Weekly Gold Analysis - Third Week of May 2024

- Home

- Information Center by DahabMasr

- Weekly Gold Analysis - Third Week of May 2024

Weekly Gold Analysis - Third Week of May 2024

Corrective Wave or Adverse Winds?

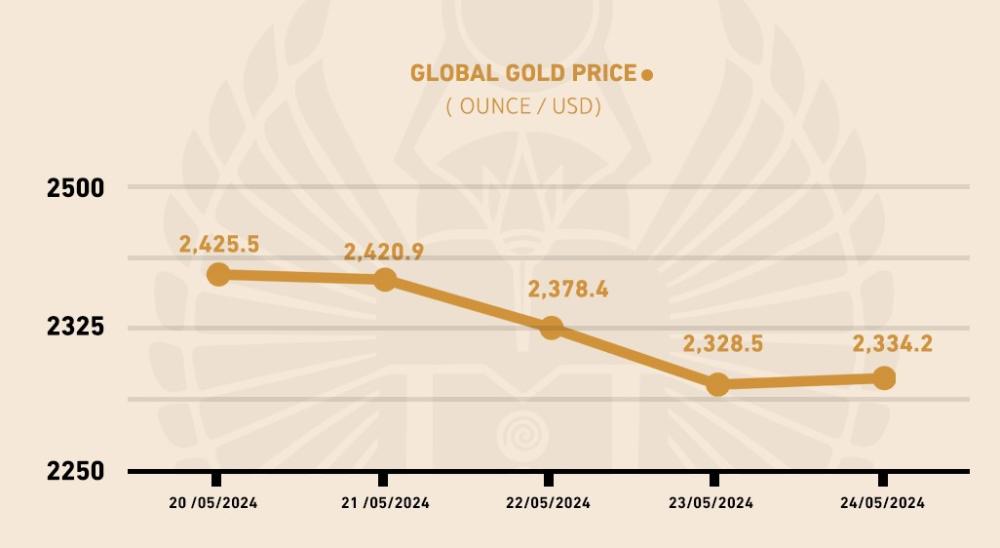

Global gold prices faced sharp losses of about $80 by the end of the week's trading following the release of the Federal Open Market Committee minutes on Wednesday evening, which negatively impacted the yellow metal. This initiated a massive corrective wave after it had reached $2,450 per ounce at the beginning of the week, following the crash incident involving the Iranian president, which might indicate political instability in the Middle East.

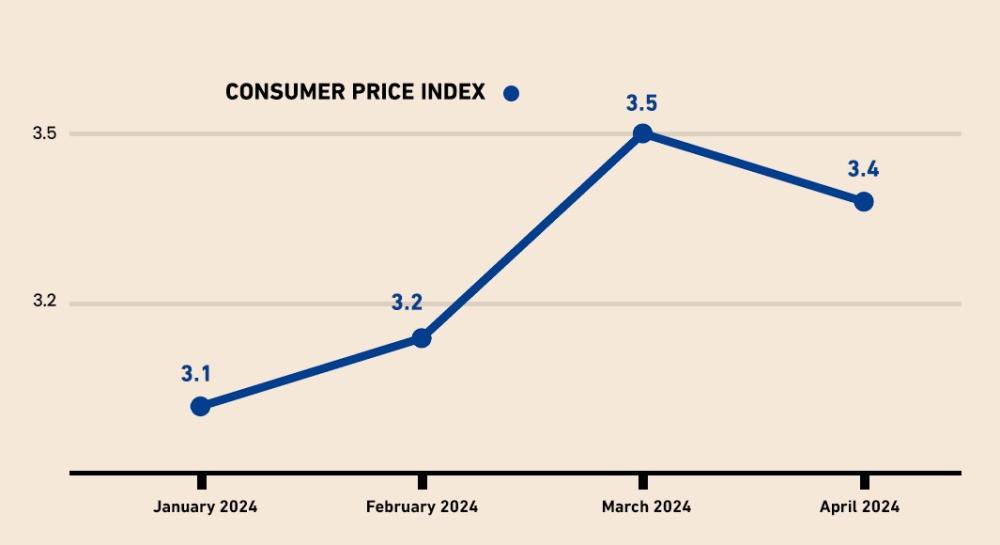

The minutes revealed policymakers' concerns about prolonged inflationary pressures with uncertainty about when to start lowering interest rates. The committee members noted no progress toward the targeted inflation rate of 2% since the beginning of the year. The Consumer Price Index, the Fed's preferred inflation measure, recorded 3.4% in April compared to 3.5%, 3.2%, and 3.1% in the first three months of the year.

