Information Center by DahabMasr

- Home

- Information Center by DahabMasr

Gold and silver prices delivered historic gains in 2025

with gold rising over 60% and silver surging more than 145%, supported by U.S. rate cuts, strong central bank buying, and rising geopolitical risks. Locally, Egypt’s 21K gold reached record levels, driven by global momentum and sustained investment demand.

Gold and Silver Price Analysis – Week 2 of December 2025

Gold advanced during the second week of December 2025, reaching $4,353 before stabilizing near $4,299, while silver hit new highs at $64.65 amid tight supply and strong industrial demand. Locally, Egypt’s 21K gold rose above EGP 5,700, supported by global momentum and stable exchange rates.

Gold & Silver Price Analysis – Week 1 of December 2025

Gold declined slightly by 0.5% during the first week of December 2025, closing at $4,170, while silver surged to a new high of $59.33 (+3.4%). Locally, Egypt’s 21K gold remained stable around EGP 5,636, supported by a weaker dollar and strong expectations of a Federal Reserve rate cut

Silver & Gold Price Analysis for November 2025

Dec 2, 2025

Gold & Silver Price Analysis – November 2025

Gold and silver prices in November 2025 saw strong upward momentum, with gold hitting $4,245 and silver reaching new highs near $56.37. Locally, Egypt’s 21K gold surpassed EGP 5,700, supported by rising investment demand, central bank purchases, and declining U.S. yields.

Gold and Silver Price Analysis – Week 3 of November 2025

Gold and silver prices in the third week of November 2025 showed mild pressure as global gold closed at $4,064 (-0.44%) amid Federal Reserve uncertainty and weaker Chinese demand. Locally, Egypt’s 21K gold stabilized near EGP 5,500, supported by strong investment demand and growing ETF inflows.

Gold and Silver Price Analysis – Week 2 of November 2025

Gold fluctuated between $4,082 and $4,240 before closing near $4,100 amid fading expectations of a U.S. rate cut. Silver moved between $50.52 and $54.36 due to tight supply and profit-taking. Locally, Egypt’s 21-karat gold remained steady at 5,470–5,500 EGP, supported by currency stability.

Gold & Silver Price Analysis – Week 1 of November 2025

Gold prices remained steady around $4,000/oz (-0.06%), balancing between weak U.S. data and rising rate-cut expectations. Silver slipped 0.68% to $48.32/oz. In Egypt, 21K gold stood at EGP 5,371, reflecting global market volatility and continued institutional flows into safe-haven assets.

Silver & Gold Price Analysis for October 2025

Nov 4, 2025

Gold & Silver Price Analysis – October 2025

Gold surged to record highs in October 2025, peaking at $4,381/oz (+3.7%), while silver closed at $48.65/oz. In Egypt, 21K gold rose to EGP 5,931 per gram, supported by strong central bank demand, a weaker U.S. dollar, and ongoing trade tensions between the U.S. and China.

Dahab Masr Research Team

gold

silver

gold price

silver prices

investing in gold

October 2025

0 comment(s)

Silver & Gold Price Analysis – Week 4 of October 2025

Oct 28, 2025

Gold Price Analysis for Week 4 – October 2025

Gold ended its nine-week rally, falling 3.28% to $4,111/oz, while silver dropped 6.24% to $48.62/oz in the fourth week of October 2025. The decline followed profit-taking and improved risk appetite amid signs of easing U.S.–China trade tensions.

Dahab Masr Research Team

gold

silver

gold price

silver prices

investing in gold

October 2025

0 comment(s)

Silver & Gold Price Analysis – Week 3 of October 2025

Oct 21, 2025

Gold Price Analysis for Week 3 – October 2025

Gold and silver prices posted strong gains for the ninth consecutive week, supported by central bank purchases and rising geopolitical tensions. Gold reached record highs near $4,380 per ounce before retreating to $4,251, while silver climbed to $54.47 per ounce

Dahab Masr Research Team

gold

silver

gold price

silver prices

investing in gold

October 2025

0 comment(s)

Silver & Gold Price Analysis – Week 2 of October 2025

Oct 14, 2025

Gold Price Analysis for Week 2 – October 2025

Gold hit a new record high, closing at $4,049/oz (+4.2%), while silver climbed to $51.24/oz (+4.1%). In Egypt, 21K gold rose to EGP 5,476 per gram, supported by global safe-haven demand, central bank buying, and expectations of U.S. rate cuts.

Gold & Silver Price Analysis for October 2025

Gold prices rose 3.4% this week to around $3,888 per ounce amid strong safe-haven demand and expectations of U.S. rate cuts. In Egypt, 21K gold reached EGP 5,236 per gram, supported by global momentum and local currency weakness.

Silver & Gold Price Analysis for September 2025

Oct 1, 2025

Gold and Silver Prices Analysis – September 2025

Gold rose 11.33% in September 2025, reaching $3,871/oz, while silver surged 16% to $47.17. The rally was fueled by the Fed’s rate cut, weaker dollar, and geopolitical tensions.

Dahab Masr Earns RJC Certification

Dahab Masr has become the first company in Egypt and North Africa to receive Responsible Jewellery Council (RJC) certification, after successfully passing an independent audit in accordance with the 2019 Code of Practices.

