Silver's Outstanding Performance in 2024: Factors Driving the Surge and Future Projections

- Home

- Information Center by DahabMasr

- Silver's Outstanding Performance in 2024: Factors Driving the Surge and Future Projections

Silver's Outstanding Performance in 2024: Factors Driving the Surge and Future Projections

The Year of Silver

With silver reaching $30 for the second time in the first half of 2024, it has joined the list of best-performing metals this year. It hit record levels, breaking $32 for the first time since 2020 during trading on May 20, with positive forecasts continuing for the upcoming period.

What is driving the rise in silver?

The rise in silver is supported by several factors:

- Increased investor appetite

- Gradual improvement in the global economy

- Growing demand for solar panels, leading to a potential supply shortage for the fourth consecutive year

- Decline in silver bullion stocks in April at the London, New York, and Shanghai exchanges, as reported by Bloomberg.

China conquers the global silver market

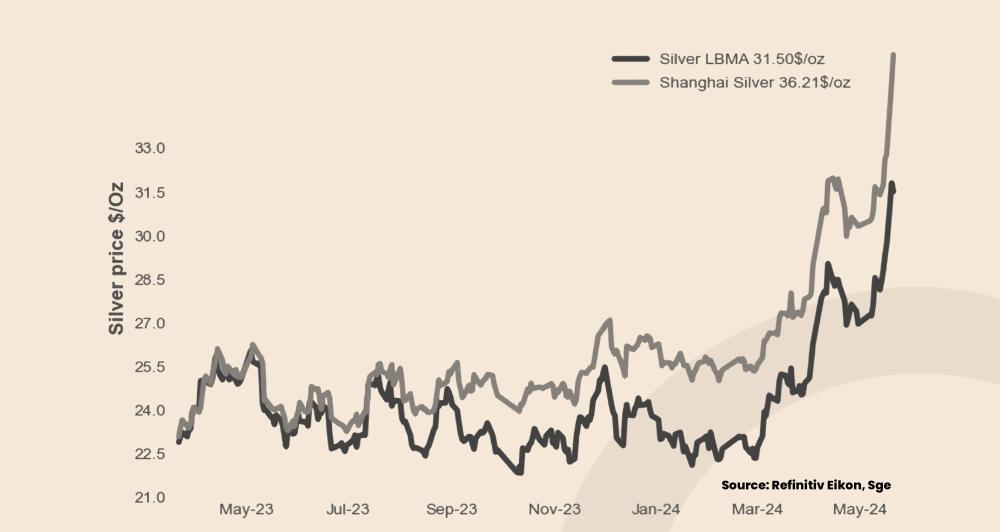

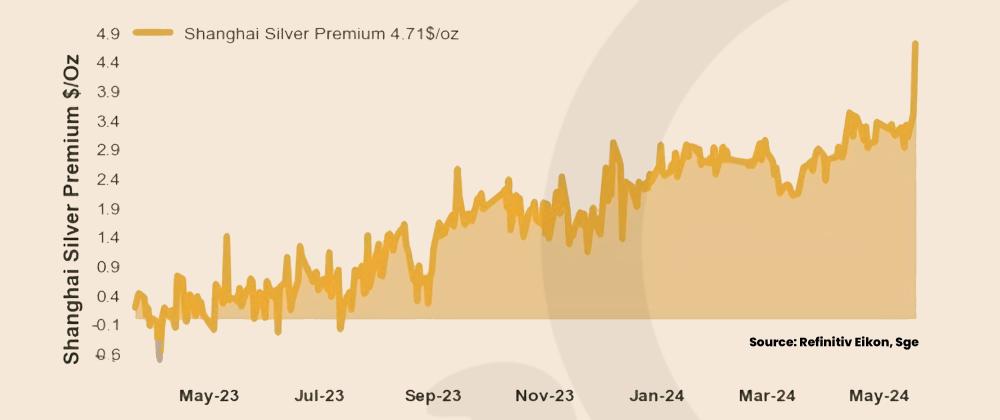

Silver prices in China continue to break records, reaching $36.2 per ounce compared to $31.5 on the London exchange. This discrepancy encourages more buying from the markets, negatively impacting global supplies. Trading volume in silver contracts peaked on the Shanghai Futures Exchange (SHFE), prompting Chinese authorities to raise the price premium to $4.7 per ounce to calm speculations.