On the other hand: Data released by the Indian central bank last Thursday showed a jump in the bank's gold purchases during the first four months of the year by about 24 tons, compared to a total of 16 tons in 2023. This is an attempt to diversify strategic reserves to hedge against fluctuations amid geopolitical tensions and a slowing global economy. This has led to an increasing trend of gold moving from the West to the East, especially to emerging markets.

In this context, the latest data from the World Gold Council report reflects the difference in investment behavior between the West and the East. There is a contrast between profit-taking from outflows of gold ETFs by Western investors in America and Europe and the increasing demand for the precious metal in Asia, particularly in China and India.

Diversification in reserves has become a common factor among central banks, with the United States increasingly using the "dollar as a reserve currency" as a weapon of foreign policy. As a result, many countries have chosen to reduce their dollar holdings.

The International Monetary Fund welcomed Zimbabwe's introduction of a new gold-backed currency, ZiG, last month as a positive step accompanied by many supplementary changes, including monetary policy measures, exchange rates, and fiscal policy. The IMF pledged to send a team in late June to conduct an economic health check in the country.

Global Gold Price

Spot gold contracts on the New York Stock Exchange closed down about $6 to record $2,334.2 per ounce, compared to $2,414.6 last week. June futures contracts also fell to $2,334.5 per ounce by the end of Friday's trading.

The Dollar Index

which measures the dollar's performance against a basket of six major currencies, ended the week lower, recording 104.8 points compared to last week's close at 104.5 points. Two-year bond yields, which are most sensitive to changes in monetary policy, recorded 4.96%.

Global Banks Forecasts

Commerzbank: $2,300 in the second half of the year

Citi: $3,000 over the next 12 months

UBS: $2,600 by the end of 2024

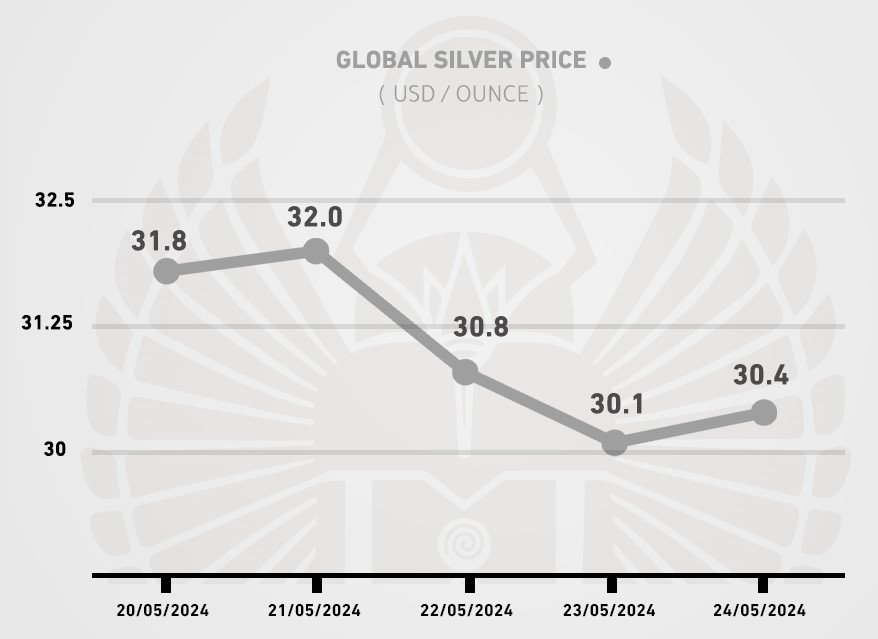

Global Silver Price

Silver gained buying momentum during the week's trading, reaching a new peak at $32 before retreating slightly but remaining above $30, driven by increasing positive expectations for the upcoming period. Commerzbank raised its silver price forecast for this year to $30 and next year to $32.