Dahab Masr Research Team

gold

silver

gold price

silver prices

investing in gold

September 2025

0 comment(s)

Silver & Gold Price Analysis – Week 3, September 2025

Sep 24, 2025

Gold Price Analysis for Week 3 – September 2025

Gold and silver prices posted strong global gains for the fifth consecutive week, supported by the Fed’s rate cut and a weaker USD. In Egypt, 21K gold reached around EGP 4,991, near record highs. Geopolitical tensions and safe-haven demand continued to drive the market.

Dahab Masr Research Team

gold

silver

gold price

silver prices

investing in gold

September 2025

0 comment(s)

Silver Price Analysis for September 2025 with Forecasts up to 2029

Sep 16, 2025

Silver Price Analysis – September 2025 with Forecasts up to 2029

In September 2025, silver prices jumped 42% YTD, surpassing $41/oz – the highest in 14 years. In Egypt, prices climbed from EGP 52 to EGP 65.25 per gram. Fed rate cut expectations, dollar weakness, and strong industrial demand drove the rally, with bullish forecasts extending to 2029.

Dahab Masr Research Team

gold

silver

gold price

silver prices

investing in gold

September 2025

0 comment(s)

Silver & Gold Price Analysis for Week 2 – September 2025

Sep 16, 2025

Gold Price Analysis for Week 2 – September 2025

Gold prices climbed for a fourth straight week, closing at $3,643/oz (+1.6%), while silver finished at $42.17/oz (+2.94%). In Egypt, 21K rose to EGP 4,946/gram. Drivers: rising odds of a Fed rate cut, softer U.S. data, and renewed ETF inflows supporting gold price momentum.

Gold & Silver Price Analysis for September 2025

In the first week, the gold price advanced, closing near $3,586/oz after touching a new high at $3,600; Egypt’s 21K traded around EGP 4,896/gram. The gold prices movement was driven by weak U.S. jobs data, rising Fed cut expectations, a tariff exemption on gold imports, USD softness, and geopolitical risks.

Silver & Gold Price Analysis for August 2025

Sep 3, 2025

Gold Price Analysis for August 2025

Gold surged strongly at the end of August, reaching a high of $3,454.06 per ounce, while 21-karat gold in Egypt hit 4,711 EGP per gram. This rally was supported by concerns over tariffs and a weaker U.S. dollar, in addition to signals from Fed Chair Powell about a potential interest rate cut.

Dahab Masr Research Team

Gold Price Today

Weekly Gold Analysis

Gold Price Forecast 2025

0 comment(s)

Gold Price Analysis – Third Week of August 2025

Aug 26, 2025

Gold Price Analysis – Third Week of August 2025

A weekly analysis of gold and silver price movements, with gold closing at $3,371 per ounce and Egypt’s 21K at 4,606 EGP per gram. Prices were driven by US rate-cut expectations, Jerome Powell’s Jackson Hole speech, and dollar weakness.

Dahab Masr Research Team

Gold Price Today

Weekly Gold Analysis

Gold Price Forecast 2025

0 comment(s)

Gold Price Analysis Second Week of August 2025

Aug 21, 2025

Gold Price Analysis in the Second Week of August 2025

A weekly analysis highlighting gold and silver price movements, with gold stabilizing near $3,335 per ounce and 21K at 4,626 EGP per gram in Egypt. Prices were influenced by US inflation data and expectations of an interest rate cut, alongside central bank actions and geopolitical developments.

Gold Price and Performance Analysis – Q2 2025

Jul 21, 2025

Gold Price Movement Analysis – Q2 2025

The Gold Price and Performance Analysis – Q2 2025 explores the key economic and geopolitical factors that pushed prices beyond $3,500 per ounce, before stabilizing around $3,300 by the end of June. The analysis monitors U.S. Federal Reserve decisions, global market trends, and the classification of gold as a high-quality Tier 1 asset under Basel III regulations—offering investors a clear outlook on market trends for the second half of the year.

تحـليـل الذهب والفضة من 7 إلى 13 يوليو 2025

Jul 13, 2025

تحليل الذهب – 13 يوليو 2025

شهد سوق الذهب العالمي استقرارًا نسبيًا خلال الأسبوع الثاني من يوليو 2025، حيث تراوح السعر بين 3,297 و3,355 دولارًا للأونصة، مدعومًا بتصاعد التوترات التجارية بين الولايات المتحدة ودول مثل كندا والبرازيل، إلى جانب استمرار التوترات الجيوسياسية في الشرق الأوسط بين إيران وإسرائيل. ساهم تراجع الدولار الأمريكي وتوقعات خفض الفائدة الأمريكية في زيادة الطلب على الذهب كملاذ آمن. محليًا، ارتفع سعر جرام الذهب عيار 21 من 4,636 جنيهًا إلى 4,682 جنيهًا، فيما تراوح سعر الفضة بين 59.5 و62 جنيهًا.

Monthly Gold Analysis – June 2025

Jul 10, 2025

Gold Analysis – June 2025

This report highlights the key economic and geopolitical developments that influenced gold prices in June, with the yellow metal maintaining its strength above $3,300 per ounce despite sharp market fluctuations.

It covers the impact of the Iran–Israel war, decisions by central banks such as the U.S. Federal Reserve and the Swiss National Bank, and the U.S.–China trade agreement—providing investors with a clear analytical view to support informed decision-making.

Monthly Gold Analysis – May 2025

Jun 13, 2025

Gold Analysis – May 2025

The analysis highlights the most significant economic and geopolitical developments that impacted gold prices in May 2025, with gold maintaining levels above $3,200 per ounce, supported by rising demand and escalating global tensions.

