Weekly Gold Analysis - Second Week of May 2024

- Home

- Information Center by DahabMasr

- Weekly Gold Analysis - Second Week of May 2024

Weekly Gold Analysis - Second Week of May 2024

"Gold Surprises Continue!"

A Continuous Series of Record Highs Since the Beginning of the Year A massive surge swept through global gold prices by the end of the week’s trading, reaching the 21st peak since the start of the year and surpassing the $2,400 mark, driven by several direct and indirect factors, including:

Geopolitical:

Intensifying clashes between Israel and Hamas in northern Gaza and southern Rafah, along with increased Russian strikes on northern Ukraine in a new attempt to seize the city of Kharkiv.

Economic:

New US sanctions involving higher tariffs on some Chinese goods, including electric cars, solar cells, semiconductors, steel, aluminum, and critical metals. The IMF criticized these trade restrictions, predicting their negative impact on the global economy due to trade and investment distortions and weakened supply chains, affecting production costs overall.

Technical:

Saxo Bank’s technical analysis last Tuesday pointed to potential buying momentum that could break the $2,398 level and close above $2,400, with the possibility of reaching $2,490. Analysts at the Canadian SIA Wealth Management predicted that surpassing the $2,400 resistance level might pave the way for a potential rise to $2,500 in the near term.

Indirect:

- Speculations about the upcoming US elections in November and their impact on commodity markets, in case Trump wins with his pledge to impose tariffs on imports of Chinese and European goods.

- Morgan Stanley mentioned in its report last week that Washington's continued use of economic sanctions could prompt some countries to seek alternatives to the dollar, and the upcoming presidential election could test the dollar's status in the global system.

- BRICS countries continue to actively stockpile gold to support efforts to move away from the dollar, leading to a rise in the precious metal’s prices.

- In recent statements by Andrew Naylor, the World Gold Council's representative in the Middle East, he explained that the rising levels of global debt and its sustainability - especially in North America - would support gold prices in the coming period.

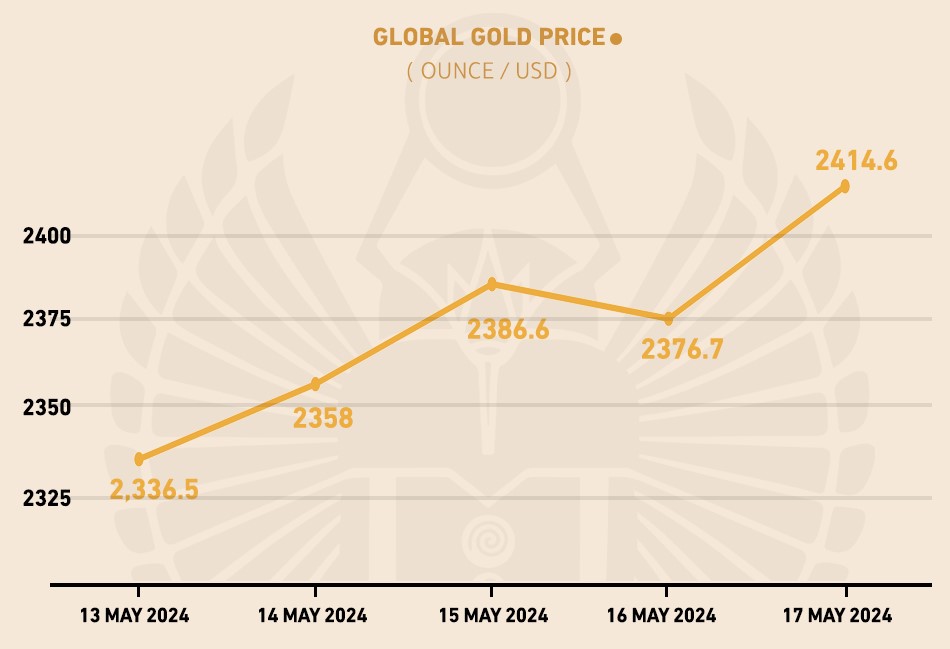

Global Gold Price:

Spot gold contracts closed in New York up by about $39, reaching $2,414.6 per ounce, compared to $2,360.5 last week. June futures rose to $2,417.5 per ounce by the end of Friday’s trading.

The Dollar Index, which measures the performance of the dollar against a basket of 6 major currencies, also ended the week lower, recording 104.5 points compared to last week's close at 105.3 points, and 10-year bond yields registered 4.4%.

