The Impact of Monetary Tightening Policies on Gold Prices: A Vision for 2023

- Home

- Information Center by DahabMasr

- The Impact of Monetary Tightening Policies on Gold Prices: A Vision for 2023

The Impact of Monetary Tightening Policies on Gold Prices: A Vision for 2023

Aug 8, 2023

By

Dahab Masr analysis team

0 comment(s)

As we transition to the second half of 2023, questions abound and the global financial community's opinions and speculations vary regarding the potential direction of gold prices. Analysts and investors are divided on whether gold will bolster its reputation as an economic fortress or whether changes in monetary strategies and the battle against inflation by central banks will diminish its dominance.

Misconceptions:

A- There's a misconception that gold prices might decline as central banks approach the end of their monetary tightening cycles, anticipating a slowdown in emerging markets and a significant decline in the US economy by the end of 2023.

B- On the contrary, when abandoning monetary tightening policies, a major shift in the investment benchmark is expected. Financial conditions might prompt investors to reevaluate their portfolios and increase allocation towards safer and hedging assets like gold. This potential decline in reliance on the US dollar could have long-term effects on global and local gold supply and demand, possibly accelerating the pace of gold price increases in a way that surprises everyone.

Review of Gold's Performance in the First Half of 2023:

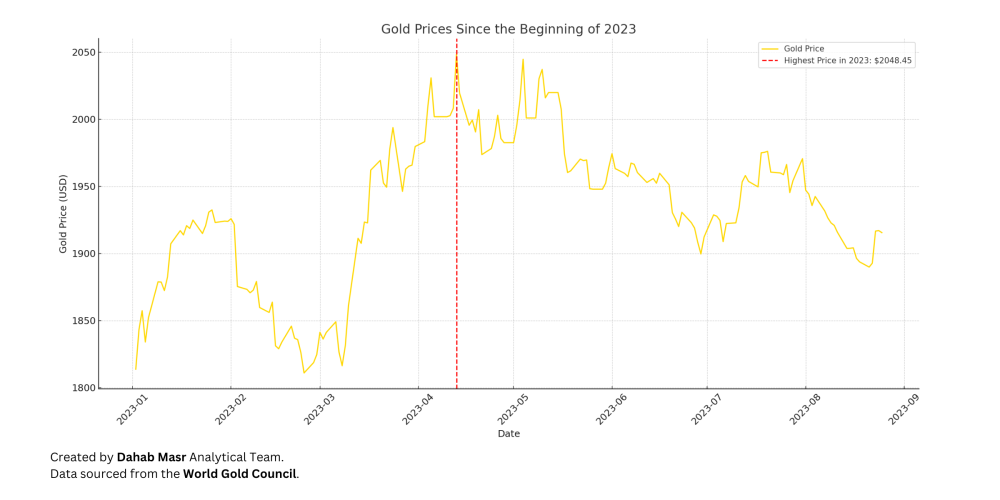

A- Our experts closely monitored global gold movements in the first half of 2023, which showcased its reliability as a trusted investment asset and safe haven. It witnessed a strong increase of 6.49%, with the global price reaching $2048.45 per ounce on April 13, 2023. These figures underscored gold's distinction from other investment assets, unlike the yields of US treasury bonds which remained relatively stable during the first half of the year compared to the previous year 2022, stabilizing gold prices both locally and globally according to the World Gold Council.

B- It is also unlikely that gold will fall below the ranges traded during the first half of this year, especially if bond yields maintain this stability. This suggests a strong investment demand for gold by the end of 2023, especially if a new economic crisis occurs, directly or indirectly related to current geopolitical conflicts, such as the crisis the banking sector witnessed in March this

Return Data and Forecasts:

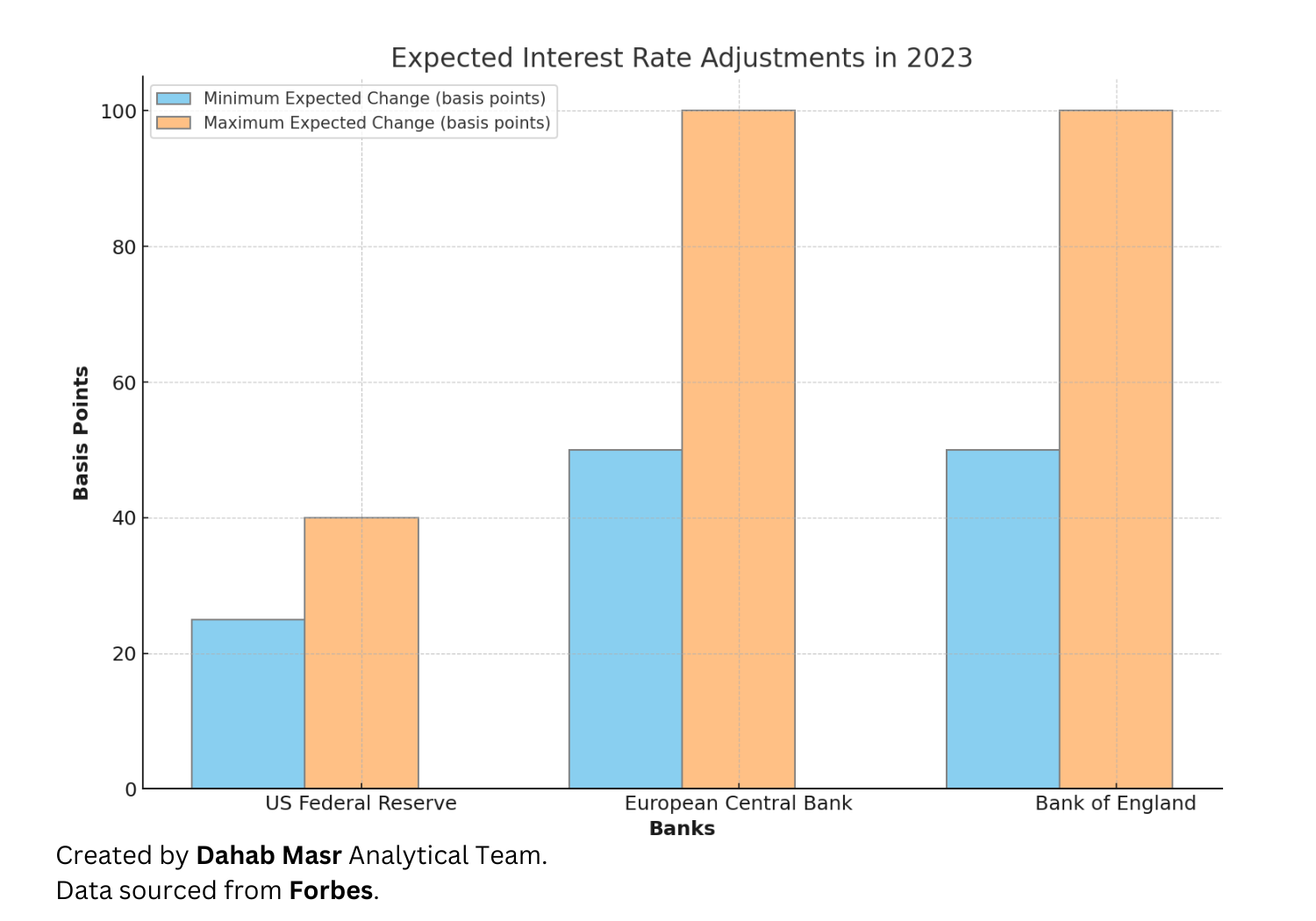

A- Based on forecasts and reports available until June 30th of the current year, market expectations were that monetary policymakers, led by the US Federal Reserve, would continue to raise interest rates until the end of the year. However, this trend is unlikely to persist due to concerns surrounding the potential pressures global economies might face due to this tightening. Therefore, monetary policymakers tend to stabilize interest rates and alleviate monetary tightening policies sooner or later.

B- The US Federal Reserve is expected to raise interest rates by between 25 to 40 basis points, the European Central Bank, and the Bank of England by 50 to 100 basis points respectively. The European Central Bank and the Bank of England already raised interest rates last month, but the Federal Reserve kept the interest rate unchanged, based on the performance of economic indicators.

C- Meanwhile, the Federal Reserve's policy shifted from a tightening stance to a wait-and-watch approach, aiming to assess the impact of previous tightening measures on the economy and the performance of economic indicators. This approach is necessary for more guided decisions and to avoid economic downturns. Some figures indicate a notable slowdown in the US economic growth this year, necessitating cautious evaluation before any decision.

Impact of Economic Slowdown:

Some figures indicate a noticeable slowdown in the US economic growth this year. If predictions of the economy not being able to handle more monetary tightening come true, gold will be supported until the end of 2023, especially when reviewing its performance in the first half of the year.

Having recently undergone three consecutive Federal interest rate cuts, gold achieved an average monthly return of 0.7% - equivalent to 8.4% annually. This fact, always confirmed by gold, suggests that in the event of increased risks of economic recession, gold investments experience significant optimism.

Main Factors Affecting Gold Price:

Economically, it's accepted: that monetary tightening policies create barriers to the rise of gold prices and make it decline. Also, when investments are withdrawn from gold-specialized funds, gold also loses some support and declines. However, gold trading in the first half of the current year proved that every rule has exceptions.

- According to the 'London Bullion Market Association' (LBMA) report, the ounce price traded at an average of $1932 in the first half of 2023. Therefore, for the gold price in the second half of the current year to trade at an average lower than the 2022 average of $1800 per ounce, it would need to trade at an average of $1668 per ounce.

However, this sharp decline in the second half of 2023 is unlikely and highly improbable, especially considering gold prices in the first half of 2023, which were trading at $2048.45 per ounce amid monetary tightening policies and the strength of the US dollar.

A Glimpse into the Future:

If the US, as expected, starts cutting interest rates, gold is likely to experience a period of strength and recovery in the second half of the year, albeit less intensely than the first half.

In the event this scenario materializes, gold will find support amid a weakening US dollar. History serves as a strong indicator, as mentioned at the beginning of the report, where monetary policy stabilization tends to achieve short- and long-term gains for gold. If the opposite occurs and interest rate hikes continue, gold is expected to maintain its current levels until interest rates are stabilized or reduced.

عربي

عربي