It also covers central bank decisions, the downgrade of the U.S. credit rating, and Federal Reserve interest rate expectations—helping investors understand market movements and make informed decisions based on clear analytical insights.

Dahab Masr Research & Market Insights Team

الذهب، التوقعات الاقتصادية، التضخم وأسعار الفائدة، التجارة العالمية

0 comment(s)

2025 تحليل الذهب الشهري - أبريل

May 12, 2025

مازالت سجلات المعدن الأصفر مليئة بالأرقام القياسية في أبريل مع صعوده إلى مستوى 3500 دولار للأونصة، نتيجة تفضيل المستثمرين حيازته بدلا من الدولار والسندات الأمريكية اللذان أصبحا من الأصول الخطرة في ظل تراجع الثقة في الاقتصاد الأمريكي; حيث أصبح الذهب يرتفع نتيجة تحول استراتيجي في هيكل النظام المالي العالمي ليلعب دوره الكلاسيكي في حفظ القيمة و الحماية من التضخم بالتزامن مع انخفاض القوة الشرائية للدولار.

Dahab Masr Research & Market Insights Team

الذهب، التوقعات الاقتصادية، التضخم وأسعار الفائدة، التجارة العالمية

0 comment(s)

2025 تحليل الذهب للربع الاول

May 4, 2025

امتاز هذا العام بسيناريو "التوقيت غير المتوقع للتذبذب"; إذ حقق المعدن الأصفر أداء استثنائي خلال الربع الأول ليصعد بنسبة 19.8% منذ بداية 2025 مقارنة بـ 27% في العام الماضي بأكمله.

Dahab Masr Research & Market Insights Team

الذهب، التوقعات الاقتصادية، التضخم وأسعار الفائدة، التجارة العالمية

0 comment(s)

2025 تحليل الذهب الشهري - مارس

Apr 8, 2025

يواصل المعدن الأصفر تسجيل القمم ليبدأ مستوى سعري جديد أعلى 3100 دولار حيث عززت حالة عدم اليقين بشأن نطاق الرسوم الجمركية الحالية و المرتقبة، من جاذبية الذهب كأداءة تحوط ضد تقلبات السوق

أيضًا استفاد الأصل الدفاعي من تجدد التوترات الجيوسياسية والتوقعات بخفض أسعار الفائدة الأمريكية في النصف الثاني من العام; وسط مخاوف ضبابية أفاق النمو الاقتصادي

أيضًا استفاد الأصل الدفاعي من تجدد التوترات الجيوسياسية والتوقعات بخفض أسعار الفائدة الأمريكية في النصف الثاني من العام; وسط مخاوف ضبابية أفاق النمو الاقتصادي

الذهب يلتفت إلى عوامل أخرى

Mar 12, 2025

شهد الذهب ارتفاعًا تاريخيًا في فبراير، مسجلًا 2955 دولارًا للأونصة، مستفيدًا من حالة عدم اليقين الاقتصادي والتوترات الجيوسياسية. سياسة ترامب التجارية الصارمة، بجانب ارتفاع احتياطات الذهب لدى الصين، عززت الطلب عليه كملاذ آمن. زادت شحنات الذهب إلى الولايات المتحدة، فيما ارتفعت حيازات صناديق الذهب المتداولة عالميًا. توقعات البنوك الكبرى لعام 2025 تشير إلى تجاوز حاجز 3000 دولار للأونصة. مع ترقب الأسواق لقرار الكونجرس حول سقف الدين الأمريكي والتطورات في غزة وأوكرانيا، يظل الذهب في دائرة الضوء كأحد الأصول الأكثر تأثيرًا في الأسواق العالمية.

Dahab Masr Research & Market Insights Team

الذهب، التوقعات الاقتصادية، التضخم وأسعار الفائدة، التجارة العالمية

0 comment(s)

تحليل يناير 2025 و توقعات اسعار الذهب الفترة المقبلة

Feb 12, 2025

تحليل يناير 2025 و توقعات اسعار الذهب الفترة المقبلة

شهد شهر يناير 2025 ارتفاعًا في أسعار الذهب بنسبة 7.4%، مسجلاً قمة جديدة عند 2817 دولارًا للأونصة. يعكس التقرير تأثير العوامل الاقتصادية مثل التضخم، التعريفات الجمركية، والتوترات الجيوسياسية على السوق، مع تقديم تحليل شامل للاتجاهات المستقبلية. اقرأ المزيد للاطلاع على تفاصيل الأداء وأهم التوقعات للأسابيع المقبلة.