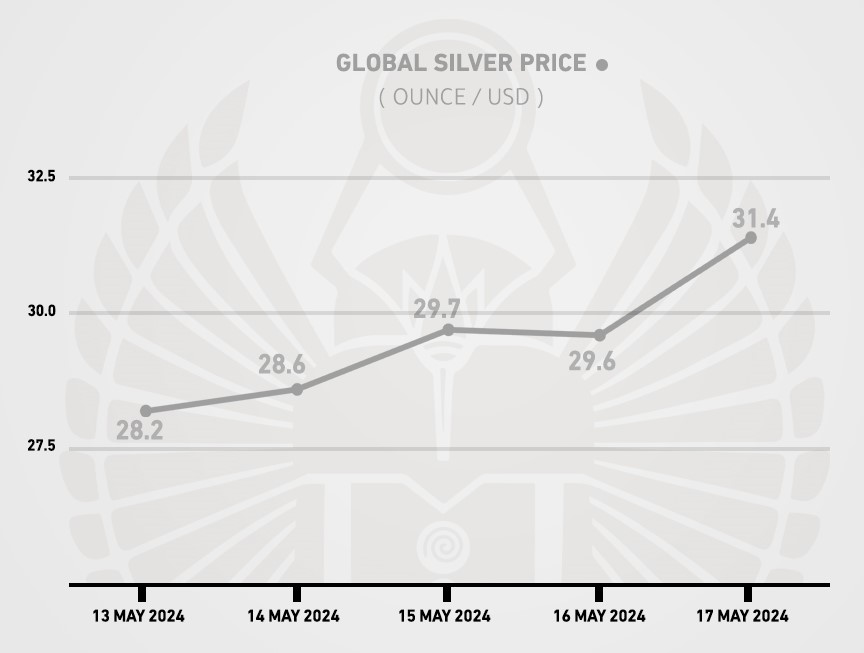

Global Silver Price:

Investor interest in holding silver through silver-backed exchange-traded funds has increased recently, in conjunction with gold reaching record levels thanks to purchases by central banks and Chinese consumers, according to Bloomberg.

Citigroup predicted in a memo last week that with continued strong economic growth in the second half of the year, the relative cost of gold might decrease to about 70 ounces of silver (which means a rise in the price of silver).

Saxo Bank also predicted further increases in silver prices this year to exceed $30 in the near term.

Spot silver contract prices jumped by 1.3% to close at $31.4 per ounce compared to $28.2 last week, while July delivery contracts recorded about $31.3 per ounce by the end of the weekly trading.

Local Market Drivers:

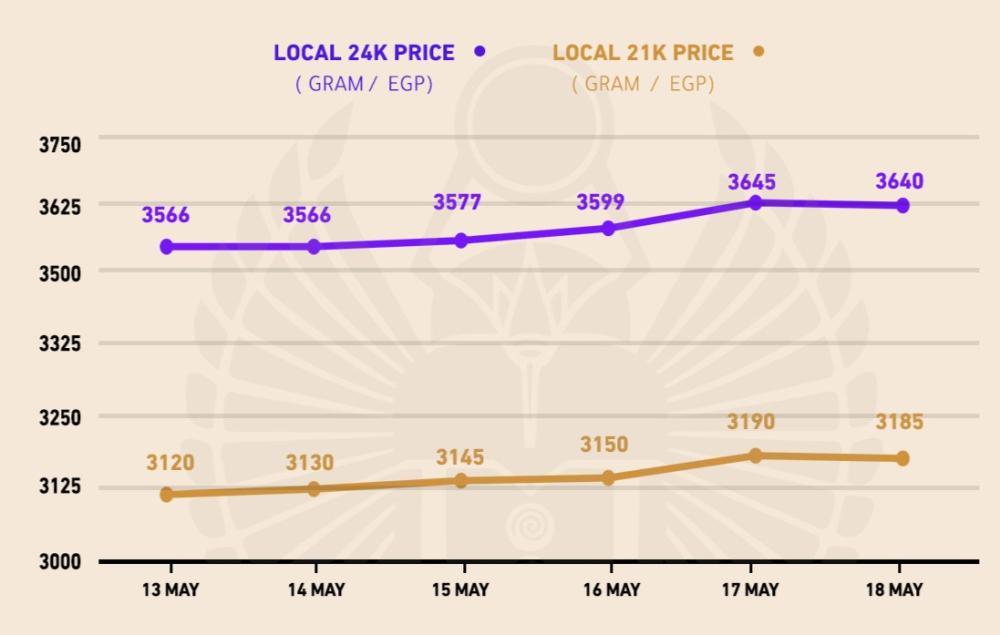

Gold prices in the local market rose relatively, in conjunction with the massive surge in the global stock market during the end-of-week trading, amid the stability of the dollar exchange rate in banks at 46.8 pounds and the movement of supply and demand in the markets.

Local Gold Price:

21-karat gold ended Saturday's trading, the last session of the week in the local market, with the average price of a gram recording 3,180 pounds, up from 3,120 pounds at the beginning of the week. 24-karat gold recorded about 3,646 pounds per gram, compared to 3,566 pounds at the beginning of the week, with calm markets coinciding with the global stock market's weekend break.

Local Silver Price:

The average price of 999 karat silver reached about 45 pounds per gram by the end of Saturday's trading, compared to 43.5 pounds at the beginning of the week, in conjunction with the surge in global stock market prices.

Local Price Expectations

Short Term:

The Dahab Masr research team expects a slight increase in local gold prices in conjunction with the rise in global prices on the stock exchange. However, prices might decline relatively if the global price corrects downward and the dollar continues to depreciate in banks. Supply, demand, and geopolitical risks remain the decisive factors in confirming price trends.

Long Term:

Local prices are likely to rise if the global price surpasses the $2,500 mark, coinciding with the potential start of interest rate cuts by the US Federal Reserve in the second half of the year.

Disclaimer:

This document presents an analysis prepared by the Research and Analysis Department of Dahab Masr, based on data obtained from several highly credible sources. However, Dahab Masr does not guarantee the accuracy of this information and data as it is not responsible for their preparation or collection, and therefore, Dahab Masr does not assume responsibility for any direct or indirect damages or losses that may result from reliance on the content herein. The use of this analysis and any decisions arising from it are solely the responsibility of the reader. Dahab Masr also recommends that readers consult a professional financial advisor before making any investment decisions.

عربي

عربي