Spot silver contracts rose by 0.7% to close at $30.3 per ounce compared to $31.4 last week. July delivery contracts recorded about $30.5 per ounce by the end of the weekly trading.

Local Market Drivers

Gold prices in the local market declined in conjunction with the sharp drop in the global exchange at the end of the week's trading, despite a slight increase in the exchange rate of the dollar in banks to 47.1 pounds.

The Central Bank of Egypt decided in its meeting held on Thursday to keep interest rates unchanged at 27.25% and 28.25% for deposit and lending.

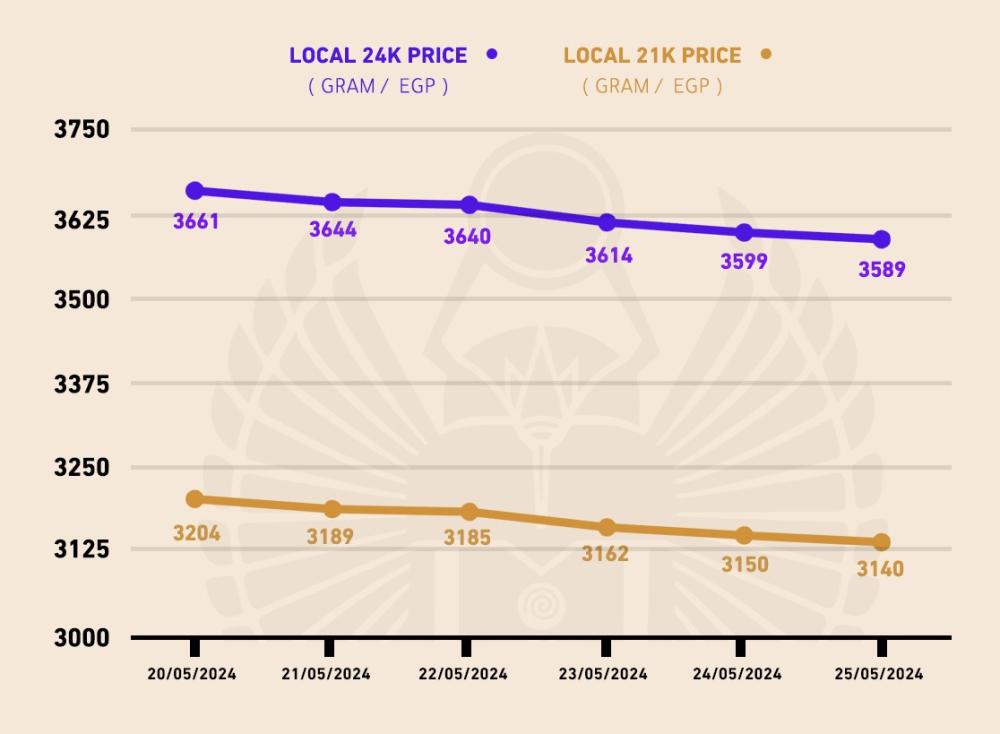

Local Gold Price

21 carat: Closed Saturday's last session of the week in the local market with an average price of 3,140 pounds per gram, down from 3,204 pounds at the beginning of the week.

24 carat: Recorded about 3,599 pounds per gram compared to 3,661 pounds at the beginning of the week, as markets calmed in conjunction with the global exchange's weekend break.

Local Silver Price

The average price of 999 silver reached about 48 pounds per gram at the end of Saturday's trading compared to 47 pounds at the beginning of the week, coinciding with the rise in global prices on the exchange.

Data Sources:

Trading Economics

Reuters

Bloomberg

Fxstreet

Metals Daily

New Zimbabwe

Central Bank Of Egypt

Disclaimer:

This document presents an analysis prepared by the Research and Analysis Department of Dahab Masr, based on data obtained from several highly credible sources. However, Dahab Masr does not guarantee the accuracy of this information and data as it is not responsible for their preparation or collection, and therefore, Dahab Masr does not assume responsibility for any direct or indirect damages or losses that may result from reliance on the content herein. The use of this analysis and any decisions arising from it are solely the responsibility of the reader. Dahab Masr also recommends that readers consult a professional financial advisor before making any investment decisions.

عربي

عربي