Dahab Masr Research & Market Insights Team

أسعار الذهب

توقعات الذهب

السياسة النقدية

الركود الاقتصادي

0 comment(s)

تحليل الذهب لعام 2024: تحليل الأداء والاتجاهات المستقبلية

Feb 5, 2025

أداء الذهب في 2024: قفزات تاريخية وتوقعات 2025

.شهد عام 2024 ارتفاعًا تاريخيًا في أسعار الذهب وسط حالة من عدم اليقين العالمي، حيث وصل الذهب إلى قمم غير مسبوقة بفعل قرارات البنوك المركزية والمخاطر الجيوسياسية. كيف تأثر السوق، وما هي التوقعات للربع الأول من 2025؟ تعرف على التفاصيل كاملة في تقريرنا السنوي

Dahab Masr Research & Market Insights Team

الذهب

أسعار الذهب

تقرير الذهب ديسمبر

السوق المصرية

الاستثمار في الذهب

0 comment(s)

تحليل الذهب ديسمبر 2024

Jan 10, 2025

تحليل الذهب ديسمبر 2024: الأداء والتوقعات المستقبلية

تحليل الذهب ديسمبر 2024 يستعرض أداء الذهب وأسعاره عالميًا وفي السوق المصرية، بما في ذلك سعر عيار 21 وسعر الدولار بالبنك المركزي. يناقش التقرير تأثير قرارات البنوك المركزية مثل الفيدرالي الأمريكي والبنك الأوروبي، بجانب الأحداث الاقتصادية والجيوسياسية مثل أزمة الديون الأمريكية والسياسات النقدية الصينية. كما يقدم نظرة مستقبلية على توقعات الربع الأول من 2025 وتأثيراتها على أسواق المعدن الأصفر.

Dahab Masr Research & Market Insights Team

Gold market analysis

Precious metals trends

Gold price forecast

December gold insights

Investment in gold

Silver

0 comment(s)

تحليل شامل لأسعار الذهب والفضة خلال الأسبوعين الأول والثاني من ديسمبر 2024

Dec 18, 2024

استقر الذهب عند مستوى 2650 دولارًا للأونصة منذ بداية ديسمبر 2024، رغم ارتفاع الدولار والعملات المشفرة. التحليل يوضح تأثير أحداث جيوسياسية كعدم الاستقرار في الشرق الأوسط وكوريا الجنوبية، ومشتريات الذهب الصينية والروسية

Dahab Masr Research & Market Insights Team

Gold market analysis

Precious metals trends

Gold price forecast

November gold insights

Investment in gold

0 comment(s)

تحليل أداء الذهب لشهر نوفمبر: الذهب يبحث عن اتجاه

Dec 3, 2024

شهدت أسعار الذهب خلال نوفمبر 2024 تقلبات ملحوظة نتيجة التوترات الجيوسياسية والاقتصادية. تصاعد التوتر بين الصين وتايوان، وارتفاع الديون الأمريكية، والسياسات النقدية للفيدرالي الأمريكي كانت من أبرز العوامل المؤثرة. كما عززت الحروب التجارية والتوترات السياسية في أوروبا مكانة الذهب كملاذ آمن. يقدم تحليل "ذهب مصر" نظرة شاملة على أداء السوق والعوامل المؤثرة، مع توقعات إيجابية باستمرار ارتفاع الأسعار خلال الفترة المقبلة.

Dahab Masr Research & Market Insights Team

أسعار الذهب

أسعار الفضة

تحليل الذهب

توقعات الذهب

Dahab Masr

Precious Metals

0 comment(s)

تقرير تحليل الذهب والفضة للأسبوع الأول والثاني من نوفمبر 2024

Nov 20, 2024

شهد الذهب تقلبات ملحوظة خلال الأسبوعين الأول والثاني من نوفمبر 2024 بسبب تأثير نتائج الانتخابات الأمريكية وارتفاع عوائد السندات. مع تزايد الإقبال على العملات المشفرة والدولار، تعرض الذهب لضغوط هبوطية، لكن صناديق الاستثمار زادت حيازتها للذهب، مما يعزز توقعات صعودية قريبة

Dahab Masr Research & Market Insights Team

تحليل_الذهب

gold_analysis

أسعار_الذهب

gold_prices

استثمار_الذهب

gold_investing

المخاطر_الجيوسياسية

geopolitical_risks

ذهب_مصر

Dahab_Masr

البنوك_المركزية

central_banks

0 comment(s)

تحليل أداء الذهب لشهر أكتوبر: المخاطر الجيوسياسية وزيادة الطلب من البنوك المركزية

Nov 7, 2024

حقق الذهب أداءً ملحوظًا في شهر أكتوبر بدعم من المخاطر الجيوسياسية وعدم اليقين الاقتصادي، مع جهود بريكس لتشكيل نظام مالي جديد. ارتفع الذهب عالميًا إلى 2750 دولارًا للأونصة في نهاية الشهر. وفي مصر، سجل سعر عيار 21 مستوى 3608 جنيه للجرام. تتجه الأسواق نحو مراقبة نتائج الانتخابات الأمريكية وسياسة الفائدة المستقبلية، ما قد يعزز الذهب كملاذ آمن للمستثمرين

Dahab Masr Research & Market Insights Team

gold report

Q3 2024

global gold demand

gold in Egypt

jewelry

bullion

investments

0 comment(s)

ملخص تقرير مجلس الذهب العالمي - أبرز نقاط الربع الثالث 2024

Oct 30, 2024

.استعرض تقرير مجلس الذهب العالمي أبرز تطورات الربع الثالث من عام 2024، حيث شهدت الأسواق العربية، بما فيها مصر، زيادة في الطلب على الذهب، مع تفوق المجوهرات بنسبة 46.5% من إجمالي الاستهلاك. يعرض التقرير التحولات في مشتريات السبائك والمجوهرات، إضافةً لزيادة الطلب الاستثماري على المعدن الأصفر

Dahab Masr Research & Market Insights Team

gold

silver

precious metals

gold price October 2024

silver price October 2024

global gold analysis

Middle East trends

geopolitical analysis

0 comment(s)

