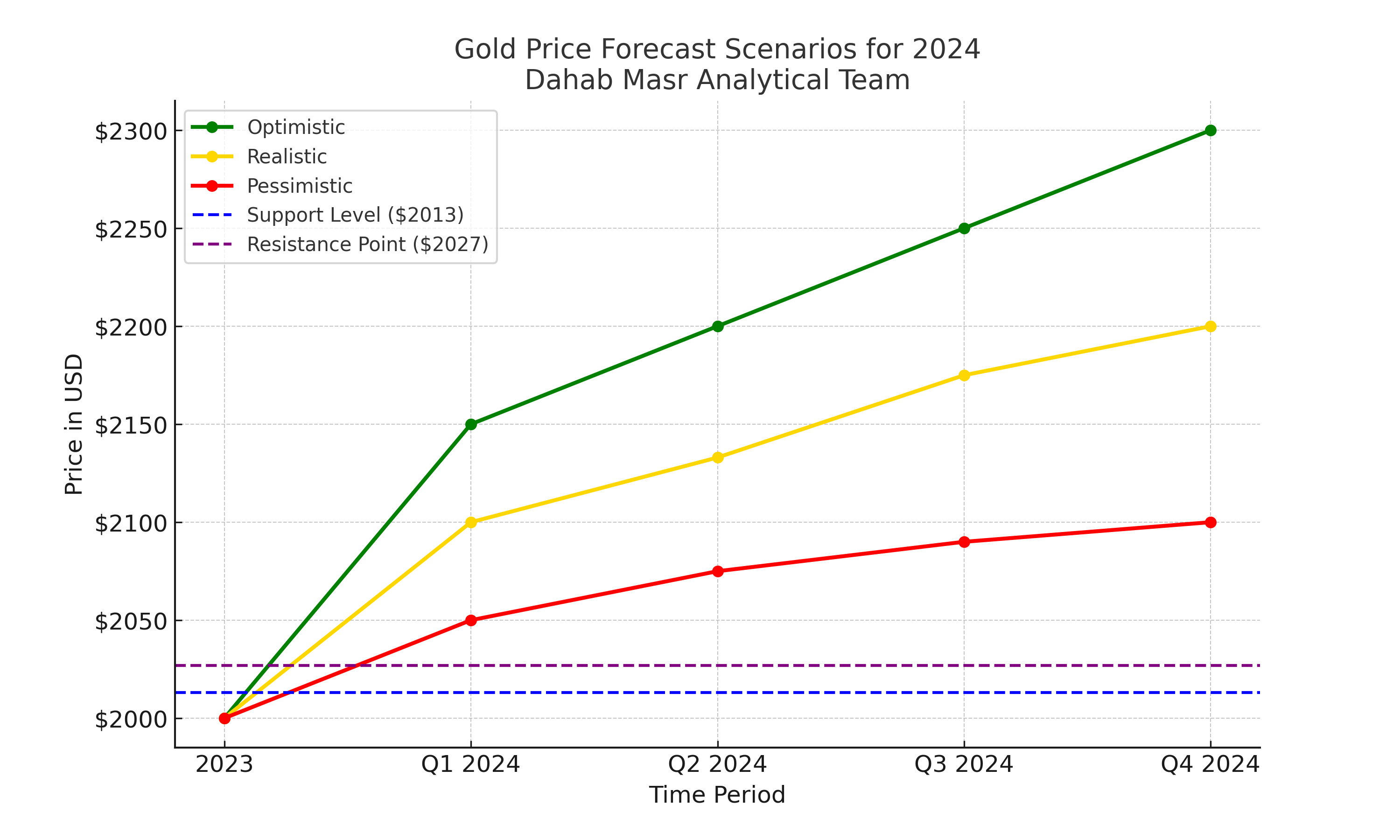

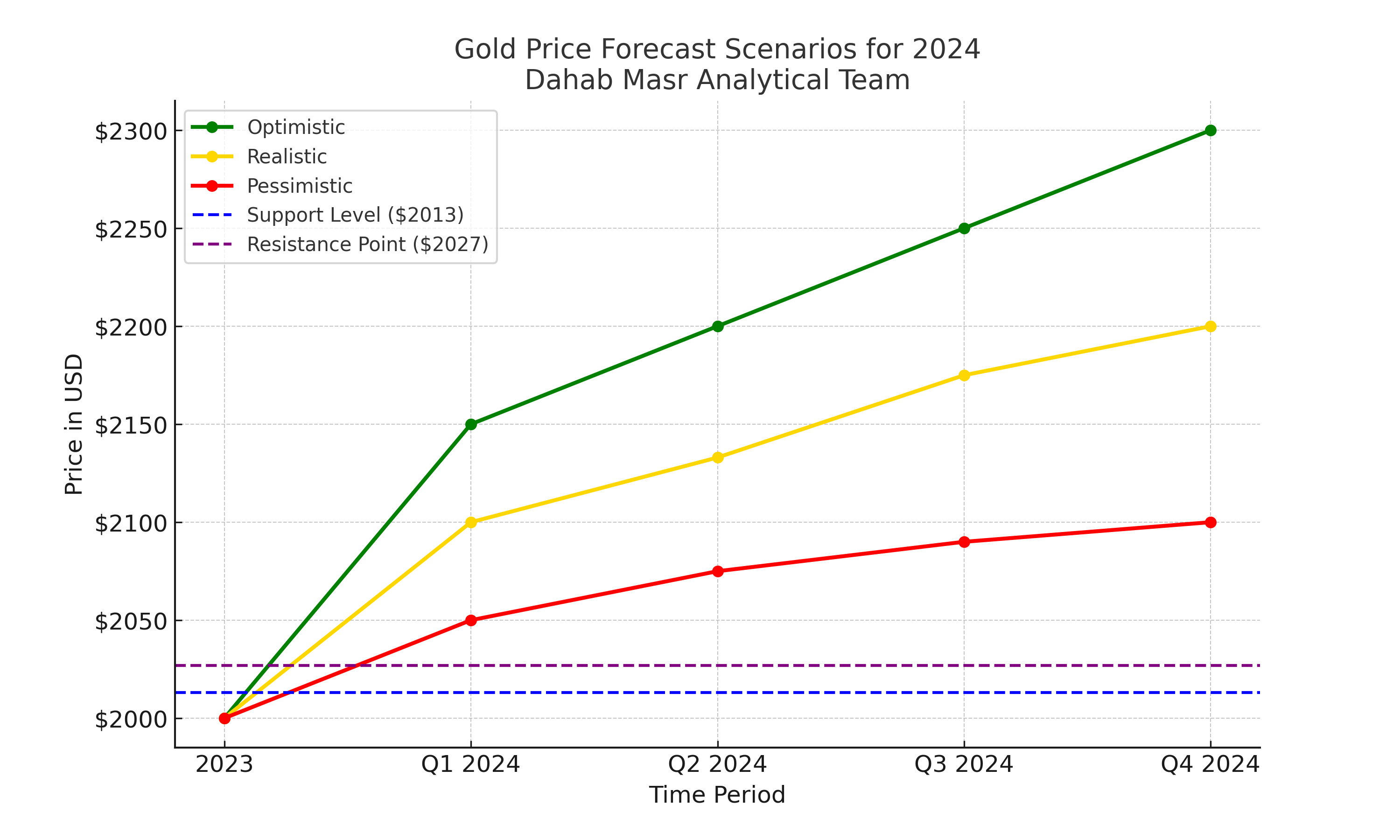

As we approach 2024, the gold market shows strong signs of resilience and potential growth. According to Dahab Masr's analysis team, gold is currently trading within a defined pivotal range with support at $2013 per ounce and resistance levels around $2027, a former support level now turned resistance.

The main trend for gold remains bullish as long as prices stay above the $2013 support level. Stabilizing prices above this level may indicate the possibility of a return to the bullish trend, targeting the first resistance at $2027. If the price exceeds this resistance, it could pave the way for an ascent towards the next resistance level at $2048.

On the other hand, if gold fails to maintain its level above $2013, it may face downward pressure, targeting support zones between $2000 and $1997, followed by last week's low at $1973.

Locally, this development is expected to reflect an increase in gold prices in Egypt, stabilizing above the 3000 Egyptian pound for 21-carat gold before the end of the first half of 2024.

Forecasts from major banks and institutions supporting our vision for 2024:

In addition to the technical analysis from Dahab Masr's team, major banks have also presented their forecasts for global gold prices in 2024:

- 'Goldman Sachs' expects a bullish price at $2133 per ounce.

- 'JP Morgan' anticipates a more optimistic figure at $2175 per ounce.

- 'UBS' predicts gold prices around $2100 per ounce.

- 'Long Forecast' expects a significant rise to $2200 per ounce by April.

Conclusion:

By integrating the technical analysis of Dahab Masr's team with insights from major central banks, the overall expectation for gold in 2024 appears significantly positive. Considering the key factor to watch is the $2013 support level, which is likely to play a crucial role in determining gold's price movement throughout the year.

عربي

عربي