Market reactions

Breaching and maintaining the precious metal above $30 could stimulate buying activity from exchange-traded funds (ETFs), increasing pressure on silver, according to an analyst at TD Securities.

Two sides of the same coin

The common factors driving gains in both gold and silver include:

- Investor concerns over ongoing inflationary pressures

- Global debt burdens

- High-interest rates

- Economic uncertainty leading to more diversified investments.

Silver garners attention from both investors and manufacturers due to its dual importance as a precious metal and financial asset for investment, as well as an industrial metal used in various sectors supporting the transition to a green economy, such as solar cells, electric vehicle batteries, and AI applications.

Where are silver prices heading?

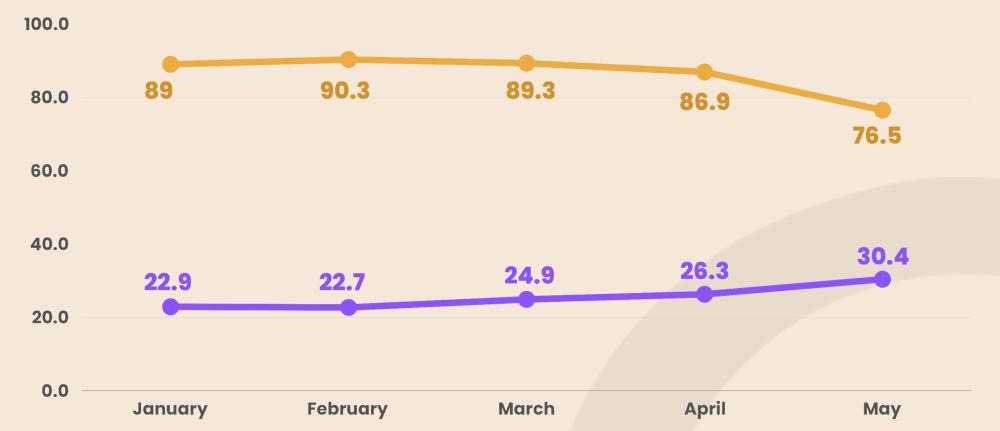

Silver prices have jumped 32% since the beginning of the year compared to a 16% increase in gold prices. This rise has brought the "gold to silver ratio" closer to its 20-year average of 68 points. The ratio was 76.5 points at the end of last week, compared to 86.3 in early January.

What lies ahead for silver?

- Short term: Prices stabilizing above $30 with continued buying momentum from investors and manufacturers, or facing a corrective wave below $30 per ounce if economic growth slows and the dollar's upward momentum continues.

- Long term: Developments in the global economy and US monetary policy in response to current geopolitical events could push the metal above $35 per ounce.

Price forecasts for the second half of the year:

- Citi Bank: $32

- MarketGauge: $35-$40

- FX Pro: $50

- UBS: $36

Data Sources:

www.silverinstitute.org

www.kitco.com

www.bloomberg.com

nvidianews.nvidia.com

goldbroker.com

Disclaimer:

This document presents an analysis prepared by the Research and Analysis Department of Dahab Masr, based on data obtained from several highly credible sources. However, Dahab Masr does not guarantee the accuracy of this information and data as it is not responsible for their preparation or collection, and therefore, Dahab Masr does not assume responsibility for any direct or indirect damages or losses that may result from reliance on the content herein. The use of this analysis and any decisions arising from it are solely the responsibility of the reader. Dahab Masr also recommends that readers consult a professional financial advisor before making any investment decisions.

عربي

عربي