تحركات الذهب والفضة في الأسبوع الثالث من أكتوبر 2024

May 27, 2024

.في الأسبوع الثالث من أكتوبر 2024، شهدت أسعار الذهب ارتفاعًا بنسبة 2.7٪ لتخترق حاجز 2700 دولار للأونصة، في ظل تزايد المخاطر الجيوسياسية. كما قفزت أسعار الفضة بنسبة 8٪ لتصل إلى 34 دولار للأونصة. لمتابعة التحليلات الكاملة والتوقعات المستقبلية لأسعار الذهب والفضة، زوروا موقعنا للاطلاع على أحدث البيانات المالية والتحليلات الاقتصادية

Dahab Masr Research & Market Insights Team

gold market

Q3 2024 analysis

gold price trends

inflation impact

central banks

geopolitical risks

precious metals investment

gold forecast

economic outlook

BRICS and gold

gold investment

0 comment(s)

تحركات الذهب في الربع الثالث من 2024

Oct 21, 2024

شهد الربع الثالث من 2024 ارتفاعًا كبيرًا في أسعار الذهب، مدفوعًا بسياسات البنوك المركزية التي زادت من المشتريات، إلى جانب التوترات الجيوسياسية المتزايدة. يقدم هذا التحليل المفصل نظرة عميقة على العوامل المؤثرة، بما في ذلك تأثير التضخم والركود، ويوفر توقعات دقيقة حول ما يمكن أن يشهده سوق الذهب في المستقبل القريب

Dahab Masr Research & Market Insights Team

silver

silver market

silver prices

Q3 2024

silver trends

silver forecast

silver analysis

precious metals

silver investment

global silver market

silver demand

silver opportunities

Dahab Masr

0 comment(s)

تحركات الفضة في الربع الثالث من 2024

Oct 16, 2024

.شهدت الفضة خلال الربع الثالث من 2024 تقلبات كبيرة مع التوقعات بمزيد من الطلب في ظل التيسير النقدي العالمي. ارتفعت الأسعار لتصل إلى 32.7 دولار للأونصة. اطلع على تفاصيل التحليل لمعرفة المزيد عن توقعات السوق

Dahab Masr Research & Market Insights Team

GoldMarket

SilverMarket

Investment

PreciousMetals

GoldPrice

SilverPrice

MarketAnalysis

GeopoliticalRisks

GoldForecast

SilverForecast

EconomicOutlook

0 comment(s)

تحركات الذهب والفضة في الأسبوع الأول من أكتوبر 2024

Oct 8, 2024

.الذهب يكشف الحقيقة دائمًا. مع التقلبات الأخيرة في الأسواق والوظائف الأمريكية، تترقب الأسواق قرارات جديدة قد تؤثر على مسار المعدن الأصفر

Dahab Masr Research & Market Insights Team

gold

silver

precious metals

September 2024

monetary easing

gold price surge

silver price stability

Dahab Masr

gold market analysis

silver market analysis

Federal Reserve

global gold trends

global silver trends

gold forecast 2024

silver forec

0 comment(s)

تحركات الذهب في شهر سبتمبر 2024

Oct 1, 2024

شهد الذهب في سبتمبر 2024 ارتفاعاً ملحوظاً في الأسعار، مدعوماً بالسياسات النقدية الأمريكية وزيادة الطلب العالمي، بالإضافة إلى التوترات الجيوسياسية التي عززت من جاذبية الذهب كاستثمار آمن

Dahab Masr Research & Market Insights Team

gold

silver

precious metals

September 2024

monetary easing

gold price surge

silver price stability

Dahab Masr

gold market analysis

silver market analysis

Federal Reserve

global gold trends

global silver trends

gold forecast 2024

silver forec

0 comment(s)

تحركات الذهب والفضة في الأسبوع الثالث من سبتمبر 2024

Sep 24, 2024

يرصد تحليل ذهب مصر أبرز تحركات أسعار الذهب والفضة خلال الأسبوع الثالث من سبتمبر 2024، حيث شهد الذهب ارتفاعًا إلى مستويات قياسية جديدة تجاوزت 2620 دولارًا للأونصة، مع مكاسب أسبوعية تقارب 40 دولارًا.

Silver Performance in 2024: Key Drivers and Future Outlook

In the first half of 2024, silver reached $30 for the second time and surpassed $32 for the first time since 2020. This surge is attributed to increased investor appetite, gradual improvement in the global economy, and rising demand for solar panels. Silver is expected to continue its upward trend, with price forecasts ranging from $32 to $50 per ounce in the second half of the year.

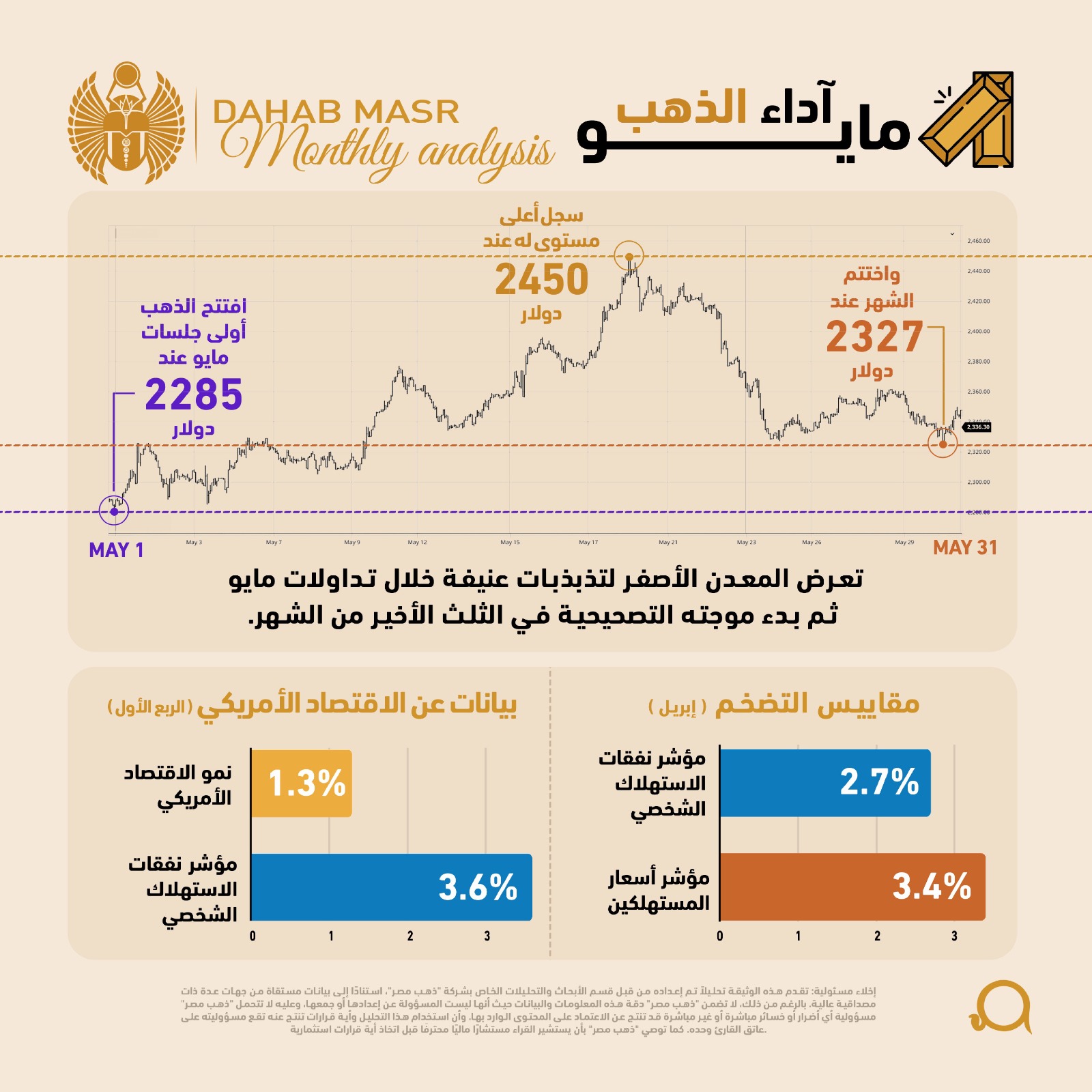

ذهب مصر: قسم الأبحاث والتحليلات: تحليل الذهب لشهر مايو 2024

Weekly Gold Analysis - Third Week of May 2024

May 27, 2024

Gold Takes a Breather in Week 3 of May 2024

Global gold prices dropped by $80, settling at $2,334.2 per ounce, influenced by the Fed's inflation concerns. India increased its gold purchases, while Western investors sold gold ETFs. Local 21-carat gold prices fell to 3,140 EGP/gram.

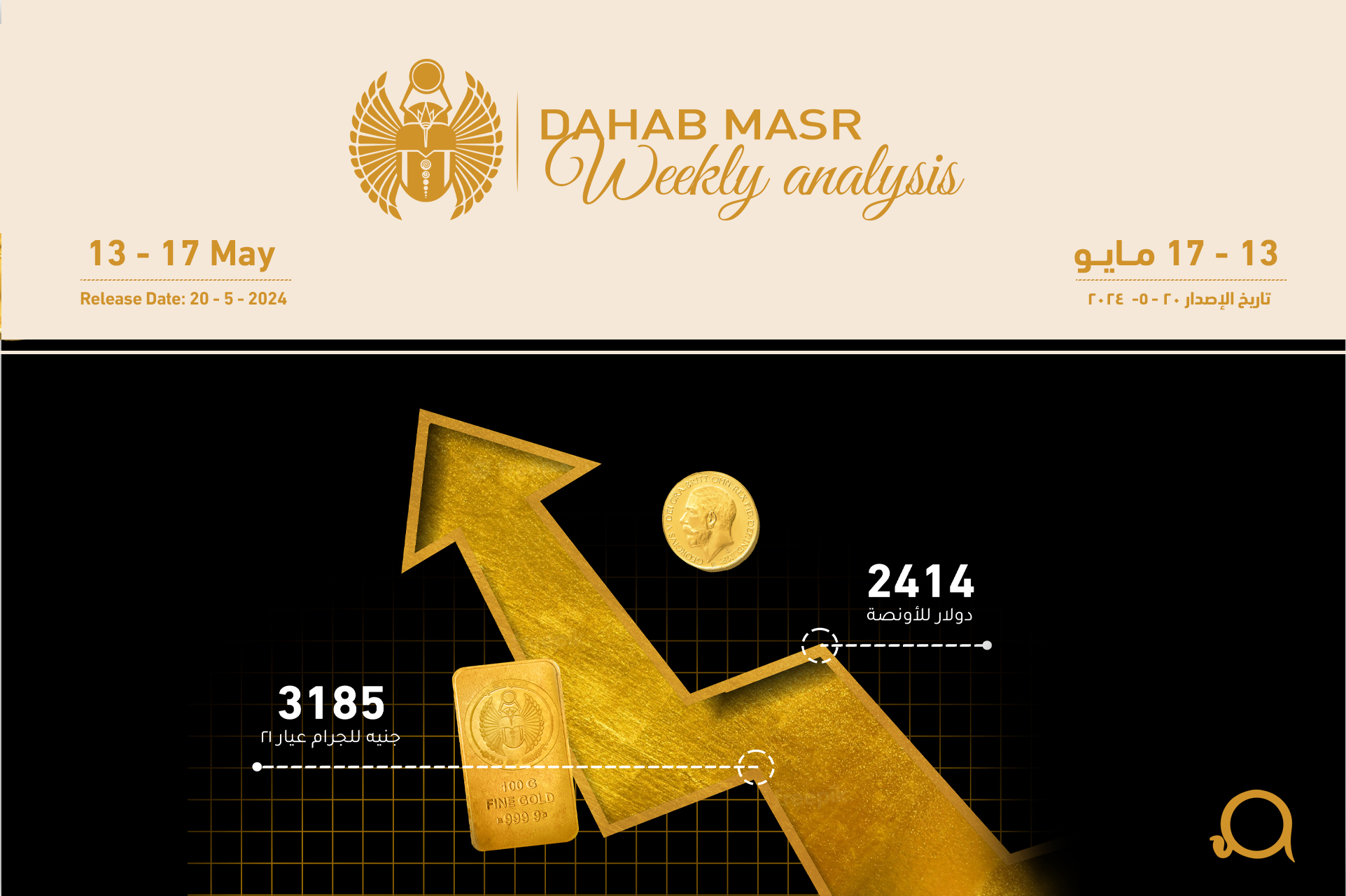

Weekly Gold Analysis - Second Week of May 2024

May 20, 2024

Weekly Gold Analysis - Second Week of May 2024

Gold prices have continued to hit record highs, surpassing $2,400 per ounce by the end of the week. This surge is driven by geopolitical tensions, new US sanctions on Chinese goods, and technical market factors. In Egypt, gold prices rose slightly, with 21-carat gold reaching 3,180 EGP per gram, and 24-carat gold at 3,646 EGP per gram.

Global Gold Market Trends:

Central Banks and Chinese Investors Recent data shows significant impacts on the gold market due to central bank activities and shifts in Chinese investment behaviors. Central banks have been actively purchasing gold, causing a global supply-demand imbalance. In 2022-2023, following the collapse of real estate and stock markets, Chinese investors increasingly turned to gold as a safe haven. These trends highlight gold's evolving role in the global financial system.

Gold's allure increased after unprecedented rises recorded since early 2024, becoming the only metal with the most enigmatic performance in recent weeks, breaking away from the logic of Federal Reserve policy — which has been unclear about the timing of interest rate cuts amidst continued high inflation rates — and defying the traditional rule that presumes an inverse relationship between the dollar and gold. Central banks and investors hedging against growing fears of geopolitical unrest in the Middle East and Russia had the strongest impact in driving the gold to historic levels.

Silver is expected to outperform gold in 2024 with global demand forecasted to reach 1.219 billion ounces, driven by strong industrial applications and green economy initiatives. Prices are predicted to rise, with spot silver potentially reaching $32 per ounce in the second half of the year.

Gold Rises Amid Uncertainty Clouds

Apr 14, 2024

Gold prices hit record highs as investors seek a safe haven amidst global economic uncertainty and geopolitical tensions. Analysts debate the driving factors behind the surge.

Gold glistens with promise in 2024! Prices poised to climb, with analysts charting a path to $2133 and beyond. Egyptian 21-Karat primed to settle over 3000 L.E. Dive in for the full golden forecast.

Dahab Masr Analytical Team

Dr. Fady Kamel

2100

2070

gold price

fedral reserve

gold vs dollar

0 comment(s)

Gold breaks through the $2,100 barrier. Is it preparing for new price jumps?

Dec 4, 2023

Gold prices surged to $2,135 per ounce on December 4, 2023, before settling around $2,060, driven by a weakening U.S. dollar and expectations of lower interest rates from the Federal Reserve in 2024.

Demand on gold report - Q3 / 2023

Jun 11, 2023

Demand for gold in Egypt remained strong in the third quarter of 2023, despite a slight decline in demand for gold jewelry. Overall demand for gold increased by 23% compared to the same period last year, and Egypt ranked third among the largest gold buyers in the Middle East.

As the second half of 2023 unfolds, gold's fate hangs in the balance. With a surprising 6.49% surge in the first half, reaching $2048.45/oz, will it weather changing economic tides and central bank strategies in the latter part of the year?

Supply and Demand Trends of Gold I Q2 of 2023

Aug 3, 2023

With the second quarter of 2023 ending, Gold's steady and bold performance left some marks across both global and local markets. Presenting you with Dahab Masr's analytical report of gold performance through Q2 of this year. walking you through all the changes and movements of the precious metal

Inflation is a hot topic in the news these days, and many people are looking for ways to protect their investments from its effects. In this article, we will explore the relationship between inflation and investment, and discuss whether inflation can sometimes be a positive thing.

The unknown facts of Egyptian demand I Q1 2023

May 16, 2023

Gold performed incredibly since the begining of 2023, Here's a detailed performance report of gold coins, bars and ingots since the first quarter of 2023

الاستثمار هو ضخ أموال في اي نشاط لخلق ارباح وعوائد. بينما تتعدد أشكال الإستثمار وطرقة و يختلف في مزاياه وعيوبه ولكل أداة استثمارية خصائصها وقابليتها الخاصة لتحقيق أرباح أو خسائر كبيرة، وقد أصبحت عملية الاستثمار غاية في الأهمية في التحديات الاقتصادية العالمية والمحلية الحالية ولكن مع كل بحث عن اداة استثمارية تجد نصائح منتشرة عن أهمية الدراسة قبل اتخاذ القرار الاستثمار.

. ذهب مصر تساعدك في هذا المقال على التعرف على اهم الادوات الاستثمارية ومزاياها وعيوبها وأفضل الطرق للتعامل معها وأشهر قصص النجاح فيه

شهد عام 2008 الأزمة المالية العالمية، والتي تعرف بالركود الكبير، الذي بدأ في الولايات المتحدة.

تسببت الأزمة في انهيار سوق العقارات، وأدت إلى العجز في سداد القروض العقارية الهشة الصنع، وفشل العديد من المؤسسات المالية التي استثمرت بكثافة في هذه القروض. حيث انتشرت الأزمة بسرعة في جميع أنحاء العالم، مما تسبب في ارتفاع كبير في معدلات البطالة وتراجع حاد في النمو الاقتصادي.

هل الوقت الحالي هو الأنسب للاستثمار في الذهب

يتسأل العديد من المستثمرين في سبائك الذهب متى يكون الوقت مناسب لاعادة الشراء مرة اخرى وتطوير استثماره في الذهب، فمن هذا الاستفسار سوف نلقي نظرة على أداء اسعار الذهب في مصر الفترة الماضية بالاضافة الى اداء السعر العالمي وفقا للبيانات الاقتصادية المحلية والعالمية التي كانت عامل مؤثر في هذه التحركات. وسوف نستعرض ما هي التوقعات للفترة القادمة وفقاً لمختلف المؤسسات المالية و البنوك العالمية.

اخذت اسعار الذهب محلياً اتجاهاً صعودياً عنيفاً خلال الفترة السابقة بفعل قرار تحرير سعر صرف الدولار الأمريكي مقابل الجنيه المصري في 11 يناير للعام الجاري، حيث تخطى سعر جرام الذهب لعيار 21 مستوى 1900 جنيهاً، وكانت هذه الفترة تعتبر قفة قوية لاسعار الذهب محلياً لم يشهدها السوق المصري من قبل.

This was the year when central banks intensified their battle against inflation, facing it with a tight monetary policy centered around raising interest rates.

Dahab Masr Analysis Team

0 comment(s)

Six reasons of why you must allocate gold into your portfolio

Dec 7, 2022

Throughout History. Gold was known for being valuable & Special.

Now including Gold in your investment portfolios Can be considered a hedge against both inflation & Depression.

As well as being a great diversifier tool to portfolios, It is also known to be a value keeper and financial shield when there is Geopolitical or Macro Economic uncertainty.

نظراً لتطور الوعي الاستثماري لدى الأفراد و رغبتهم في التحوط من عوامل التضخم عن طريق الاستثمار في الذهب، شهدت مصر معدلات طلب مرتفعة للغاية في سوق الذهب بداية من شهر نوفمبر السابق. لذلك عند النظر على الأداء السعري لجرام الذهب بداية من منتصف شهر نوفمبر حتى يوم 6 ديسمبر، سنجد أن سعر الجرام حدث به قفزة لم نشهدها من قبل.

What are Gold Reserves?

A gold reserve is, Gold held by a nation’s central bank to back the value of its local currency, throughout the gold standard era, it was used as a guarantee to redeem intentions to pay depositors, noteholders, and trading peers. Additionally, reserves were combined by governments to meet the costs of waging war and to acquire and hold “treasure,” because the policies of the time emphasised the importance of doing so.

We have collected all the triggering announcements of The third week of feburary here.

You can find the reason behind every move at gold's price here.

We have collected all the triggering announcements of The first week of feburary here.

You can find the reason behind every move at gold's price here.

Following yesterday’s rally in a short-squeeze, gold prices continued to refresh two-month highs seen around $1,846 earlier in a largely quiet session on Thursday. On Wednesday, the precious metal saw the largest daily gains since November, deriving support from a downside correction in US Treasury yields that pushed the dollar lower.

hajardev

0 comment(s)

Increased appetite for less liquid How are the alternatives doing?

Jan 1, 2022

After a strong 2020 performance where the price rallied 25% in US dollar terms in an environment where rates fell, gold has been much weaker during 2021, down 5% year-to-date with rising rates. While demand for gold has rebounded, particularly in the jewelry and bar and coin markets, the recent gold price sell-off has been largely driven by the sharp increase in interest rates in global fixed income markets relative to the record lows they reached last year

Gold—Not Just a commodity

Gold is often part of the broad commodity complex: as a component of a commodity index, a holding in an ETF, or a future trading on a commodity exchange. While gold shares some similarities with commodities

Gold benefits from diverse sources of demand: as an investment, a reserve asset, jewelry, and a technology component. It is highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time.

عربي

عربي